Stock markets are on a bit of a pause following concerns that the Federal Reserve may not be ready to cut interest rates until September. Undoubtedly, the odds of a June cut were pretty low to begin with. Either way, a “higher for slightly longer” kind of environment may take a slight stride out of the market’s march higher, even with the artificial intelligence (AI) boom still very much in full swing.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

As the market rally slows pace, the following high-rated tech stocks may be worth loading up on. Therefore, in this piece, we’ll look at three very different technology companies using TipRanks’ Comparison Tool. Each one of the names has a Strong Buy recommendation, according to Wall Street analysts.

Sony (NYSE:SONY)

Sony is a Japanese entertainment company that offers a unique and diversified mix of businesses, ranging from film production to music and video games to electronics. The stock was a major mover going into and after its latest earnings, which came in ahead of analyst expectations. Though not all segments may find themselves firing on all cylinders at the same time, the company remains diversified (and cheap) enough to make it a worthy bet right here. All things considered, I’m staying bullish on SONY stock at just over $80 per share.

For the latest (fourth) quarter, the entertainment giant reported earnings per share (EPS) of $0.99, topping expectations of $0.69. Most remarkably, the Music, Pictures, and Imaging & Sensing Solutions segments all saw impressive double-digit growth for the quarter. Meanwhile, Game & Network Services (G&NS) saw low growth, up 2.2% for the quarter, thanks in part to falling shipments for the PlayStation 5 (PS5).

The PS5 is a great console but been experiencing a bit of a midlife crisis of late. Indeed, the top-selling console is a major needle mover, not just for the gaming business but the overall firm.

As the firm readies a Pro model with a new GPU, perhaps the gaming division will finally get the shot in the arm it needs before the PS6 rolls around. The console is rumored to include better ray tracing and AI upscaling, the latter of which could be a literal game changer. Of all the industries AI could propel into the future, gaming has to be close to the top of the list.

Though not truly the PS6, I do view the PS5 Pro as the next best thing to a generational refresh. Whether it kicks off a midcycle refresh remains the big question. Either way, developers are gearing up for the upgrades, which could result in a steady and stacked pipeline of truly next-generation-feeling titles.

Given the dominant gaming business and the wide-moat film, music, and electronics businesses, I view Sony stock as a fantastic deal at 15.7 times trailing price-to-earnings (P/E) now that shares have come down a bit after their big 10% post-earnings pop.

What Is the Price Target for SONY Stock?

SONY stock is a Strong Buy, according to analysts, with four unanimous Buys assigned in the past three months. The average SONY stock price target of $112.93 implies 39.8% upside potential.

Uber (NASDAQ:UBER)

Uber stock’s bull run of 2023-24 is now officially over, with shares of the ride-hailing giant now down 22% from their all-time highs. The multi-month fall has been a rather steady descent on the back of some fantastic second-quarter earnings results. Undoubtedly, the hot valuation was in need of a cool-off, but now that shares have chilled out in a bear market, I view them as a great pick-up ahead of the summer travel season. I’m staying bullish on the stock as the bearish descent extends.

As the travel season heats up, Uber seems to be gearing up to save its customers some money with its shuttle-booking service. Such a service could not have come at a better time. Consumers are a bit strapped for cash amid inflation, and Uber continues to demonstrate the tremendous value proposition of its mobility services. Additionally, the firm’s recent Instacart (NASDAQ:CART) partnership to help power its restaurant delivery capabilities could open Uber’s doors to new customers who may be enticed to give Uber’s app a go as well.

Add the Uber One subscription, which offers discounts on mobility and food delivery services, plus an expansion to 25 new countries into the equation, and it’s clear that it’s too soon to depart Uber stock while it’s going for a modest 51 times forward P/E, close to the lowest it’s been in the past year.

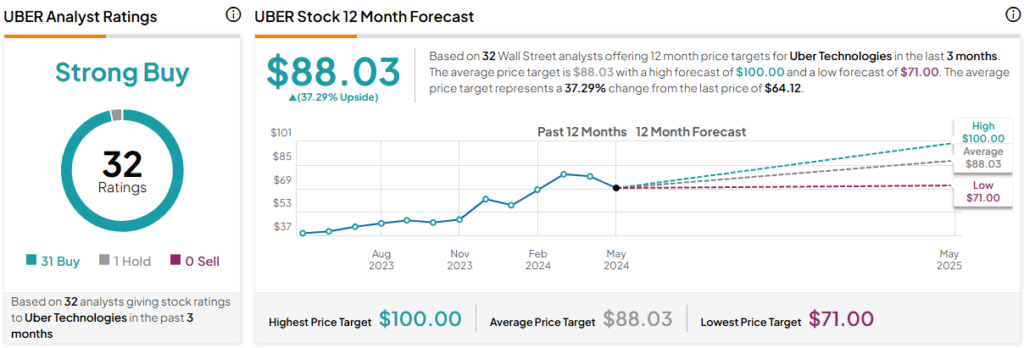

What Is the Price Target for UBER Stock?

UBER stock is a Strong Buy, according to analysts, with 31 Buys and one Hold assigned in the past three months. The average UBER stock price target of $88.03 implies 37.3% upside potential.

Cadence Design Systems (NASDAQ:CDNS)

Cadence Design Systems is picking up speed again after suffering a 15% correction back in April. As the AI boom heats up again, thanks in part to continued explosive demand for AI accelerators, Cadence is one of the high-performing AI plays to watch as it inches back to all-time highs again. Today, the stock is off just 12% from its high, a level that could be breached should Cadence be able to pass an earnings bar that it lowered just over a month ago. All things considered, I’m staying bullish on CDNS stock.

Looking ahead, I’d look for the new Palladium Z3 and Protium X3 systems to jolt growth in the second half of the year. These new products aim to “usher in a new era of accelerated verification, software development, and digital twins.” When you hear “digital twins,” think of the AI leader Nvidia (NASDAQ: NVDA), whose technology is integral to powering these sophisticated models.

In recent quarters, Cadence has formed a closer relationship with Nvidia. The two forces will be ready to launch the Millennium M1 supercomputer, which is every bit as impressive as it sounds. The supercomputer will tackle very difficult problems in science and engineering, providing up to 100x design impact through accuracy, speed, and scale and a 10x increase in throughput compared to CPU-only solutions.

The stock trades at 49.5 times forward P/E, which is well above the application software industry average of over 30.9 times. Still, I think the premium is well worth paying because of the Z3, X3, and M1 (not to be confused with the first generation of Apple (NASDAQ:AAPL) silicon).

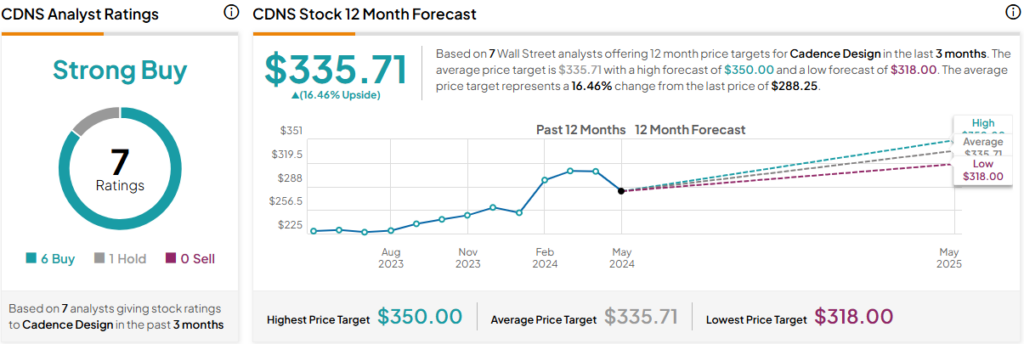

What Is the Price Target for CDNS Stock?

CDNS stock is a Strong Buy, according to analysts, with six Buys and one Hold assigned in the past three months. The average CDNS stock price target of $335.71 implies 16.5% upside potential.

The Takeaway

There you have it — three analyst-praised technology companies that still have room to boom in the second half of the year. Sony, an entertainment kingpin that’s expanded its reach across numerous media, is objectively the cheapest based on P/E ratios alone. Personally, I view it as the best bet. For those seeking greater growth, though, CDNS stock is tough to beat, given innovations that could move the needle in the coming year. At writing, analysts see the most upside to be had from SONY stock (~40%).

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue