If you’re looking to invest in some of the market’s top growth stocks but want to avoid stocks that have gotten ahead of themselves and become overvalued during the current bull market, a GARP (growth at a reasonable price) ETF like the iShares MSCI USA Quality GARP ETF (BATS:STLG) could be exactly the solution that you are looking for.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This relatively unheralded ETF from BlackRock’s iShares combines elements of both growth and value investing and has seen a sizzling 43.2% gain over the past year.

I’m bullish on this under-the-radar ETF based on its scintillating performance over the past year, strong track record over the past three years, reasonable approach toward growth investing, and modest expense ratio. Plus, the ETF is rated highly by TipRanks’ Smart Score system, and sell-side analysts also view it favorably, assigning it a consensus Moderate Buy rating.

What Is GARP Investing, Anyway?

Popularized by legendary Fidelity portfolio manager Peter Lynch, GARP investing looks to give investors the “best of both worlds” by combining features of both growth investing and value investing. GARP investors prioritize investing in companies generating strong revenue and earnings growth that trade for reasonable valuations.

While GARP investors seek to capture the upside of top growth stocks, they aim to eschew frothy stocks with nosebleed valuations, which have become more common in a market now trading at record levels. This sensible strategy can potentially mitigate some of the risk and volatility that typically come with these types of higher-risk stocks if the market contracts.

While these GARP stocks are certainly not immune to a market correction, they should hold up better than stocks trading at more egregious valuations or stocks that aren’t profitable.

STLG neatly encapsulates the principles of this strategy into ETF form. According to iShares, STLG invests in an index of large- and mid-cap U.S. “growth stocks exhibiting favorable value and quality characteristics.” STLG seeks to give investors “exposure to growth companies at a reasonable price, balancing growth with value and quality characteristics to help avoid companies with unsupported valuations.”

Essentially, this strategy gives investors exposure to some of the U.S. market’s top growth stocks while avoiding exposure to stocks that are particularly overvalued.

Impressive Performance Out of the Gate

This strategy of investing in high-quality growth stocks while avoiding some of the names that have gained excessively during a multi-year bull market appears to be working well based on STLG’s excellent performance so far.

The ETF launched in January 2020, so it hasn’t been around for long enough to establish a very long track record of performance, but its early results have been encouraging.

As of May 31, STLG has returned an impressive 14.9% over a three-year time frame. This handily beat the broader market. For comparison, the Vanguard S&P 500 ETF (NYSEARCA:VOO) returned 9.6% annually over the same time frame.

Past performance is, of course, no guarantee of future results, and it remains to be seen whether STLG can continue to outperform the broader market over a longer time horizon, but it looks promising thus far based on this three-year comparison.

STLG’s Portfolio

STLG owns 164 stocks, and its top 10 holdings make up nearly half of the fund (48.4%). You can check out an overview of STLG’s top 10 holdings below.

As you can see, STLG owns many of the top growth stocks that have driven the market to new highs over the past year, like its top holding Nvidia (NASDAQ:NVDA), and additional top 10 holdings like Adobe (NASDAQ:ADBE), Applied Materials (NASDAQ:AMAT), Broadcom (NASDAQ:AVGO), and Eli Lilly (NYSE:LLY). So, just because the fund takes valuation into account doesn’t mean investors need to miss out on some of the market’s most exciting stocks.

While these stocks don’t feature the types of valuations that pure value investors are on the hunt for, it appears that the fund’s strategy of finding a balance between value and growth is working well, as many of these stocks have performed exceptionally well over the past year. Red-hot Nvidia is up 206.9% over the past 12 months, while Broadcom has broken out with a 114.8% gain, and shares of Eli Lilly have nearly doubled.

TipRanks’ Smart Score system also generally holds these stocks in high regard. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

As you can see, seven out of STLG’s top 10 holdings receive Outperform-equivalent Smart Scores, and Broadcom, Eli Lilly, and KLA Corporation (NASDAQ:KLAC) all receive “Perfect 10” Smart Scores.

STLG itself receives an Outperform-equivalent ETF Smart Score of 8 out of 10.

How Much Is STLG’s Expense Ratio?

STLG features a reasonable expense ratio of 0.15%, meaning that an investor in the fund will pay just $15 in fees on a $10,000 investment annually. Assuming that STLG returns 5% per year going forward and maintains this expense ratio, an investor allocating $10,000 to STLG would pay a reasonable $85 in fees over the next five years.

Is STLG Stock a Buy, According to Analysts?

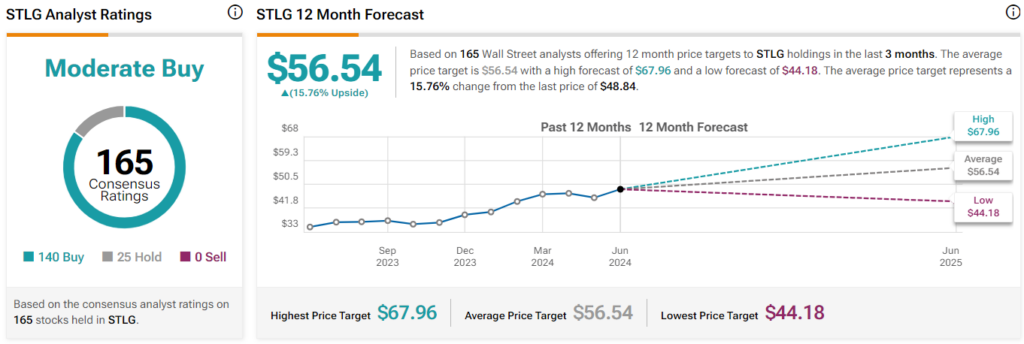

Turning to Wall Street, STLG earns a Moderate Buy consensus rating based on 140 Buys, 25 Holds, and zero Sell ratings assigned in the past three months. The average STLG stock price target of $56.54 implies 15.8% upside potential from current levels.

The Takeaway

In conclusion, I’m bullish on STLG based on its strong, market-beating performance over the past three years and the fund’s sensible strategy of investing in top growth stocks while keeping an eye on valuation. This has resulted in an attractive portfolio of holdings.

STLG enables investors to tap into some of the market’s most compelling growth stocks while avoiding the pitfalls of investing in some of its frothiest stocks. I also like the ETF’s Outperform-equivalent Smart Score and its favorable outlook from analysts.