With growing adoption and sales of EVs (Electric Vehicles), Germany-based solar EV maker Sono Motors (NASDAQ:SEV) is grabbing eyeballs. While the company has the potential to reduce your fuel and energy bills, it is still in its early stages and faces heightened competition, which could hurt its prospects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Against this background, let’s check whether Sono Motors stock could generate returns for investors.

Solar Motors: The Pros and Cons

The answer to this is more complex. The company recently showcased its affordable ($25K) solar-powered EV “Sion,” with 42K reservations and pre-orders. This is a positive development and adds visibility over future revenues. Further, through its solar business, Sono Motors offers solar tech to power other EVs, which diversifies its revenue base.

The affordability of Sion and its proprietary lightweight solar technology, like solar kits (with applications in trucks, buses, and trailers), make Sono Motors an attractive long-term play. Also, its partnerships and purchase orders are positive.

The favorable sector trends, initial bookings, and growing partnerships all support the bull case. However, the company is still in its early stages and plans to start the production of its solar EVs in the second half of 2023. This means that Sono Motors may not generate any material revenue in the near future.

Further, costs related to the commercialization of the Sion and the increase in sales and marketing expenses are expected to rise, implying that the company could continue to deliver losses in the coming years. The auto industry is highly competitive, and any low-priced vehicle launch from EV makers could hurt the demand for Sion.

Bottom Line: Is SEV a Good Stock to Buy?

Weighing pros and cons, Sono Motors’ low entry price, solar technology to power EVs and initial reservations should support its stock price. However, investors should note that investments in Penny stocks could be highly risky (learn about investing in Penny stocks: Are Penny Stocks a Good Investment?).

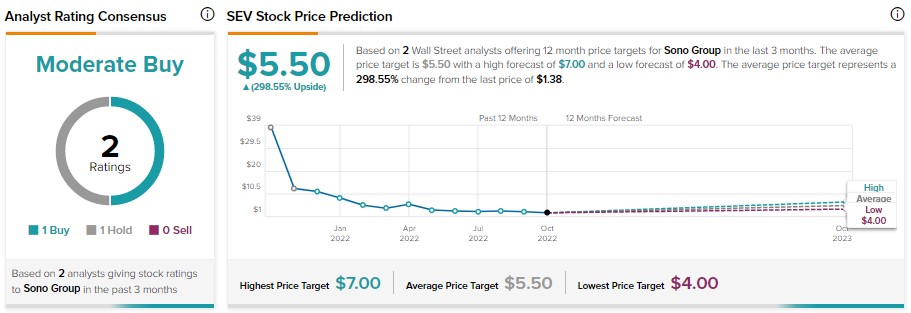

On TipRanks, SEV stock has a Moderate Buy consensus rating based on one Buy and one Hold. Further, these analysts’ average price target of $5.50 implies 298.6% upside potential.

Additionally, SEV stock scores seven out of 10 on TipRanks’ Smart Score system suggesting a Neutral outlook.

Meanwhile, investors can leverage TipRanks’ Penny Stocks Screener to find Penny stocks with a higher likelihood of beating the benchmark index.