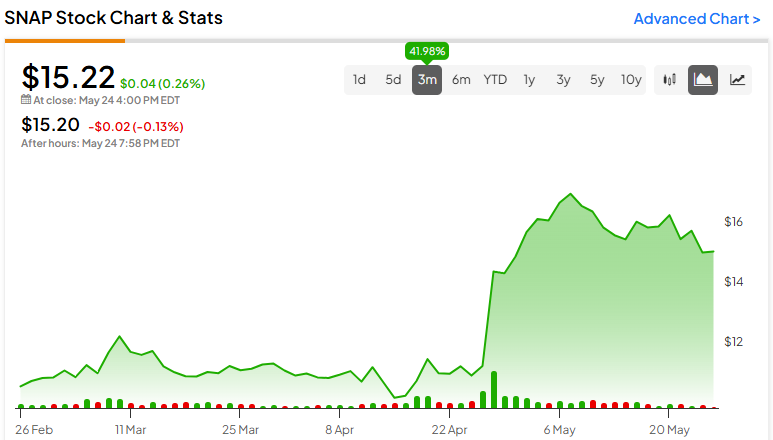

Snap stock (NYSE:SNAP) rebounded after its Q1 earnings. In my view, the recent share price rally offers investors an attractive selling opportunity. The social media and camera technology company has failed to achieve meaningful profit margins despite showing encouraging user and revenue growth metrics. While its adjusted metrics may claim profitability, they can be quite deceptive. Further, SNAP’s valuation appears overly high relative to its overall prospects. For this reason, I remain bearish on the stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Revenue Growth Reaccelerates But Fails to Boost Margins

Snap’s post-earnings rally may initially seem somewhat justified, given that the company achieved a reacceleration in revenue growth. Nevertheless, Snap once again failed to boost its margins to meaningful levels, which is the basis of my bear case. Let’s take a deeper look at its Q1 report.

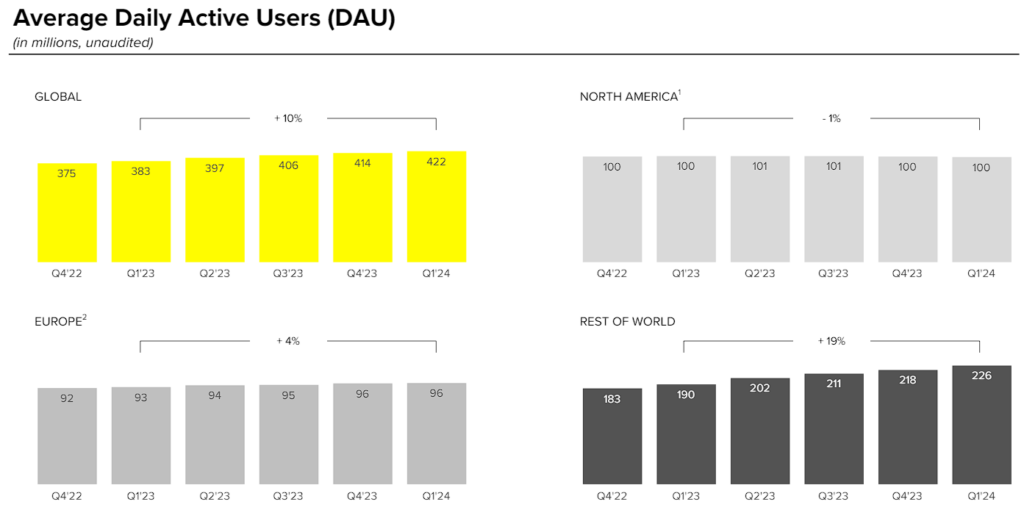

For the quarter, revenues increased by 21% year-over-year to $1.2 billion. This marked an acceleration of 16 percentage points over the prior quarter’s growth rate, which was powered by double-digit active daily user growth (DAUs), general improvements to its advertising platform, and higher demand for Snapchat’s advertising solutions. In turn, this was due to the improvement in the advertising landscape from last year.

More specifically, Snap’s DAUs reached 422 million in Q1, an increase of 39 million or 10% year-over-year. Management attributed this boost to several efforts made to broaden and deepen user engagement. For instance, the ongoing momentum of Snap’s 7-0 Pixel Purchase optimization model resulted in an increase of 75% in purchase-related conversions compared to last year.

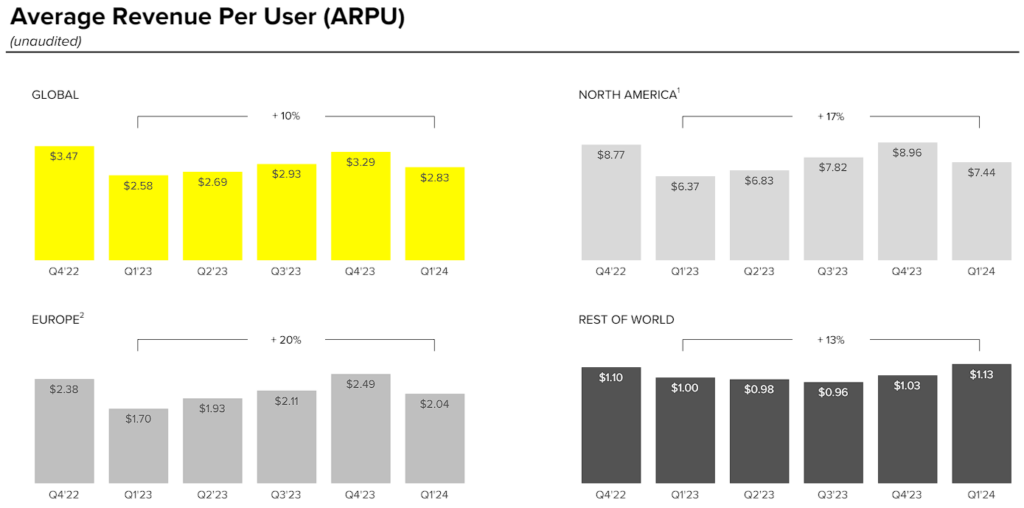

Further, Snap recorded growth in the total time spent watching content on a worldwide basis year-over-year. This led to increased advertiser interest in the platform, which, combined with a more favorable ad environment compared to last year, led to its average revenue per user (ARPU) growth of 10% to $2.83.

Despite these improvements, Snap once again failed to achieve meaningful margins. In fact, its operating margin was once again negative at -28%. At this point, Snap is a 13-year-old company that has achieved massive scale. Thus, seeing continuous operating losses is absolutely inexcusable, in my view.

The company may claim it has reached profitability by boasting positive adjusted EBITDA and free cash flow. These two metrics came in at $45.7 million and $37.9 million, respectively. However, there are two critical considerations to bear in mind. Firstly, these figures are relatively insignificant on a standalone basis. Secondly, they are easily questionable, given that in both figures, stock-based compensation (which is dilutive to shareholders) of $254.7 million has been added back for the quarter.

Therefore, Snap keeps destroying shareholder value, even after posting a rebound in revenues. It may be an indirect value destruction through dilutive compensation, but this is exactly what’s happening. After all, its GAAP figures clearly show this through the ongoing operating losses. Further, there is also no plan in sight for the company to reach meaningful GAAP margins, while recent revenue growth gains could flip if the ad industry were to take a breather. Thus, Snap finds itself in a tough spot.

Snap’s Valuation Is Crazy

Besides the fact that Snap’s investment case offers no visibility to investors, with the lack of meaningful profits likely to last for several more years, the stock’s valuation appears rather crazy. Following Snap’s post-earnings rally, the stock is now trading at about 60.7 times this year’s expected adjusted earnings per share. Not only is this multiple likely based on non-GAAP earnings, which include the dilutive nature of stock-based compensation, but it is in itself absurd, given Snap’s flawed fundamentals.

Taking this a step further, SNAP stock is also trading at about 36 times next year’s expected non-GAAP earnings per share. Thus, while Wall Street expects significant earnings growth next year, a questionable part in itself, the current valuation still appears quite inflated even on a two-year forward basis.

Is SNAP Stock a Buy, According to Analysts?

After its recent rally, Wall Street appears to have mixed feelings about the stock. SNAP stock features a Hold consensus rating based on eight Buys, 18 Holds, and two Sell ratings assigned in the past three months. At $15.59 per share, the average Snap stock price target suggests 2.4% upside potential.

If you’re uncertain which analyst to follow if you want to buy and sell SNAP stock, the most profitable analyst covering the stock (on a one-year timeframe) is Ross Sandler from Barclays (NYSE:BCS), boasting an average return of 47.12% per rating and a 62% success rate.

The Takeaway

To sum up, while Snap’s Q1 revenue growth and user engagement metrics may appear promising, the company’s continuous inability to achieve meaningful profitability remains a great concern. The dubious nature of its adjusted financial metrics worries me even further.

In the meantime, Snap’s current valuation appears excessively rich relative to its lack of GAAP profits and the dilutive nature of SBC, which artificially boosts adjusted metrics. For these reasons, I remain bearish on Snap’s long-term outlook and see the recent share price rally as an attractive opportunity for investors to sell their stock.