Snap (SNAP) might be named after the act of taking a quick photo, but the name might better reflect the stock’s current broken condition. Shares snapped into pieces, so to speak, shedding 39% in a single session and for the first time in over two years dropped into the single digits following the social media app’s woeful Q2 results.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Recall that in May, the company lowered its Q2 guidance, as a reflection of the quickly deteriorating macro environment, but SNAP still failed to meet expectations.

The company generated revenue of $1.11 billion versus the $1.14 billion anticipated by Wall Street, indicating a 13% year-over-year uptick, far below Q1’s 38% increase. The company delivered adj. EPS of -$0.02, compared to the -$0.01 analysts predicted.

As for the Q3 outlook, well there is none. The company said “forward-looking visibility remains incredibly challenging” as to why no guidance was offered. SNAP did say that so far, sales in the quarter were “flat” compared to the same period a year ago but that failed to impress given the Street was after 18% growth.

Analysts were lining up to reflect on the disappointing report, and Monness’ Brian White spares no mercy, noting the “digital specter goes full poltergeist with haunting trends.”

“The tone of the call was as chilling, void of any hope Snap’s prospects will change anytime soon,” the 5-star analyst riffed on the theme. “The headwinds that have been negatively impacting Snap remain the same; however, the macroeconomic environment has materially weakened in recent months. Moreover, we believe the company has not adapted well to Apple’s privacy initiatives, most notably App Tracking Transparency (ATT). Furthermore, we believe TikTok has increasingly become disruptive to Snap.”

White stays on the sidelines with a Neutral rating and no fixed price target in mind. (To watch White’s track record, click here)

The stock has been the recipient of plenty of downgrades since the results were published but not all are in the doubters’ camp.

Jefferies’ Brent Thill notes the positives and thinks investors will be pleased that engagement has been strong compared to the same period last year, as time spent watching content on the platform increased. Additionally, the company’s effort to rein in spending should also be applauded.

“As we likely enter a period of slowing rev growth, we believe investors will welcome SNAP’s more prudent investment approach, which includes a significant slowdown in hiring and nonpersonnel related costs,” the analyst explained. “Even with our reduced rev ests, we still believe SNAP is capable of generating positive EBITDA and FCF in FY23.”

Thill’s rating stays a Buy and while the price target is reduced from $25 to $20, the new figure still suggests shares will double in the year ahead. (To watch Thill’s track record, click here)

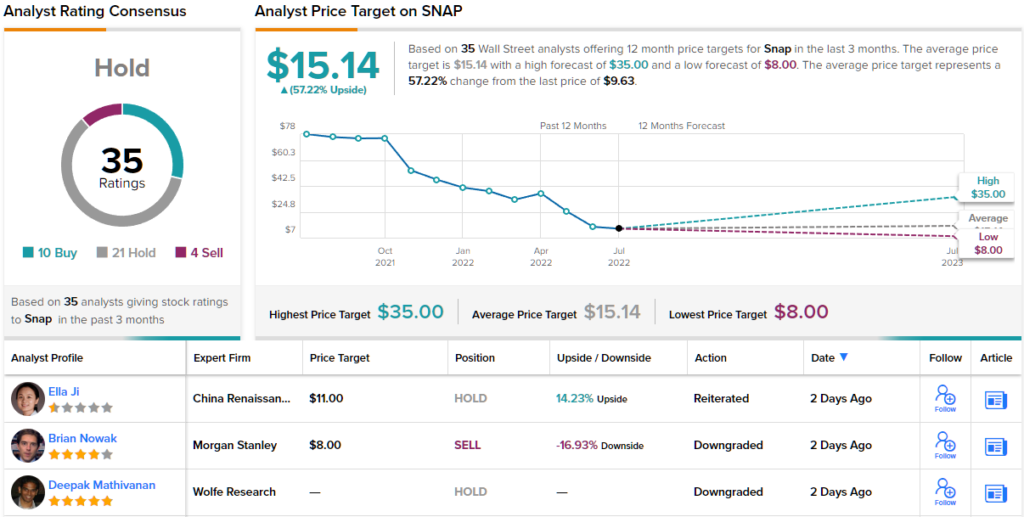

Overall, according to TipRanks, the consensus on Wall Street is that SNAP stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $9.63, could zoom ahead to $15.14 within a year, delivering 57% profits to new investors. (See SNAP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.