Growth stocks have taken a hammering recently but one small company with a clear pathway to growth has sidestepped the carnage and catapulted ahead. Over the past week, shares of Super League Gaming (SLGG) have almost tripled in value.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company operates in the eSports segment, a fast-growing industry. According to NewZoo, there are 2.6 billion gamers across the globe, and by 2022, the eSports industry is anticipated to rake in $1.8 billion.

The audience is a massive one too, with more than 400 million on YouTube and Twitch. For perspective, Netflix, Hulu, HBO, and ESPN combined do not reach the same figures.

“In fact,” says Maxim analyst Allen Klee, “There are more professional eSports viewers than viewers of the NHL and MLB.”

It is an opportunity which Klee thinks Super League – with its focus on competitive amateur players – is well placed to capitalize on.

The TAM (total addressable market), then, is a huge one, and Klee estimates that if just “10% of gamers participated in an amateur eSports league at $5 per month, it would represent a $15B+ opportunity.”

At present, the company has more than 20 game titles and throughout the year holds more than 1,500 events. Super League has also built several partnerships for “both physical and digital events,” and has developed “key relationships with popular games, venues, and sponsors.”

Klee also believes the company is in the early stages of monetizing its potential and anticipates revenue streams will increase from different sources, including advertising, sponsorship, micro-transactions, and subscriptions.

Last year, the company’s registered users numbered 3 million, but from this base, Klee anticipates some serious growth.

The analyst expects revenue to increase by 94% in 2020 to $2.1 million, then to more than double to $5.0 million in 2021 and more than double again to $12.0 million in the following year.

“We project adjusted EBITDA losses to improve over 2020-2022 before turning positive in 2024,” the analyst said.

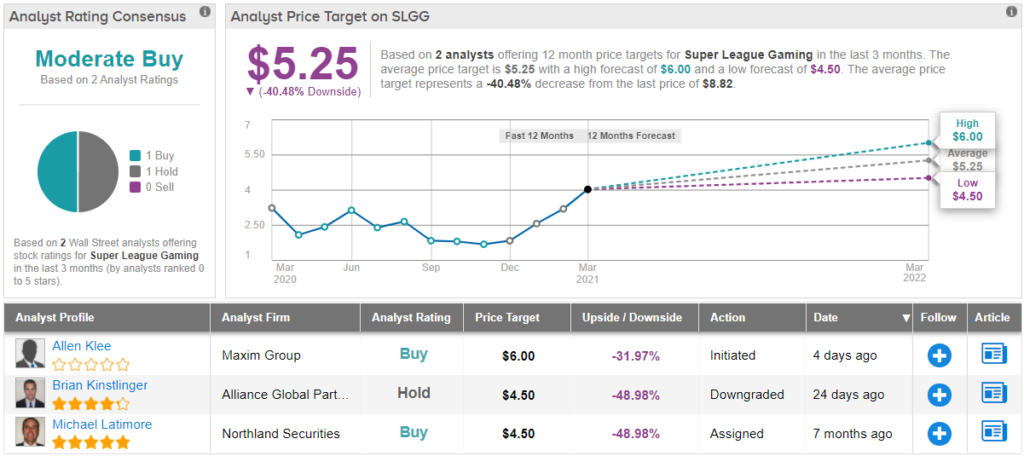

Accordingly, Klee initiated coverage of Super League with a Buy rating and $6 price target. However, the supersized gains have pushed the share price beyond Klee’s target, which now indicates downside of 32% from current levels. It will be interesting to see whether the analyst downgrades his rating or upgrades the price target over the coming months. (To watch Klee’s track record, click here)

Only one other analyst has chimed in recently with a SLGG review, assigning the stock a Hold. Overall, SLGG has a Moderate Buy consensus rating, backed by a $5.25 price target. Following SLGG’s rise, the figure indicates shares will decline by ~40% in the coming months. (See SLGG stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.