Suncor Energy (SU) (TSE: SU) is a Canada-based integrated energy company which is specialized in producing synthetic crude from oil sands.

The company also engages in the exploration, acquisition, development, production, and marketing of crude oil in Canada and internationally. It also markets and trades in natural gas, crude oil, byproducts, refined products, and power.

Suncor has experienced strong tailwinds this year from rising oil prices, as it has greatly outperformed the S&P 500. However, can the company continue this performance going forward?

Growth Catalyst – Spending Patterns are Shifting

On May 20th, the Conference Board of Canada said that the consumer confidence index fell by 11.7 points for the month. The index is now at 88.1, compared to 113.6 in 2019.

Consumers are starting to grow increasingly worried about their future finances as they begin reducing their spending on bigger ticket items. This suggests that spending patterns are beginning to shift from consumer discretionaries toward the essentials.

Fortunately for Suncor, oil and gas are essential items, and their prices have been red hot. Although consumers are concerned, it’s important to remember that the economy is still strong. Thus, the demand for oil and gas will remain as long as the economy doesn’t weaken.

Therefore, investors can continue to expect strong financial performances from Suncor as it continues to hedge against inflation.

Valuation

To value Suncor, I will use a single-stage DCF model because its free cash flows are volatile and difficult to predict. For the terminal growth rate, I will use the 30-year U.S. Treasury yield as a proxy for expected long-term GDP growth.

My calculation is as follows (in Canadian dollars):

Fair Value = Average FCF per share / (Discount Rate – Terminal Growth)

$41.85 = $2.4 / (0.088 – 0.0307)

As a result, I estimate that the fair value of Suncor is approximately C$41.85 under current market conditions.

Risks

As is the case for all commodity businesses, the main risk for Suncor is the fact that its performance is reliant upon the price of the underlying commodity. As history illustrates, commodity prices are volatile and sensitive to business cycles.

Currently, commodities are experiencing a boom that is creating windfall profits for the industry. However, this can quickly change, along with the price of the stock. Therefore, investors need to be aware of this dynamic before piling into Suncor.

Investors should include the stock in their portfolios only if they have a positive outlook on the price of oil and gas.

Wall Street’s Take

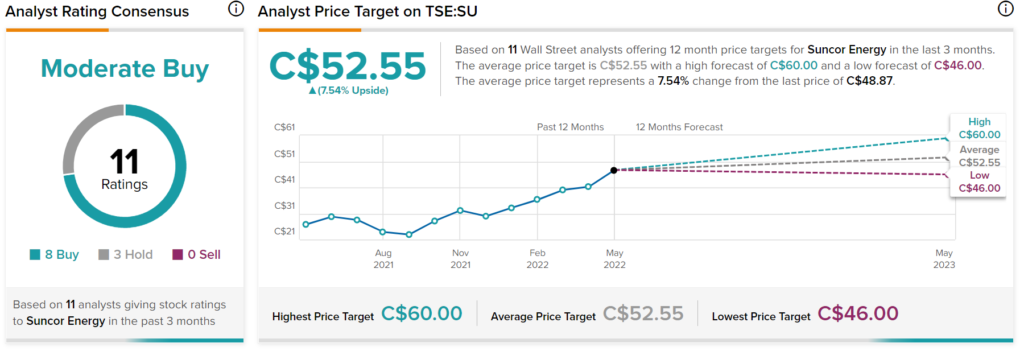

Turning to Wall Street, Suncor has a Moderate Buy consensus rating based on eight Buys, three Holds, and zero Sells assigned in the past three months. The average Suncor price target of $52.55 implies 7.54% upside potential.

Analyst price targets range from a low of $46 per share to a high of $60 per share.

Final Thoughts

Suncor currently has the tailwind of booming commodities, helping it achieve strong profitability in the current high inflation environment.

In addition, analysts appear to be more optimistic in their price targets for Suncor than the single-stage DCF valuation suggests. Nonetheless, the consensus price target still suggests limited upside potential, suggesting that investors should be more cautious if the stock price continues to increase.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Questions or Comments about the article? Write to editor@tipranks.com