2020 won’t soon be forgotten by investors. Inflicting wide-spread destruction, COVID-19 devastated businesses all over the world and brought the economy to its knees. Retail was among the sectors to be put in a chokehold, but amid the chaos, some retail stocks have received a standing ovation from the Street.

Footwear retailer Shoe Carnival (SCVL) falls into this category. Putting it simply, Susquehanna analyst Sam Poser told clients, “Buy any weakness.” To support this claim, he cites the company’s most recent quarterly performance.

“The strong Q2 2020 print provides a new foundation for SCVL and was the result of great foresight, great customer engagement, great support of employees, great execution, and great vendor relationships. That new foundation should allow SCVL to take advantage/gain share from the recent bankruptcies of Modell’s and Stage Stores and Nike’s decision to no longer sell to Dillard’s, Belk, Boscov’s and others,” Poser explained.

Diving into the details of the release, SCVL reported EPS of $0.71, blowing both the Street’s and Poser’s forecasts out of the water. That said, the retailer missed the mark when it came to consolidated same-store sales (SSS), but Poser points out that if “SSS only reflected the time stores were open, SSS exceeded a 20% increase.” He also mentions that the shift out of the back-to-school selling season was partly to blame for the miss.

Investors have expressed concerns regarding the contraction of merchandise margin, but Poser doesn’t see this result as a negative. “SCVL is managing through the COVID-19 pandemic very efficiently, and sales and margins reflect that. SCVL was one of few companies to pay its store employees while stores were closed, which facilitated rapid store reopenings and a well-trained, loyal workforce,” he commented.

Poser added, “SCVL’s financial position is strong, and there is no debt on the balance sheet. SCVL’s CRM and loyalty program led to robust ecommerce growth (334%-plus) and improvement in store traffic levels until the BTS comparisons hit at the end of the quarter…We remain confident that after attaining 25 million ShoePerks loyalty members, a double-digit increase in Gold ShoePerks members (who spend on average $16 more per transaction than that of regular members) and a double-digit ecommerce conversion rate, SCVL is well positioned to continue to grow market share.”

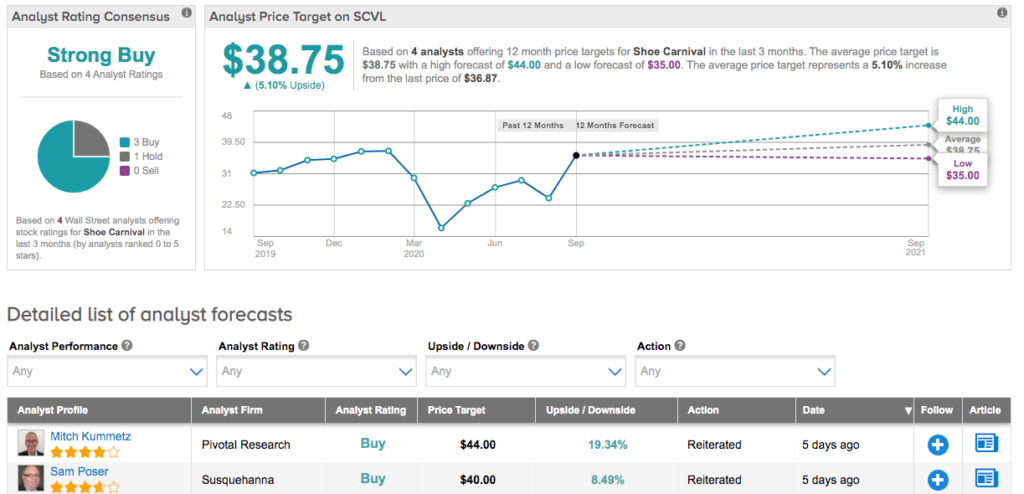

All of the above keeps Poser with the bulls. In addition to maintaining a bullish call, the analyst left the price target at $40. This target suggests shares could surge 8% in the next year. (To watch Poser’s track record, click here)

In general, other analysts echo Poser’s sentiment. 3 Buys and 1 Hold add up to a Strong Buy consensus rating. With an average price target of $38.75, the upside potential comes in at 5%. (See Shoe Carnival price targets and analyst ratings on TipRanks)

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.