Instacart (NASDAQ:CART), officially known as Maplebear, is a North American online grocery retailer. During the pandemic, when online shopping peaked, the company had enormous success. Macroeconomic headwinds, like rising interest rates, might be impacting its short-term growth. Nonetheless, Wall Street anticipates 44% upside in CART stock by the end of 2024.

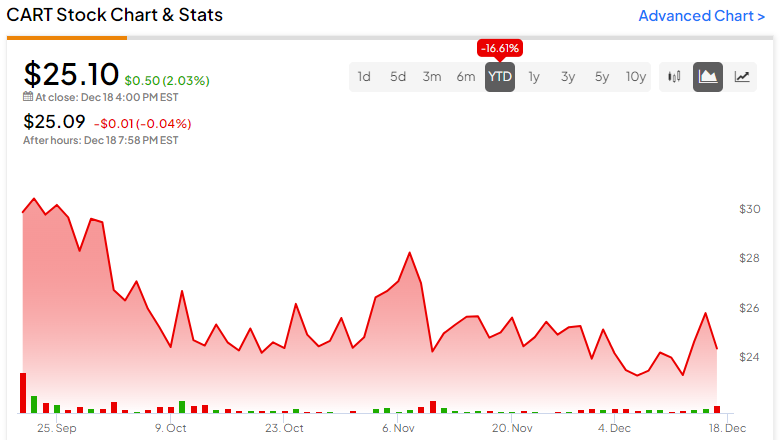

Founded in 2012, Instacart swiftly made its name in the retail industry by offering a unique service: delivering groceries and everyday essentials directly to consumers’ doorsteps. The growing adoption of online shopping makes me bullish on Instacart’s long-term prospects. The company went public in September 2023, but its shares have fallen by 16.1% since then compared to the S&P 500’s (SPX) gain of about 7% in the same period.

Instacart Had a Great Quarter

Instacart’s model is ingenious: customers can order groceries through the app or their website from their preferred stores, and Instacart’s shoppers would pick and pack the items before delivering them within hours. This approach evaded the traditional constraints of grocery shopping, freeing consumers from the time-consuming chore of navigating aisles and checkout lines.

Over the past few years, Instacart has evolved beyond a mere grocery delivery service. Its platform has expanded to include partnerships with a diverse range of retailers, from supermarkets and specialty stores to pharmacies and even pet supply stores. This diversification has widened its user base.

Furthermore, the launch of Instacart+, formerly known as Instacart Express, a subscription-based service that provides unlimited free delivery for a flat monthly or yearly fee, cemented its position as a household staple.

In the third quarter, gross transaction value (GTV) increased by 6% year-over-year, driving a total revenue increase of 17% to $764 million. Instacart defines GTV as the “value of the products sold based on prices shown” on its platform. Revenue also exceeded the $736.9 million consensus estimate.

Advertising and other revenue also came in at $222 million, up 19% from the prior-year quarter and accounting for 29% of total revenue.

More Growth Ahead

While the company is not profitable on a net-income basis, it is working on achieving profitability over the next few years. Plus, its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) jumped by an impressive 120% to $163 million from the year-ago quarter.

Furthermore, Instacart is constantly innovating. Its foray into advertising initiatives and expansion into new markets reflects its commitment to evolve. In its Q3 shareholder letter, management emphasized recent partnerships with “Kaiser Permanente, Mount Sinai Solutions, Wellness West, and the City of Columbia, South Carolina.”

It has also partnered with Mastercard (NYSE:MA) to provide eligible members with a two-month free trial of Instacart+ as well as a $10 monthly discount on their second eligible Instacart purchase every month.

Looking ahead, management expects Advertising and Other revenue to drive EBITDA growth in the fourth quarter to the $165 million to $175 million range. Additionally, GTV growth could land in the 5% to 6% year-over-year range in Q4. For the full year, Instacart expects GTV year-over-year growth to be in the mid-single digits, with EBITDA potentially tripling from 2022 levels.

Meanwhile, analysts predict revenue of $3.04 billion for the full year. For 2024, revenue is estimated to increase by 7.9% year-over-year to $3.29 billion, with earnings of $0.34 per share.

I believe the company’s vast scale, partnerships with 1,400 retail banners, and ongoing efforts to make Instacart more accessible to consumers will propel it to exceptional growth in the coming years.

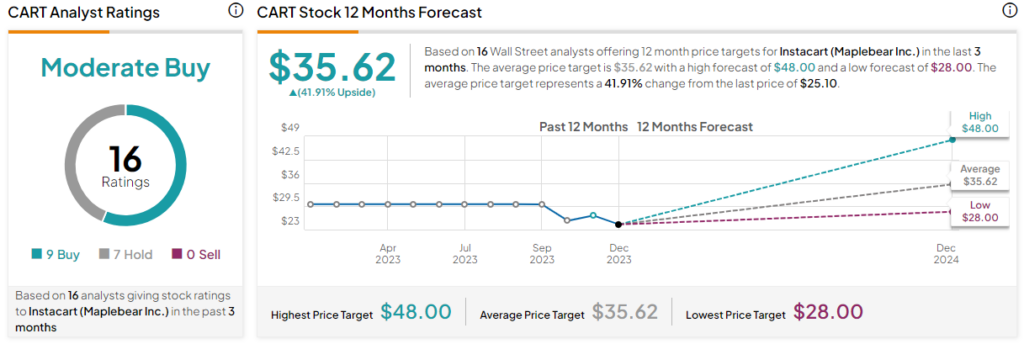

Is CART a Buy, Hold, or Sell, According to Analysts?

Following the company’s strong third-quarter results, Oppenheimer analyst Jason Helfstein reiterated his Buy rating on the stock. The analyst is impressed with Instacart’s increased profitability as a result of its advertising strength and believes the company has the potential to grow its revenue in the coming years.

Additionally, JPMorgan (NYSE:JPM) also maintained its Buy rating on the stock with a price target of $33, impressed with Instacart’s first quarterly results as a public company. Despite the competition, the firm considers Instacart’s growing profitability and advertising revenue to be commendable.

Furthermore, Stifel Nicolaus analyst Mark Kelley cited Instacart’s strong third quarter and “promising 4Q23 guidance, as well as key positives such as increased order numbers, Instacart+ MAU growth, and expanding advertising business,” as reasons for his bullish stance on the stock. The five-star analyst has a Buy rating and a price target of $48 for CART.

Overall, CART stock earns a Moderate Buy rating on TipRanks. Out of the 16 analysts that cover the stock, nine rate it a Buy, and seven rate it a Hold. The average CART stock price target of $35.62 implies upside potential of 41.9% over the next 12 months.

The Bottom Line on Instacart

Instacart displays the transformative power of technological innovation in the retail sector. As it navigates through short-term challenges and continues to adapt, I believe the company has more room to grow as the demand for online grocery shopping progresses. Therefore, I believe the stock can possibly hit its mean price target in the next 12 months.

Note that the company is still in its early stages of growth, so it is bound to experience some volatility. Hence, it would be a good addition for investors with a good risk appetite, eyeing some solid growth in the long haul.

Furthermore, TipRanks has assigned a Smart Score of 9 out of 10 to Instacart stock, indicating high potential for the stock to beat the broader market.