At these depressed multiples, I am inclined to be bullish on Spotify (SPOT) as it takes the fight to its competitors. Music streaming is quickly becoming commoditized. However, Spotify has levers it can pull to evolve into something more than just an audio streamer.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Shares of the popular music streamer got a bit of relief this week as it rallied with the broader market. Indeed, recession fears have grown out of hand, with the tech-heavy Nasdaq (NDX) leading the charge higher. After suffering a 74% fall from peak to trough, Spotify’s recent rally seems constructive.

Though the odds of a recession have unlikely decreased this week, results from the second-quarter earnings season have been quite impressive thus far. Indeed, analysts have gotten a tad too bearish on stocks of late, with downgrades from across the board.

Up ahead, Spotify is ready to unveil its second-quarter results on July 27, with a low bar ($0.67 per-share earnings loss expected) ahead of it. Though only a small sample of Q2 earnings has been revealed, it’s hard not to be encouraged. In fact, Spotify has beat earnings estimates in the last five quarters.

At writing, Spotify stock trades at 1.96 times sales. That’s incredibly cheap for a firm capable of so much growth. Sure, there’s an economic slowdown likely over the next 18 months as the Fed takes the punch bowl away. However, Spotify is eager to expand into new market verticals to keep its sales growth alive.

Spotify Takes on Big Tech Rivals

Undoubtedly, podcasts have been a top differentiating factor for Spotify. With the Joe Rogan Experience and a wide range of other exclusives, Spotify has built a bit of a moat for itself. Still, competition is fierce, with Apple (AAPL) Music offering incredible savings for service bundlers.

As consumers look for ways to save money, many may be inclined to jump ship from Spotify to Apple Music. However, doing such can be a tremendous inconvenience, resulting in minimal savings for all but the most dedicated Apple fans.

As Apple and other big-tech rivals look to challenge Spotify and the incumbent music-streamers on price, Spotify needs to offer its users more of a reason to stick around. That means offering more features and functionality to make the Spotify ecosystem stickier than it is currently.

Spotify’s move into podcast content is a great first step. But it needs to do more if it’s to survive the onslaught from tech behemoths that have nothing to lose from a “race to the bottom” on pricing.

Moving Beyond Music

Spotify has done an excellent job of staying on its toes amid rising competition in music streaming. Acquiring podcast content allows Spotify to stand out from other music streamers. However, such acquisition costs could push the company further away from profitability. These days, investors want to see improving profitability prospects, not uptrending expenses.

Unfortunately, Spotify must keep spending if it’s to defend its turf from hungry and disruptive rivals that view music streaming as just another service to sweeten a bundle.

In terms of bundling, Spotify may be at a disadvantage. But it can catch up as it looks to pressure its mega-cap rivals in other areas such as audiobooks, video streaming, and gaming.

Undoubtedly, the audiobook arena is an area where Spotify can really thrive as an audio streamer. The business of audiobooks seems to be quite similar to that of Podcasts — it’s all about content acquisition.

Like Podcasts, the audiobook market is fast-growing. According to Maru Group, approximately 13% of American adults are subscribed to an audiobook service like Audible, a subsidiary of Amazon (AMZN).

Indeed, Spotify can disrupt the disruptors by entering such new markets.

Audiobooks aren’t the only place Spotify is looking to disrupt. The firm’s push into video podcasts could also prove bountiful. Finally, Spotify’s acquisition of the music-guessing game Heardle for an unknown amount could be the start of a move into more interactive forms of media.

Wall Street’s Take on Spotify

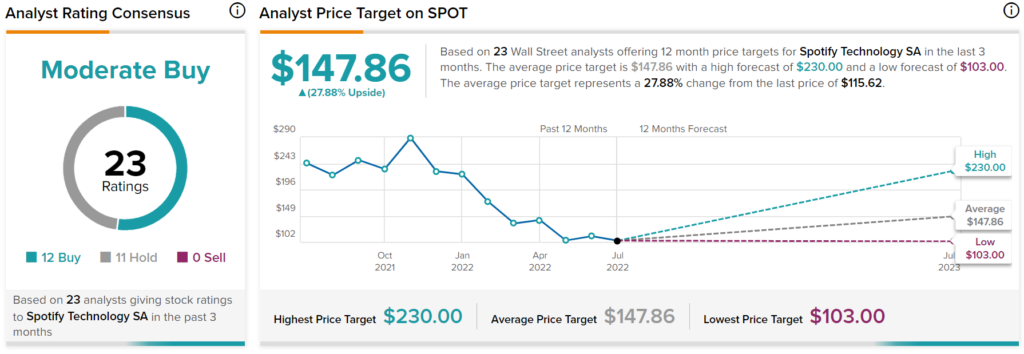

Turning to Wall Street, SPOT has a Moderate Buy rating based on 12 Buys and 11 Holds assigned in the past three months. The average Spotify price target is $147.86, implying an upside of 27.9%. Analyst price targets range from a low of $103.00 per share to a high of $230.00 per share.

The Bottom Line: Spotify is Willing to Fight Larger Competitors

Spotify will always be a music and audio firm at heart. However, it’s shown a willingness to move outside its comfort zone in an effort to bring the fight to its rivals and keep its growth alive.

At these depths, Spotify stock is nothing short of intriguing as it wanders into second-quarter earnings.