For the past month, the S&P 500 has been hovering mostly around the 4100s without breaking out meaningfully in either direction. However, J.P. Morgan’s head of technical strategy Jason Hunter thinks that is about to end, and not in a good way for the bulls – at least in the short term.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

“We continue to expect a sell off from that area to retest medium-term support at the 3764 Dec low and 3760 Oct 61.8% retrace this spring, and look for an eventual extension back to key levels near 3500 by early summer,” Hunter recently said. “We believe that will ultimately set a cycle bottom, especially if that weak performance is accompanied by impulsive yield curve steepening. Until that setup emerges, we suggest maintaining a bearish bias and staying defensively positioned.”

That “cycle bottom” is about 15% lower than current levels, so if Hunter is correct, we’re in for a deep summer plunge. However, that’s not to say there are no opportunities out there for investors to take advantage of in the meantime.

Taking the advice to stay “defensively positioned,” Hunter’s analyst colleagues at J.P. Morgan have an idea about which stocks can do that job. We’ve ran a pair of their recent picks through the TipRanks database to see whether there’s widespread agreement on Wall Street that these names offer protection from any incoming pain. Let’s check the results.

Alight, Inc. (ALIT)

The first JPM pick we’ll look at is Alight, a company offering employee management solutions. Alight provides BPaaS (Business Process as a Service) for payroll and benefits administration via the firm’s Worklife platform, which makes use of data analytics and AI.

Alight provides services to customers across different industries, particularly wealth, health and human resources and has grown into an international concern with the services reaching ~100 countries. With more than 16,000 employees, the business serves more than 4,300 customers as well as 30 million workers and their families.

With more than 25 years of industry know-how to draw upon, Alight is a trusted name in the HR and benefits administration services space and counts some top names amongst its client base. New additions in the most recently reported quarter – for 4Q22 – included Chipotle Mexican Grill, General Electric and Cintas.

Elsewhere in the quarter, the company beat expectations on the headline metrics. Revenue reached $942 million, amounting to a 9% year-over-year increase and coming in ahead of consensus by $24.25 million. Likewise on the bottom-line, adj. EPS of $0.21 just edged ahead of the $0.20 forecast. The company also announced a two-year restructuring plan targeting better margins and cash flow conversion and anticipates the efforts will result in yearly savings of $100 million (3% of revenues).

Highlighting the company’s defensive credentials, J.P. Morgan analyst Tien-tsin Huang lays out the bull-case for Alight.

“With continued BPaaS outperformance and strong visibility into FY23, we remain positive about near-term results and continue to consider ALIT an undervalued utility with attractive defensive growth… Alight has a sticky business model with highly recurring revenue and top-of-class retention. Alight trades at a discount to peers, and we believe growth acceleration and margin expansion on the back of the BPaaS transformation have the potential to provide healthy upside,” Huang explained.

Quantifying this bullish stance, Huang rates ALIT an Overweight (i.e., Buy) to go alongside a $12 price target. The implication for investors? Potential upside of 32% from current levels. (To watch Huang’s track record, click here)

Huang is certainly not alone in his confident take. All recent reviews – 6, in total – are positive, naturally culminating in a Strong Buy consensus rating. The forecast calls for 12-month returns of 53%, considering the average target stands at $13.92. (See ALIT stock forecast)

Juniper Networks (JNPR)

Next under the JPM microscope is Juniper Networks, a specialist in network infrastructure products. Catering to ISPs (internet service providers), cloud providers, governments, public sector organizations, and other enterprises, Juniper’s offerings run the gamut from routers and switches to network management software and network security products.

With almost 11,000 employees and a $9.6 billion market cap, it’s no surprise to see Juniper generates an impressive amount of revenue. In the recently reported 1Q23 statement, the top-line increased by 17.1% year-over-year to reach $1.37 billion, beating the Street’s forecast by $30 million. It was a similar story at the other end of the scale, as adj. EPS of $0.48 trumped the $0.43 anticipated by the analysts.

Looking ahead to Q2, Juniper guided for revenue of ~$1.41 billion, give or take $50 million, compared to the Street’s $1.40 billion forecast. Adj. EPS is expected to reach $0.54, plus or minus $0.05. Consensus had $0.53.

Looking further ahead than that, J.P. Morgan’s Samik Chatterjee thinks Juniper’s defensive attributes are sound and believes investors should take the long-term view when considering the company’s prospects.

“Looking to FY24, Juniper guided to growth despite a tough comp from FY23, led by expectations to exit the year at a backlog 2x the pre-pandemic levels as well expectations for better order trends than in recent quarters as lead times stabilize,” the analyst explained. “More importantly, we believe investors should view the set up for multi-year revenue growth to drive significant multi-year earnings growth, with Juniper committed to operating leverage and margin expansion… [We] continue to see Juniper positioned as most defensive and resilient relative to the peer group on a relative basis.”

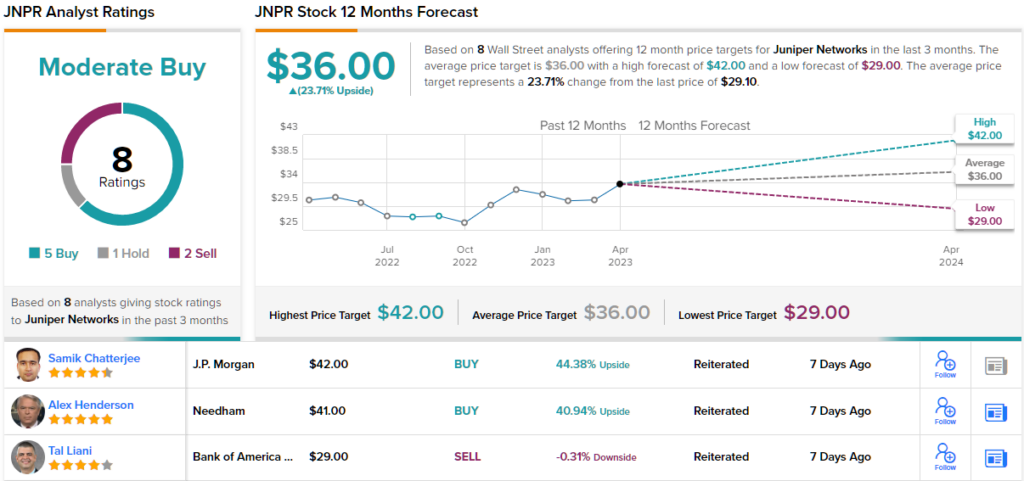

These comments underpin Chatterjee’s Overweight (i.e., Buy) rating while his $42 price target implies one-year share appreciation of 44% is in the cards. (To watch Chatterjee’s track record, click here)

In total, 8 analysts have waded in the with JNPR reviews over the last 3 months, and these break down into 5 Buys, 1 Hold and 2 Sells, for a Moderate Buy consensus rating. Going by the $36 average target, investors will be pocketing returns of ~24% a year from now. As an added bonus, Juniper also pays a $0.22/share quarterly dividend, which currently yields 2.82%. (See JNPR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.