Not everyone is happy to see the resumption of required federal student loan repayments. However, there’s a silver lining for anyone invested in SoFi Technologies (NASDAQ:SOFI) stock. Overall, SoFi Technologies is in the winner’s circle, and I am bullish on SOFI stock because the company is demonstrating growth during a challenging time for the economy.

SoFi Technologies offers an all-in-one personal finance app, but the company is also a legitimate bank and lender. How legitimate? Put it this way – SoFi just forged a partnership with banking behemoth BlackRock (NYSE:BLK) “to place a $375 million personal loan securitization exclusively with funds and accounts managed by BlackRock investment advisors,” according to the news release.

That’s not even the most exciting news, though. SoFi Technologies just released a slew of quarterly data points that indicate notable improvement for SoFi. With that encouraging info in hand, prospective investors can decide whether it’s the right time to take a chance on SOFI stock.

SoFi Technologies Announces Deposit Growth

Do you remember how worried banking customers were earlier this year? The financial headlines had people freaking out about deposit outflows and even bank runs as people lined up at ATMs to withdraw their funds.

High interest rates are still putting pressure on banks. Yet, SoFi Technologies survived the fear cycle and is still standing tall today. In fact, SoFi didn’t report major deposit outflows in 2023’s third quarter.

As it turned out, SoFi Technologies reported Q3-2023 total deposit growth of $2.9 billion. That’s up 23% quarter-over-quarter, and SoFi’s total deposits reached $15.7 billion in the third quarter.

It seems like just yesterday that commentators were fretting about “cash sorting” and banking customers cashing out their financial accounts. Apparently, SoFi Technologies isn’t devastated by the “cash sorting” phenomenon.

Indeed, SoFi appears to be improving its financials, as the company reported a very mild quarterly earnings loss of $0.03 per share. That’s noticeably narrower than the consensus estimate of a $0.08-per-share loss.

SoFi Technologies Gets a Revenue Boost from Student Loan Repayments

Borrowers don’t love the resumption of student loan repayments, which started back up this month. On the other hand, it’s good news for SoFi Technologies, which generates revenue from helping students refinance their loans.

Now, some might point out that the third quarter didn’t include October. Hence, SoFi Technologies shouldn’t have seen any benefits of the student loan repayment resumption in its third-quarter results.

Yet, that logic is flawed. SoFi Technologies’ third-quarter student loan volume grew 133% quarter-over-quarter and 101% year-over-year to over $919 million “as borrowers prepared to resume student loan payments in October.”

All in all, SoFi Technologies’ adjusted net revenue increased 27% year-over-year to $531 million. No doubt, student loan repayments were a contributing factor to this impressive top-line result.

Just consider how student loans might positively affect SoFi Technologies’ fourth-quarter financial results. Could SoFi soon shift from net losses to a profitable profile?

It’s definitely possible. According to SoFi Technologies’ quarterly press release, the company’s management sees SoFi moving “toward expected GAAP net income profitability in the fourth quarter.”

That’s not a guarantee that SoFi Technologies will actually be profitable in Q4. Nonetheless, it’s a positive sign that SoFi’s management is raising this topic now. If SoFi Technologies earns a profit, that would only add to the company’s sense of legitimacy among financial commentators and the general public.

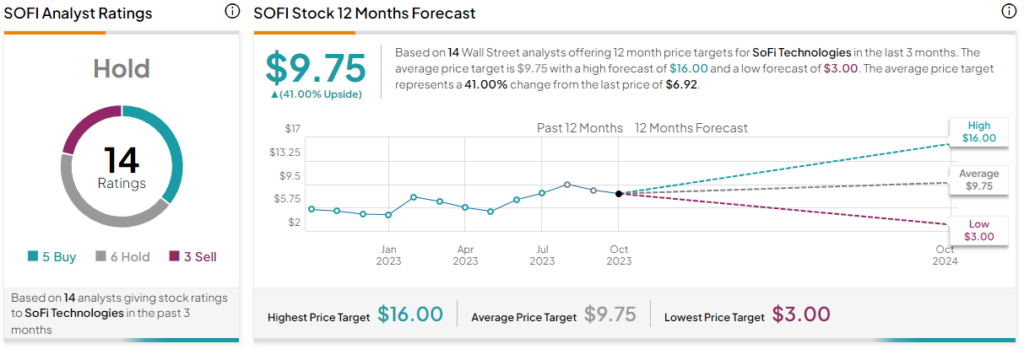

Is SOFI Stock a Buy, According to Analysts?

On TipRanks, SOFI comes in as a Hold based on five Buys, six Holds, and three Sell ratings assigned by analysts in the past three months. The average SoFi Technologies price target is $9.75, implying 41% upside potential.

Conclusion: Should You Consider SOFI Stock?

SoFi Technologies didn’t experience a deposit outflow in the third quarter, and the company is already benefiting from student loan repayments. It’s entirely possible that the fourth quarter will be even better than SoFi’s impressive third quarter.

Best of all, SoFi Technologies could become a profitable business in the near future. So, in case you couldn’t already tell, I’m definitely bullish on SOFI stock, and I feel that investors should consider the stock.