Outperforming comes with a price, too. In the months leading up to Snap’s (SNAP) 2Q20 earnings call, shares of the disappearing photo app had been on a supercharged run up, increasing since the March meltdown by a massive 200% and boosted by a strong Q1 earnings report. But Tuesday’s Q2 print failed to impress and following the quarterly statement’s release, a selloff ensued.

More than any other social media platform, Snap has benefited the most from COVID-19’s disruption. And that success is partly to blame for the deflated reaction to the latest report; Simply put, Snap couldn’t match Q1’s outstanding results.

So, what spooked investors? Snap beat top line estimates by bringing in revenue of $454 million, a year-over-year increase of 17% and ahead of the Street’s call for $444.5 million. Snap also increased the all-important DAUs (daily active users) in Q2 by 17% – up to 238 million. But this is where Snap becomes a victim of its own success.

During Q1’s earnings call in April, management called for 239 million DAUs in Q2, so the figure reported didn’t quite make the cut (while also coming in just below the Street’s 238.5 million estimate). Additionally, the 17% growth is below the previous quarter’s 20% increase. So, basically Snap’s growth rate is slowing down.

Add into the mix a net loss expanding from last year’s $255 million to $326 million and EBITDA dropping from -$79 million to -$96 million, and you can see why some might be worried.

However, for Rosenblatt Securities analyst Mark Zgutowicz, the mixed results are no reason to ring the alarm bells. Buoyed by Snap’s “resilient” DR (direct response) ad mix, the 5-star analyst is not overly bothered about DAU growth, and said, “While some concerns were raised with near-term DAU growth, we ultimately see scale driven by more advertisers and more creative ad units, which Snap continues to bring to the table… Snap’s ads platform is benefitting from non-seasonal ecommerce advertiser strength, which appears to be sustaining, if not gaining, momentum in 3Q.”

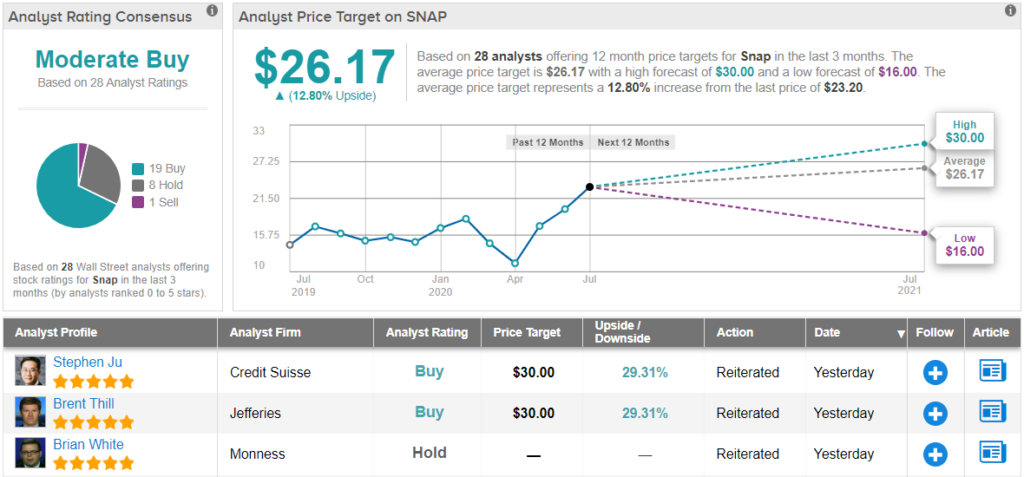

Accordingly, Zgutowicz reiterated a Buy along with a $30 price target. Investors could be pocketing gains in the shape of 30%, should Zgutowicz’s target be met over the next 12 months. (To watch Zgutowicz’s track record, click here)

Now, what about the rest of the Street’s thoughts on Snap? A Moderate buy consensus rating is based on 19 Buys, 8 Holds and 1 Sell. The analysts’ average price target hits $26.34 and implies potential upside of nearly 13% in the year ahead. (See Snap stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.