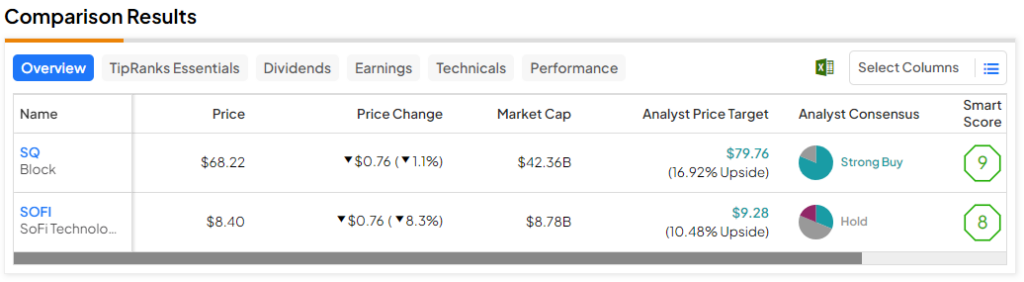

In this piece, I evaluated two fintech stocks, Block (NYSE:SQ) and SoFi Technologies (NASDAQ:SOFI), using TipRanks’ comparison tool to see which is better. A closer look suggests a neutral view for Block and a bullish view for SoFi.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Previously known as Square, Block provides payment-processing solutions for credit cards, including point-of-sale software and hardware. Meanwhile, SoFi Technologies offers lending and financial services products, including home, student, and personal loans. It also provides related technology products and solutions.

Shares of Block are down 11% year-to-date, although they’re up 71% over the last three months. Despite that recent rally, the stock is off 16% over the last year. Meanwhile, SoFi shares are down 8% year-to-date after Monday’s 20% pop but are up 21% over the last three months, bringing their one-year return to 32%.

Block (NYSE:SQ)

While Block was profitable in 2021, it took a bit of a detour by diverting significant attention away from its healthy and growing payment processing businesses and toward blockchain and Bitcoin (BTC-USD), even changing its name to reflect that diversion. As such, Block looks like a bit of a wait-and-see story, so a neutral view seems appropriate.

Unfortunately, Block’s Bitcoin diversion is triggering extreme movements in its financial results, which is a tough pill for many investors to swallow. For example, the company’s CashApp revenue rose 34% year-over-year in the third quarter, but it was up only 26% when excluding Bitcoin trading.

More importantly, there’s been significant insider selling in Block shares recently. Although TipRanks shows Informative Buy transactions of $26.5 million over the last three months, all of that is from a single transaction three months ago. More recently, we’ve begun to see insiders sell off some shares, although those sales just haven’t been enough to offset that sizable $26.5 million non-open-market purchase three months ago.

These were Auto Sell transactions, which aren’t included in the Informative Sells total. Insiders often establish preset trading plans with prices at which to automatically sell their company’s stock. Thus, a rising number of Auto Sell transactions, especially as a stock price increases like Block shares have over the last three months, suggests that insiders don’t see anymore upside left in the near term.

As Citi analysts noted recently, Block shares have been range-bound between $50 and $90 for the last 20 months. While downside could indeed be limited in the near term, as Citi suggested, I would argue that significant upside also appears limited, at least for now.

However, Block could be worth monitoring for any significant positive change, signaling that things are changing for the better. Once Block gets its financial house in order, meaning GAAP (generally accepted accounting principles) profitability alongside steady growth with less dependence on Bitcoin for growth, its stock price could take off, as it’s certainly cheap on a historical basis.

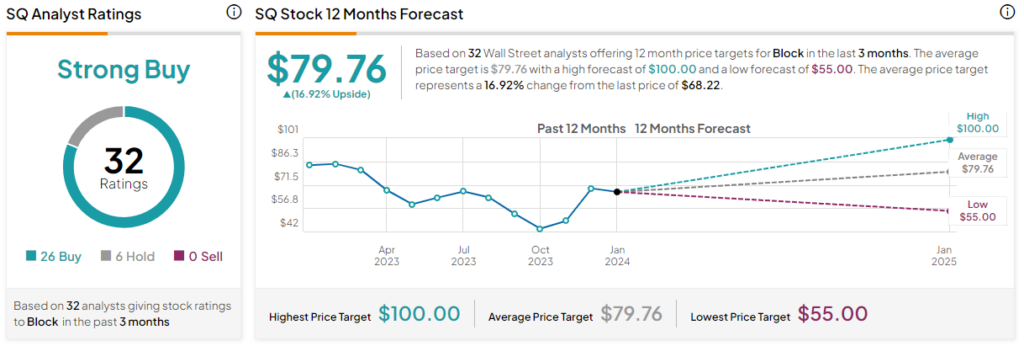

What Is the Price Target for SQ Stock?

Block has a Strong Buy consensus rating based on 26 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $79.76, the average Block stock price target implies upside potential of 16.9%.

SoFi Technologies (NASDAQ:SOFI)

For SoFi Technologies, the big story on Monday was its fourth-quarter earnings results, which revealed its first quarterly profit since going public. Although SoFi shares have risen a lot on the earnings news, the company looks like a long-term buy-and-hold position, especially as interest rates fall, encouraging consumers to take out more loans.

First, it should be noted that SoFi’s profits were on a GAAP basis, while Block is only profitable on a non-GAAP or adjusted basis. GAAP profitability represents true profits because it includes all those little (or sometimes large) extra items that get excluded from analyst estimates. Thus, while Block has been profitable on an adjusted basis, GAAP profitability is what’s critical because it shows the true state of a business.

On Monday, before the opening bell, SoFi Technologies reported GAAP net revenue of $615 million, up 35% year-over-year, and $594 million in adjusted net revenue, up 34%. The company’s adjusted EBITDA rose 159% year-over-year to $181 million, and it achieved its target adjusted EBITDA margin of 30%.

SoFi also reported GAAP net income of $48 million or 2 cents per share in earnings, versus the consensus estimate of less than 1 cent per share, and added almost 585,000 new members, raising its total member count 44% year-over-year. Overall, Monday’s print was essentially perfect, with all three of the company’s segments being profitable on a contribution basis.

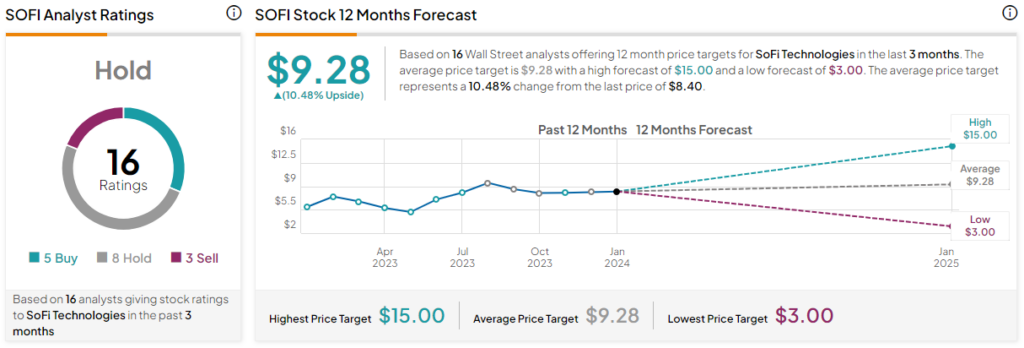

What Is the Price Target for SOFI Stock?

SoFi Technologies has a Hold consensus rating based on six Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $9.33, the average SoFi Technologies stock price target implies upside potential of 10.5%.

Conclusion: Neutral on SQ, Bullish on SOFI

While things could change suddenly for Block or SoFi Technologies, tipping either of them one way or the other, as things stand now, SoFi looks like a long-term buy-and-hold stock. It also remains well below the roughly $25/share price notched in February 2021 — just months after its initial public offering when it was unprofitable with no sign of future profits.

On the other hand, Block needs to refocus on what’s really important, which is its payment processing business. Until it does that, its earnings results may be choppy and volatile, just like Bitcoin’s price.