It might not be the biggest name reporting earnings during this big tech loaded week, but SoFi Technologies’ (SOFI) Q3 readout is still likely to be on many market watchers’ radar.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Before the market opens today (Tuesday), the neo bank will deliver its quarterly results, the print coming at a good moment for the stock, having rallied to trailing twelve-month highs, helped along the way by September’s rate cut. So, can investors expect more gains once the company dials in the print?

Ahead of the readout, J.P. Morgan analyst Reginald Smith’s thoughts are leaning “relatively positive,” with Smith believing rate cuts, and the return of bank loan buyers, should be beneficial to loan sale volume and economics. “That said,” the analyst goes on to say, “we continue to closely monitor credit performance in SoFi’s HFS personal loan book, which was approaching the company’s internal fair value loss rate assumptions.”

Numbers-wise, boosted by an 85% year-over-year uptick in Financial Services (vs. the Street at 74%), Smith sees total revenue climbing by 19% YoY and landing at $633 million, just under consensus at $634 million. Smith expects Tech Platform revenue to rise by 14% YoY (Street has 18%) and Lending revenue to drop by 6% compared to consensus at -4%. Consistent with Street expectations, Smith anticipates SoFi will post its fourth quarter in a row of positive GAAP EPS.

But while Smith thinks SoFi is “well positioned into the quarter with plenty of levers to print strong 2H24 results,” the analyst refrains from getting fully behind the stock right now. Given the recent strong gains (up by 52.5% over the past 3 months), the shares are at present trading at 2.8x tangible book, the “highest level since December ‘23, representing more than a half turn premium to SoFi’s TTM avg P/TB multiple.”

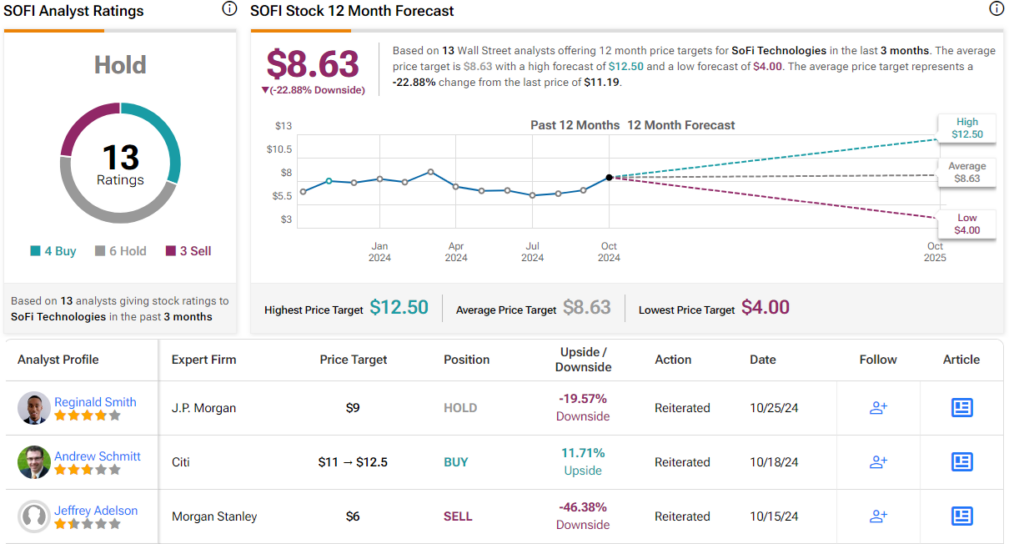

As such, Smith reiterated a Neutral rating on the shares along with a $9 price target, suggesting the stock will see downside of 19.5% in the months ahead. (To watch Smith’s track record, click here)

Smith’s opinion is the most prevalent one on Wall Street with 5 others joining him on the sidelines, and with an additional 4 Buys and 3 Sells, the stock claims a Hold consensus rating. The $8.63 average target is slightly lower than Smith’s objective and factors in a one-year slide of 23%. (See SOFI stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.