In this piece, I compared two nuclear energy stocks — SMR and LEU to see which is better. The energy crisis in Europe triggered by Russia’s invasion of Ukraine is causing many ESG-focused investors to rethink their energy stock investments. Traditionally, fossil fuels and nuclear energy were off the table for those with environmental, social, and governance concerns. However, nuclear energy is now looking attractive to some for its zero-carbon nature.

NuScale Power Corp (NYSE:SMR) and Centrus Energy Corp (NYSE MKT:LEU) attack the nuclear energy question in two different ways. NuScale is building small modular nuclear reactors, while Centrus focuses on high-assay, low-enriched uranium (HALEAU). Upon closer analysis, it looks like SMR stock may be a better bet. Let’s see why.

NuScale Power (SMR)

On the one hand, NuScale Power is pretty much trading near the bottom of its all-time range. It went public at around $10 a share via a SPAC merger in December 2020, and it has since erased almost all the gains it enjoyed in 2022. On the other hand, NuScale is unprofitable with very little revenue yet. A deeper dive suggests a bullish view might look appropriate — with the caveat that this is a high-risk name.

Despite trading at the ground floor of where it went public via its SPAC merger, NuScale’s price-to-sales (P/S) multiple is outrageous, at around 54 times. The company is unprofitable yet, having recorded only 2.9 million in revenue for 2021. However, its revenue exploded in the last 12 months to $10 million, suggesting the potential for powerful growth in the near term.

In 2022, the Nuclear Regulatory Commission certified the design for NuScale’s new reactor, a massive win for the company as the commission hasn’t certified any designs in years. The company’s reactors differ from other nuclear reactors because they are much smaller than the massive, site-specific nuclear plants in use by utilities for decades.

NuScale’s design is also the first design ever to be approved for an advanced nuclear reactor in the U.S. Additionally, the company entered into an agreement last year with a South Korean industrial firm to forge materials for its small modular reactors.

Finally, NuScale has a positive book value per share, at $2.42/share, which is more than can be said for Centrus. Also, NuScale has no debt despite its lack of revenue. In fact, it had $318.6 million in cash and equivalents as of the most recent quarter and only $84.8 million in total liabilities.

What is the Price Target for SMR Stock?

NuScale Power has a Hold consensus rating based on zero Buys, one Hold, and zero Sell ratings assigned over the last three months. At $13, the average price target for NuScale Power stock implies upside potential of 23.93%.

Centrus Energy (LEU)

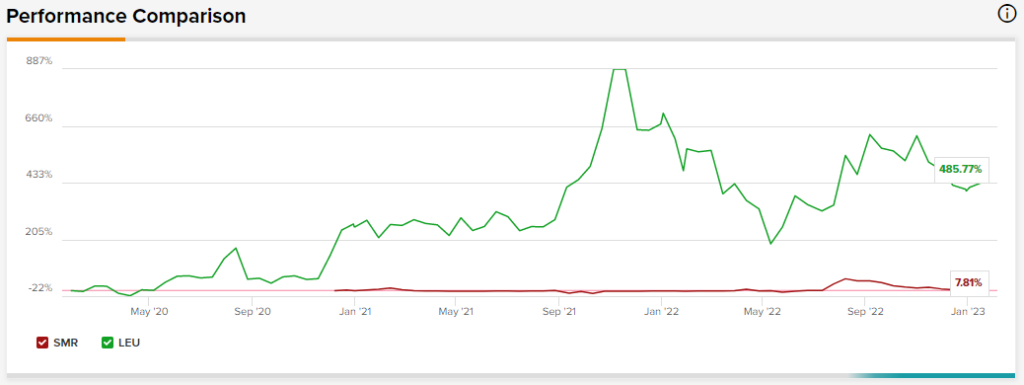

Centrus Energy is much more established, having a publicly-traded history dating back to 1998. The stock is up 11% already for 2023 and has gained 29% for the last six months. Its high debt suggests a neutral view might be appropriate.

Centrus offers a different way to play the uranium market. Last month, the company signed a contract with the Department of Energy to produce HALEU, which is uranium that’s been enriched to a higher concentration than the uranium used to fuel the current fleet of light water reactors. HALEU is expected to power next-generation reactors.

One concern is Centrus’ negative price/book value per share (-$6.92/share), which indicates balance sheet insolvency because its liabilities outweigh its assets. While it doesn’t necessarily mean the company is a bad investment, it does make it extremely risky. On its balance sheet, Centrus had $131.7 million in cash and equivalents, $618.2 million in total assets, and $718.5 million in total liabilities as of its most recent quarter.

However, Centrus’ P/S ratio of 2.1 and P/E ratio of 4.7 look attractive relative to the recent run-up in nuclear energy stocks. Despite having been around for decades, the company still had “only” $256.6 million in revenue for the last 12 months, although it is turning a profit, generating $147.1 million in net income for the last 12 months.

What is the Price Target for LEU Stock?

Centrus Energy has a Moderate Buy consensus rating based on two Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $60.50, the average price target for Centrus Energy stock implies upside potential of 53.9%.

Conclusion: Bullish on SMR, Neutral on LEU

Both companies are speculative, so Centrus could have just as bright of a future as NuScale, or NuScale could flop while Centrus soars. For now, though, Centrus’ debt is a critical concern. Ultimately, investors interested in nuclear energy stocks may want to weigh the good and bad for themselves and choose which one looks better to them.