Being an investor in a company inherently implies you are a supporter of its values and prosperity – or so we often assume. There have been many instances in which enterprises are scrutinized for their principles, which can have a major effect on how they are perceived by all their stakeholders, including their investors. The most visual example lies in how investors have treated the tobacco industry over the past couple of decades. However, investing in tobacco companies may not be as unethical as it seems.

With ESG investing becoming increasingly widespread and investors evolving as unwilling to profit from companies harming people’s health, shares of tobacco companies have remained under pressure for years. Yet, many have seen this as an opportunity to buy shares of tobacco companies on the cheap.

So what is the sensible thing to do? Should you invest in cancer-promoting tobacco companies? Let’s examine.

The Effect of Investors’ Behavior on Tobacco Stocks

To answer the question of whether one should invest in tobacco companies, we first need to understand the effects of doing so. Does investing in tobacco companies actually benefit them?

Companies rely on investors for funding, especially in their early stages. For instance, a growth company in its early stages may require constant funding to pursue its goals. Thus, retaining its share price high to support the minimum dilution possible during share issuances is crucial. In this case, investors buying shares actually and practically aid the company.

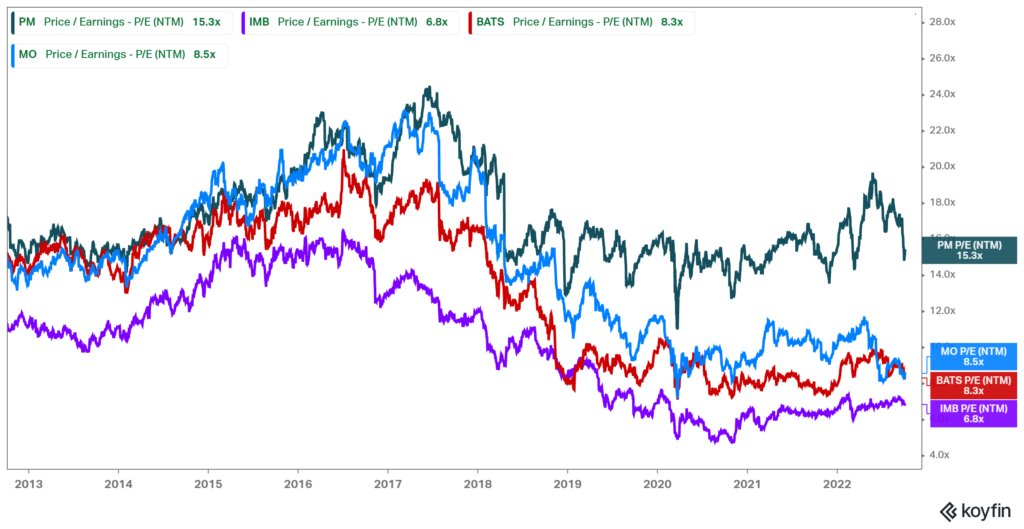

In the case of tobacco giants, this is far from true. These companies are incredibly mature and incredibly profitable. Not only are they not issuing shares, but they are, in fact, buying back their stock to reward their shareholders. Here’s the fascinating part; buybacks are more effective when the price/valuation of a stock is relatively low/below fair value. This happens when investors overlook and disregard a stock, resulting in a disconnect from its actual financials – precisely what is happening with tobacco stocks.

Yes, by avoiding shares of the tobacco behemoths, you are actually kind of helping them, as far-fetched as it sounds. Since 2008, which is when Philip Morris (NYSE: PM) was spun-off from Altria Group (NYSE: MO), the two companies have reduced their share count by 26.1% and 14.2%, respectively. They are taking advantage of their consistently cheap valuations to repurchase and retire stocks on the cheap.

Ironically, this is particularly beneficial for tobacco giants as they are saving tons of money on future dividend payments. The bedrock of each and every tobacco stock’s favorable investment case these days is based on their massive yields, which increase investors’ margin of safety and predictability when it comes to their future total-return potential.

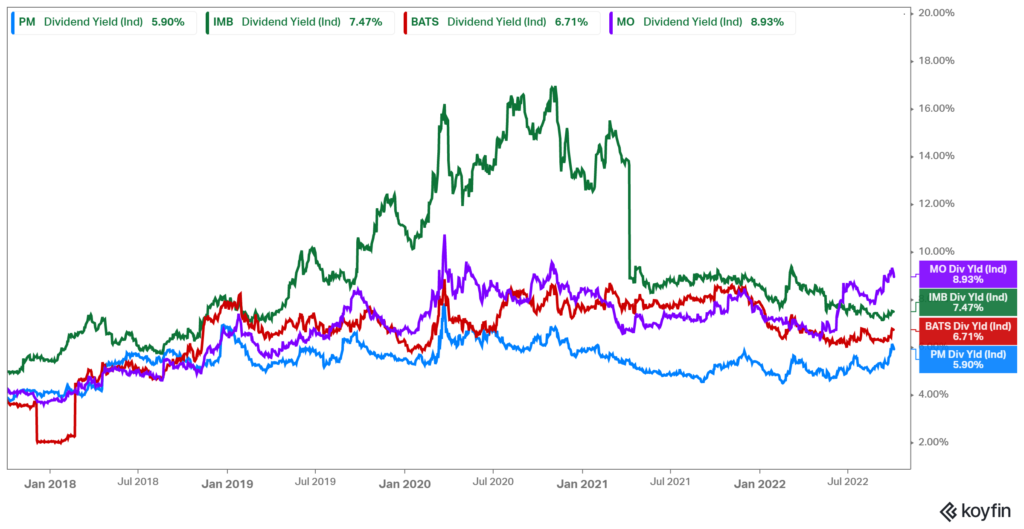

Altria, Philip Morris, British American Tobacco p.l.c. (NYSE: BTI), and Imperial Brands PLC (OTC: IMBBY) are currently yielding 8.9%, 5.9%, 6.7%, and 7.5%, respectively.

Thus, by buying back shares at such cheap valuations/high yields, tobacco giants are not only assisted with sustaining their payouts but even with keeping growing them at relatively attractive paces.

Does It Make Financial Sense to Invest in Tobacco Stocks?

We have now established that investing in tobacco stocks does not contribute to their financial success; if anything, the contrary is the case. Thus, to answer the question of whether one should invest in tobacco companies, the thesis shifts to whether it makes financial sense to do so.

Now, there are multiple views on this topic, and each tobacco giant has its own unique investment case. However, by and large, I would argue that, yes, it makes great sense to invest in tobacco giants, especially in the current market environment. This is due to their unique characteristics.

As I mentioned, their yields are hefty, which increases viability when it comes to projecting future total returns while widening investors’ margin of safety. These companies enjoy extremely resilient cash flows, their products are highly inelastic and inflation-resistant, and profits are likely to keep growing even during the harshest market environments.

Tobacco giants have clearly exhibited their ability to keep growing their profits and dividends under all economic landscapes. Altria Group and Philip Morris have grown their dividends for 52 consecutive years (going back to their pre-split days). British American Tobacco has grown its dividend for 26 consecutive years (in its original LSE listing.)

Combined with their cheap valuations and the industry’s rejuvenation (e.g., smokeless products), I believe this is an ideal time to be a buyer of the tobacco behemoths.

Conclusion: It All Comes Down To Preference

If we agree that investing in tobacco stocks doesn’t contribute to their success and that tobacco stocks can be relatively fruitful investments moving forward, then it all boils down to individual preference and one’s own structure of values and ethics.

In other words, if one sleeps better at night knowing that their dividends are not coming from sales of a product that is harmful to people, avoiding tobacco stocks is the sensible thing to do.

If, on the other hand, one is not bothered by this and sees that their investment is uncorrelated with the future sales/profits/dividends tobacco giants are going to generate and might as well profit from a market opportunity, then investing might be the sensible thing to do.

Where do you lean?