A lot has happened at the Walt Disney Company (NYSE: DIS) that has caught investors’ attention. On November 8, the entertainment behemoth reported dismal Q4 results where EPS of $0.30 fell below the street’s expectations of $0.56 per share. To bring a turnaround, its former CEO, Robert Iger, is back at the helm, succeeding CEO Bob Chapek. The street is bullish on the move, and so am I, given the strong business fundamentals and long-term growth drivers attached to the Disney brand.

Business Initiatives Under CEO Robert Iger

Robert Iger served as Disney’s CEO for 15 years and has agreed to lead the company once again for a two-year stint. Since Iger will not reign as the CEO for too long, another transition will soon be in the cards. Until then, let’s take a peek at the plans set forth by the leadership change. On November 29, Disney filed its annual report. It provided further details on the future course of action under the leadership of returning CEO Bob Iger, who intends to make a number of strategic moves, including organizational and operating changes.

According to the SEC filing, “While the plans are in early stages, changes in our structure and operations, including within DMED (and including possibly our distribution approach and the businesses/distribution platforms selected for the initial distribution of content), can be expected.”

The company will now emphasize the distribution of content through direct-to-consumer (DTC) streaming services instead of traditional distribution methods. During Fiscal Year 2023, Disney expects to release 20 films. Out of that, certain films will be distributed exclusively on DTC streaming services in certain regions.

As a result, the Direct-to-Consumer segment will report higher revenues and costs. Likewise, lower revenues and costs will be associated with the Content Sales/Licensing and Linear Networks segment.

In addition, under the erstwhile CEO Bob Chapek, numerous films were moved directly to Disney+, much to the dislike of producers. However, things may change for the better, as the trend of the pre-pandemic era is expected to return with more theater releases under CEO Bob Iger’s tenure.

Streaming Will be the Long-Term Growth Driver

Bob Iger’s topmost priority is to ensure that the company’s streaming business turns profitable. Disney’s streaming services are expected to be a significant growth driver for the company in the coming years. It includes Disney+, ESPN+, Hulu, Disney+ Hotstar, and Star+.

Disney+ has done well in a short span of three years. Currently, the Disney+ streaming platform ranks as the third largest streaming platform, with 164 million subscriptions. Netflix is the leader with 223 million subscribers, followed by Amazon with 200 million subscriptions. However, Disney+ is still losing money and is expected to turn a profit in Fiscal Year 2024.

Nonetheless, in the long run, Disney should be able to have an edge in the streaming industry versus peers based on its strong business franchise, world-class titles, and industry-leading skill sets. On top of that, Disney has a competitive advantage as it owns the content studios that make original films and TV series. On the other hand, its peers, like Netflix (NASDAQ: NFLX), pay a fortune to rent the content for a few years.

Separately, the company continues to make amusement park upgrades with introductions of new attractions and growth initiatives. Its investments and upgrades are backed by a strong balance sheet and healthy cash flows.

Is Disney a Buy or Sell?

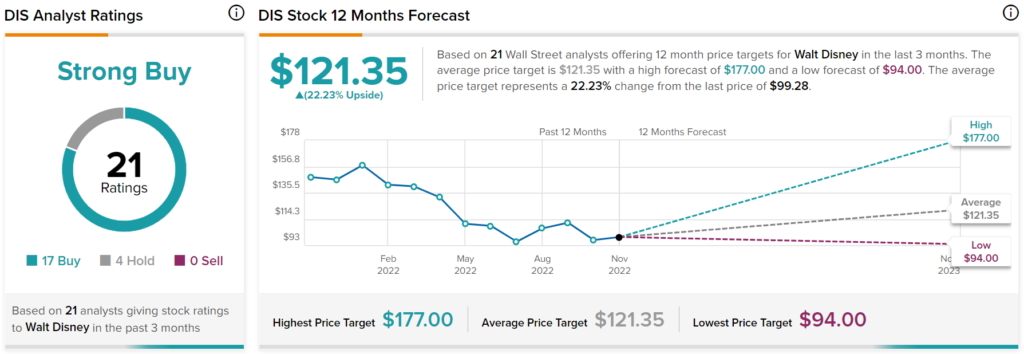

The Wall Street community is optimistic about Disney stock. Overall, the stock commands a Strong Buy consensus rating based on 17 Buys and four Holds assigned in the past three months. Disney’s average price target of $121.35 implies a 22.23% upside potential from current levels.

Concluding Thoughts: Wall Street is Optimistic About Iger’s Return

Disney stock has lost more than 37% of its market capitalization on a year-to-date basis. It was only a year ago that the company touched its all-time high of $197. Currently, the stock is trading approximately $100 lower than those highs. CEO Bob Iger’s return may mean a lot of things. To some, it may mean an indication of troubled waters ahead. To others, it may give a ray of hope toward a quick path to profitability. While only time will tell if the transition will turn out successful, the street considers it to be a positive move and is bullish on Disney stock.

Read full Disclosure