To the untrained investor, Snowflake (NASDAQ:SNOW) stock may be one of the priciest stocks in the market right now. However, when you consider its financial trajectory and impressive position in the AI race, it becomes more apparent that Snowflake stock looks cheap compared to its growth prospects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Undoubtedly, AI stocks are all the rage these days, with chip stocks like Nvidia (NASDAQ:NVDA) hogging the headlines and capturing most of the investor euphoria. We must not forget about the software plays, though, as they may be next up to the plate once investors look to other places to find value in the wild world of AI.

The AI Boom Has Just Begun, and It’s Not Just About Nvidia!

Nvidia stock boomed on unprecedented AI chip demand. Once consumers and businesses have the chips and AI firepower, they could go a while without buying more, especially for the firms that overordered. In that regard, investors shouldn’t expect Nvidia to keep one-upping itself consistently. It’s the AI play that we all have heard about non-stop of late.

After the AI chip boom could come a software boom as firms look to harness the power of generative and predictive AI. Indeed, big-tech names have been leading the way on the front of software, with the FAANG cohort leading the way, pushing price-to-earnings (P/E) multiples toward the higher end of the historical range.

The “Magnificent Seven” stocks, as MadMoney host Jim Cramer calls them, are wonderful tech companies that have a solid footing in the AI scene. Looking beyond big tech, though, I do see plenty of underappreciated AI growth stories, such as Snowflake, that may be next for a huge upside move as the AI rally continues.

Snowflake Stock: An AI Stock to Play the Software Side of Things

At this juncture, not only does Snowflake stand out as an AI software winner, but one that could catch investors and analysts off-guard in a similar way Nvidia did. It’s hard to gauge the type of explosive growth that AI can bring to the table.

The floodgates for AI really opened earlier this year when the ChatGPT headlines hit us from left, right, and center. With AI at its tipping point, we may see the “AI jolt” shift from hardware (chip plays) to data plays. Snowflake is a powerful company that stands behind the data cloud.

Let’s think about what goes into building a generative AI. Not only does a company need the hardware (think Nvidia chips), but they also need data, publically available and private. It’s the private data that’s more valuable and could help companies gain an edge when it comes to generative AI.

Snowflake’s data cloud not only helps firms more easily manage massive data sets, but its Data Marketplace can also act as a go-to place for people to transact one of the most precious resources in the AI age — data.

Arguably, private, proprietary data could be more valuable than AI chips themselves. There’s private data that money can’t buy, and it’s the data advantage that could separate the haves from the have-nots in the world of generative and predictive AI technologies.

Snowflake: Smart Partnerships Should Have Investors Excited

Nvidia has been teaming up with a lot of firms these days. Everybody wants in on the AI action, and there’s no better way than to make a deal with the visionary Nvidia CEO Jensen Huang. Snowflake and Nvidia announced a partnership at the latest Snowflake summit to help firms build LLMs (Large Language Models) using proprietary data in the Snowflake Data Cloud.

Indeed, Nvidia also stands out to be a winner on the software side of the AI race. Regardless, I do think Snowflake faces more upside as a less-obvious AI stock that investors may still need time to better appreciate. Perhaps it’ll take a profound quarterly beat for Snowflake stock to get the respect it deserves. For now, it’s one of my favorite AI stocks on the software side.

Aside from Nvidia, Snowflake also has an AI partnership with AI heavyweight Microsoft (NASDAQ:MSFT). Altogether, it seems like Snowflake is ready for the AI wave to give its stock a lift.

Is SNOW Stock a Buy, According to Analysts?

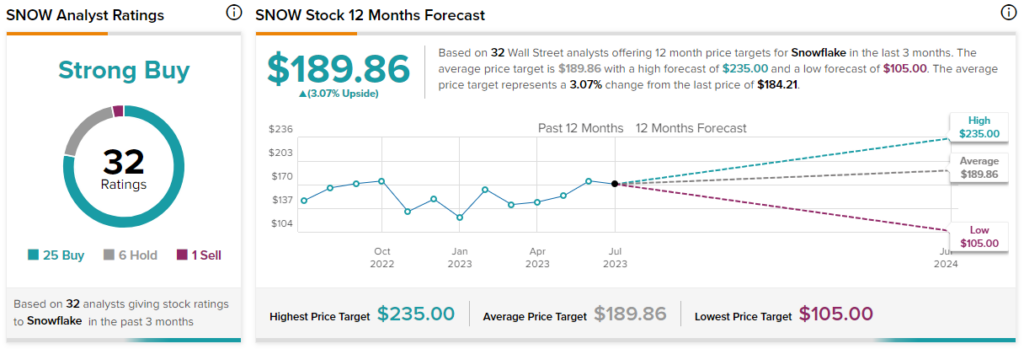

Turning to Wall Street, SNOW stock comes in as a Moderate Buy. Out of 32 analyst ratings, there are 25 Buys, six Holds, and one Sell recommendation.

The average Snowflake stock price target is $189.86, implying upside potential of 3.1%. Analyst price targets range from a low of $105.00 per share to a high of $235.00 per share.

The Bottom Line on SNOW Stock

Snowflake has the AI foundation to soar higher from here. While the stock trades at a lofty 26.1 times price-to-sales, that’s not as expensive as it sounds, at least according to Scotiabank analyst Patrick Colville, who recently issued a massive upgrade on the stock (price target to $212 from $137).

Mr. Colville sees $10 billion in product revenue, with free cash flow margins of around 30% in Fiscal Year 2029. I think Colville is right to give Snowflake the long view. Still, I’d argue there’s room for further price target hikes should the AI boost hit Snowflake sooner rather than later!