Starbucks (NASDAQ:SBUX) delivers delicious coffee and tasty dividends, and a move to the upside may be brewing in SBUX stock right now. I am bullish on Starbucks stock as the company demonstrated impressive top-line strength despite inflationary pressure.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Starbucks is, without a doubt, the most well-branded coffee shop chain in America. If you drive too fast and miss a Starbucks, don’t worry, as there’s probably another one a few blocks down the street.

Yet, even a highly-successful business is susceptible to issues like high inflation and COVID-19 lockdowns in China. On the other hand, there’s data indicating Starbucks’ resilience and even suggesting that SBUX stock might be an all-weather holding for cautious investors.

Starbucks Performed Poorly in China – Here’s Why

Last week, Starbucks released its earnings results for 2023’s first fiscal quarter. SBUX stock promptly dropped in post-market trading, probably because of Starbucks’ weak sales in China. However, there’s an explanation for this.

Starbucks’ comparable-store sales in China decreased 29% year-over-year, which is certainly a disappointing result for Q1 FY2023. This is significant because Starbucks has 6,090 stores in China (versus 15,952 stores in the U.S.).

Interim CEO Howard Schultz provided an explanation for the soft quarterly China sales in a conference call. “In early December, zero COVID was lifted, and COVID infection spiked across China, resulting in a dramatic decline in consumer activity across the country,” Schultz pointed out. He added that, at the peak of COVID-19 in China, “nearly 1,800 Starbucks stores were closed during that month.”

This, however, is a temporary problem for Starbucks. Schultz assured that Starbucks’ customers in China “are creating a full return to familiar pre-COVID routines and lifestyles.” Consequently, “huge consumer demand in China is waiting to be unleashed.”

Of course, there’s no way to guarantee that there won’t be a fresh wave of COVID-19 infections in China. Barring that type of event, however, it’s reasonable to predict that the demand for consumable products will recover in China, and that’s potentially good news for Starbucks and its investors.

Starbucks’ Non-China Sales Were Strong

If financial traders are willing to overlook Starbucks’ hopefully temporary issue in China, they should consider how well the company did outside of that country. As it turns out, Starbucks served up some hot and fresh data points for eager shareholders.

Indeed, Starbucks’ Q1 FY2023 comparable-store sales were up 5% globally, up 10% in the U.S., and up double-digits internationally when we exclude China from the calculation. Plus, even with the China headwinds factored in, Starbucks’ quarterly sales of $8.7 billion were nearly in-line with the analyst consensus estimate of $8.79 billion.

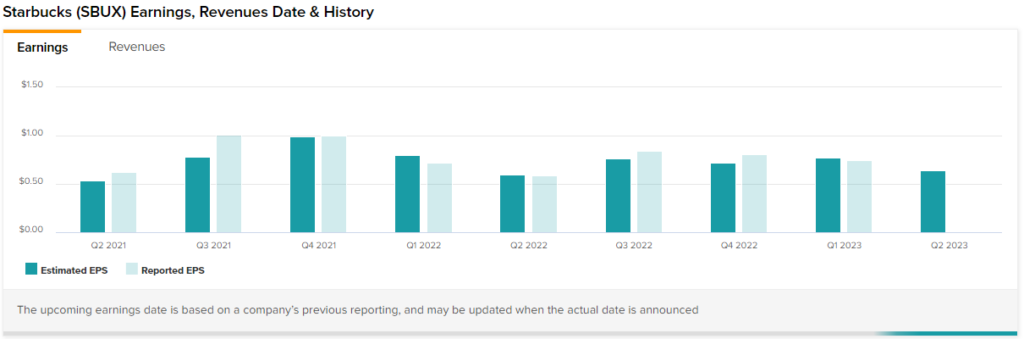

Turning to the bottom line, Starbucks earned $0.75 per share, which barely missed Wall Street’s estimate of $0.77 per share. So, Starbucks didn’t do too badly – and continues to pay a near-2% dividend, by the way – and the company will probably perform better during the current quarter if there aren’t too many problems in China.

Starbucks Doesn’t Have a Demand Problem Despite Inflation

You might think of Starbucks coffee as a luxury (although I know people who consider it a necessity), and it might seem obvious that demand for Starbucks’ products would drop during a period of high inflation. Yet, Starbucks CFO Rachel Ruggeri recently put this misconception to rest.

“We aren’t seeing an issue with our demand,” Ruggeri said bluntly. This, evidently, is true even though Starbucks’ prices were up 5% year-over-year as of 2022’s fourth quarter. Thus, while Starbucks coffee may be a luxury, evidently, the customers are willing to pay for it.

We can assume that Ruggeri wasn’t referring to China-based sales when she said she was not “seeing an issue” with the demand for Starbucks’ products. Again, Starbucks’ non-China sales were fairly strong during the most recently reported quarter.

Also, continuous price increases might not be necessary. “In the back half of the year, we’ll start to see pricing return more towards historical levels,” Ruggeri predicted. That’s probably good news for Starbucks coffee drinkers and for the company’s shareholders.

Is SBUX Stock a Buy, According to Analysts?

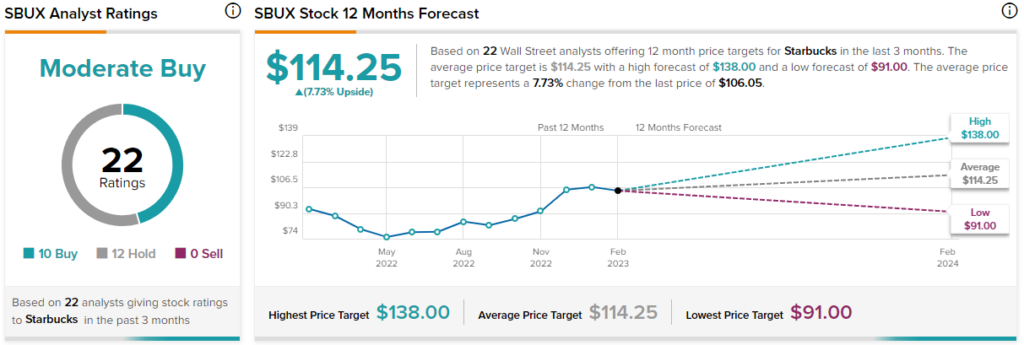

Turning to Wall Street, SBUX is a Moderate Buy, based on 10 Buys and 12 Hold ratings. The average Starbucks stock price target is $114.25, implying 7.7% upside potential.

Conclusion: Should You Consider Starbucks Stock?

Don’t assume that Starbucks will wither and fail during times of high inflation. There was an unfortunate situation in China, but outside of that, Starbucks performed well in terms of quarterly sales.

If some folks sold their SBUX stock after the company released its earnings report, don’t fret. Instead, consider buying and holding some Starbucks shares, as the company is actually demonstrating all-weather resilience.