Semiconductor stocks have unquestionably been the hottest part of the market, and the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) is an excellent way for investors to play the semiconductor space. I’m bullish on this sometimes overlooked semiconductor ETF based on the strong historical performance of its underlying index, its highly-rated portfolio of top semiconductor stocks from across the semiconductor value chain, and its favorable expense ratio.

What Is the SOXQ ETF’s Strategy?

SOXQ is based on its underlying index, the PHLX Semiconductor Sector Index.

According to Invesco (NYSE:IVZ), this index is “designed to measure the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business. Semiconductors include products such as memory chips, microprocessors, integrated circuits and related equipment that serve a wide variety of purposes in various types of electronics, including in personal household products, automobiles, and computers, among others.”

SOXQ invests in “companies engaged in the design, distribution, manufacture and sale of semiconductors. The index is reconstituted annually (each September) and rebalanced on a quarterly basis.

SOXQ’s Holdings

As discussed above, SOXQ holds 30 semiconductor stocks. Its top 10 holdings make up a relatively high 64.0% of assets. Below is an overview of SOXQ’s top 10 holdings from TipRanks’ holdings tool.

As you can see, SOXQ gives investors plenty of exposure to the company leading the generative AI revolution, Nvidia (NASDAQ:NVDA), which has a weighting of 10.7% in the fund. It also gives investors plenty of exposure to the competitors trying to close the gap with Nvidia in this area, like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC).

Another thing that I really like about SOXQ is that it invests across the semiconductor value chain, not just in chip developers like Nvidia and its peers. For example, within its top 10 holdings, SOXQ has positions in Taiwan Semiconductor (NYSE:TSM), the world’s largest chipmaker, or foundry, which manufacturers chips for the likes of many of the other companies on this list like Nvidia, Advanced Micro Devices, and Qualcomm (NASDAQ:QCOM).

The fund also owns stocks like Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and ASML Holding (NASDAQ:ASML), which provide the equipment and machinery used in the semiconductor manufacturing process.

I like that SOXQ invests in these companies, as they play pivotal roles in the semiconductor supply chain and because they enjoy significant moats around their businesses. Only a handful of companies in the world have the technological expertise to produce cutting-edge semiconductors or the complex machinery required to produce them.

All of these companies have posted strong performances over the past year. For instance, Lam Research is up 96.9%, Applied Materials is up 78.4%, ASML is up 50.4%, and Taiwan Semiconductor is up 45.5%.

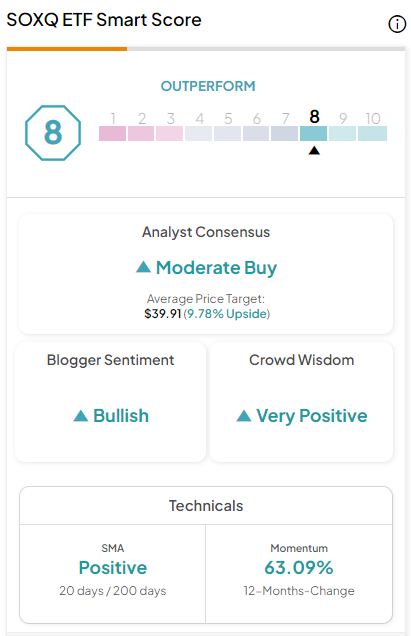

Furthermore, all of these stocks enjoy Outperform-equivalent Smart Scores from TipRanks. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Taiwan Semiconductor has a ‘Perfect 10’ Smart Score, while Lam Research, Applied Materials, and ASML all have Outperform-equivalent Smart Scores of 8 or above. More broadly, an impressive nine out of SOXQ’s top 10 holdings enjoy Outperform-equivalent Smart Scores of 8 or better.

SOXQ itself comes in with an Outperform-equivalent ETF Smart Score of 8.

Historical Performance of SOXQ’s Index

SOXQ only launched in 2021, so it doesn’t yet have a very long track record of performance. The fund lost 35.6% in 2022, when the tech sector struggled, but came roaring back with a massive 66.7% gain in 2023 when advances in AI drove a tech sector rebound led by semiconductor stocks.

However, luckily for us, SOXQ’s underlying index, the PHLX Semiconductor Index, has been around for a long time, giving us a basis to judge how SOXQ would have performed historically. As of January 31, the index has posted impressive returns of 15.4% on a three-year annualized basis, 29.3% on a five-year annualized basis, and 25.3% on a 10-year annualized basis.

A Favorable Expense Ratio

With an expense ratio of just 0.19%, SOXQ is a cost-effective option for investors. This 0.19% expense ratio means that an investor will pay just $19 in fees on a $10,000 investment annually.

In addition to being inexpensive in general, SOXQ’s expense ratio is also considerably lower than those of its peers. For example, the VanEck Semiconductor ETF (NASDAQ:SMH), the iShares Semiconductor ETF (NASDAQ:SOXX), and the SPDR S&P Semiconductor ETF (NYSEARCA:XSD) all have identical expense ratios of 0.35%.

SOXQ’s ratio is likely cheaper because it is newer and trying to compete with these ETFs, which works out in investors’ favor.

How much of a difference does this make over time? Assuming that the ETFs return 5% per year going forward and maintain their current expense ratios, an investor putting $10,000 into SOXQ would pay $243 in fees over the course of the next 10 years. Meanwhile, an investor putting $10,000 into any of the three larger ETFs would pay $443 in fees over the same period.

As you can see, while SOXQ is a smaller fund, it offers a more cost-effective way to invest in the semiconductor sector.

Is SOXQ Stock a Buy, According to Analysts?

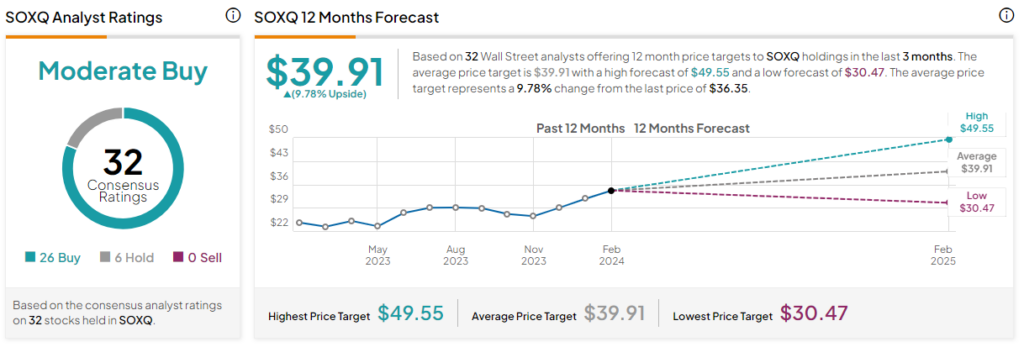

Turning to Wall Street, SOXQ earns a Moderate Buy consensus rating based on 26 Buys, six Holds, and zero Sell ratings assigned in the past three months. The average SOXQ stock price target of $39.91 implies 9.8% upside potential.

Looking Ahead

The SOXQ ETF offers investors an excellent way to invest in the red-hot semiconductor sector. I’m bullish on SOXQ because it features a strong portfolio of highly-rated stocks across the semiconductor supply chain, from generative AI darling Nvidia to the companies making the chips and the equipment needed to make them.

I’m also constructive on the relatively new ETF based on the strong historical performance of its underlying index and because it is one of the cheapest ways to broadly invest in the semiconductor space, with an expense ratio that is considerably lower than that of its peers.