Reopening retail has not been good for Squarespace (SQSP). The company dropped 14.4% in premarket trading after reporting earnings, but it rallied into today’s trading session and is now down only 2%. However, I do believe SQSP has the potential to go up from here based on its low stock price and improving product line. I am moderately bullish on SQSP stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

While Squarespace’s latest earnings report proved welcome, its projections didn’t. SQSP now projects revenue of $857 million to $867 million for FY 2022 compared to its previous projection of $867 million to $879 million. Still, the company turned in EPS of $0.45, which blew the FactSet consensus of $0.09 per share out of the water. Revenue, meanwhile, came in at $212.7 million against FactSet’s projections of $212 million.

E-commerce firms like Squarespace were pandemic darlings. As companies scrambled to develop an online presence after having their physical retail forcibly shut down by government officials, Squarespace stepped in to give companies a way to sell online.

However, the last 12 months for Squarespace have been continuously declining. This time last year, share prices challenged the $60 mark. Today, they aspire to the $20 mark, losing roughly two-thirds of their value in the last year but off of their lows of $14.43.

Even casual observers know what took Squarespace down. The lightning in a bottle that was 2020 will likely never be back. Nonetheless, Squarespace still has a lot to offer and may be able to get some of those pandemic highs back.

Wall Street’s Take on SQSP Stock

Turning to Wall Street, Squarespace has a Moderate Buy consensus rating. That’s based on five Buys and six Holds assigned in the past three months. The average Squarespace price target of $27 implies 38% upside potential.

Analyst price targets range from a low of $22 per share to a high of $38 per share.

Investor Sentiment is Mainly Negative

Squarespace has a Smart Score of 3 out of 10 on TipRanks. That puts it at the highest level of “Underperform.” This also makes it more likely than not to lag the broader market. Investor sentiment mirrors this score well, though there is one significant bright spot in the picture.

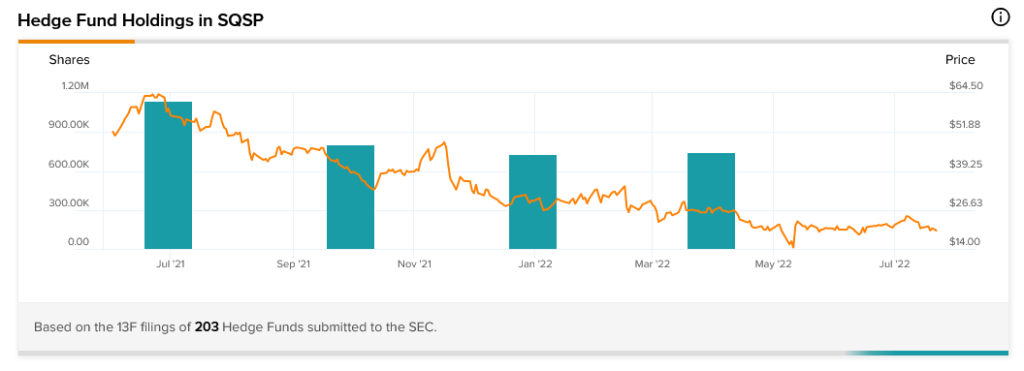

That bright spot comes from hedge fund involvement. Based on the results of the TipRanks 13-F Tracker, hedge funds increased their involvement between December 2021 and March 2022, the most recent figure.

This bright spot is dulled by the almost trivial nature of the increase. Hedge funds added an extra 17,800 shares in that quarter. Given that hedge funds owned 730,777 in December 2021, that’s not much of a boost at all.

Insider trading, however, is turning negative. Insiders sold $18,900 worth of shares in the last three months. A look at the full year suggests that the sell-off is comparatively recent and somewhat more focused. Over the last 12 months, there have been 12 Buy transactions and 11 Sell transactions.

As for retail investors, there’s a clear decline there as well. The number of TipRanks portfolios that hold Squarespace stock decreased 0.9% in the last seven days. Portfolios with Squarespace stock were down 2.2% in the last 30 days as well.

Finally, there’s Squarespace’s dividend history. The company has yet to issue a dividend. Squarespace is commonly considered a growth stock, though its growth rate has been significantly hampered in recent months.

Squarespace Still Provides Value, but the Pandemic Boost is Gone

Squarespace made a name for itself by stepping in to fill a problem that retailers had, en masse, back in 2020. When government officials stepped in and shut down physical retail altogether, these stores turned to Squarespace. While SQSP still has its customers, it won’t see that kind of boost again because new lockdowns are unlikely to occur.

The exact value of mass lockdowns is, at best, suspect. A Johns Hopkins report found that lockdowns in Europe and the United States reduced COVID-19 deaths by just 0.2%.

Shelter-in-place orders reduced deaths by a meager 2.9%. At the same time, the report noted, lockdowns produced “devastating effects” on economies as well as a range of non-fatal social ills.

Thus, looking for further mass lockdowns to step in and give Squarespace a whole new shot at adding to its customer base is likely a bridge too far. That also reduces the likelihood of Squarespace recovering to its pandemic-era highs.

Worse, analysts are starting to turn on the company as well. A recent research note from JMP Securities’ Andrew Boone suggests that Squarespace may be lagging behind competitors in the field, including Shopify (SHOP) and Wix (WIX).

Boone noted that the company could use more investment in its overall product line. Squarespace, in its current form, is better suited to small businesses and artistic creators, Boone added.

A study of website developers found that Shopify did a better job of making commerce happen. Meanwhile, Wix had Squarespace beat on ease of use. That does leave Squarespace in a bad position, forced into a middle-of-the-road state where it falters in two major competitive advantages.

However, don’t count Squarespace out just yet. Boone’s suggestion of product line improvement has not fallen on deaf ears. Squarespace 7.1 now includes the Fluid Engine tool, a slate of new design tools that offer more customization options.

New controls for page layouts will also offer further customization and control in arranging content within said pages. Squarespace itself calls this “a new industry standard in no-code website design.”

Further, consider that Squarespace is trading just off its 52-week lows. That, coupled with the new product features, represents a potential major opportunity in the making.

Conclusion: SQSP Stock is Still Attractive Despite Reopening Headwinds

The days when online presence went instantly from “nice to have” to “we can’t make money without it” are gone. Those companies also have their websites in place and may not have much need for Squarespace beyond that. However, Squarespace is taking this seriously. Recommendations to improve the product line have been heard and acted upon.

It knows the competition it faces from Wix and Shopify, and it’s working to stay fresh in the face of that competition. Throw in a very attractive entry point, and it might be worth getting in just to take a shot at the current lowest Wall Street price target, let alone the average.

Squarespace’s best days are likely behind it. However, its good days are still quite possibly on hand. More realistic goals are still quite attainable. That’s why I’m at least moderately bullish on Squarespace.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue