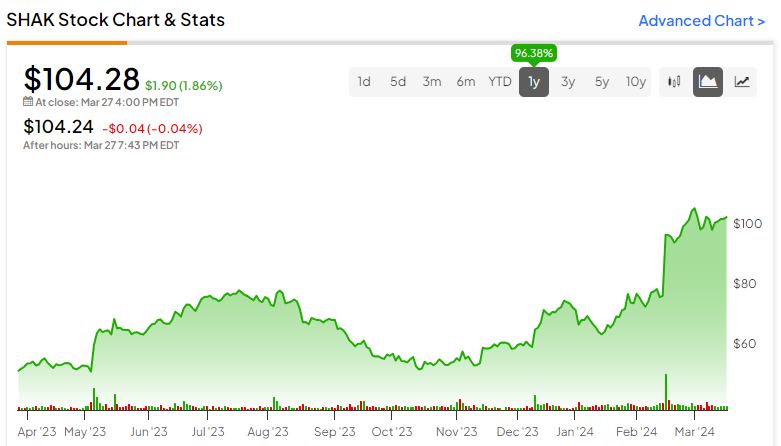

Shake Shack stock (NYSE:SHAK) has seen strong momentum, with shares nearly doubling over the past year. The New York-based fast-casual burger chain known for its gourmet flair has sustained robust growth, rightfully exciting investors about its future prospects. However, the market appears to ignore the most alarming factor in Shake Shack’s investment case: the company’s razor-thin margins. In fact, I don’t see how its soft margins will translate to meaningful profits. Thus, I am bearish on the stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Aggressive New Store Openings Fuel Growth

On the positive side of Shake Shack’s investment case, the company’s aggressive new store openings keep fueling top-line growth. At the end of FY 2022, Shake Shack numbered 436 system-wide (corporate + franchised) stores. By the end of FY 2023, this number had climbed to 518, a year-over-year increase of 18.8%.

At the same time, the company managed to drive some growth (more on that later) in same-store sales at existing locations. Specifically, in Q4, the company grew “same-shack” sales by 2.8%. This growth can be broken down to an increase of 1.4% in-store traffic, which management said actually accelerated through the quarter (driven by marketing initiatives), and an increase of 1.4% tied to price mix.

The combination of a notably higher store count and modestly higher same-store sales led to system-wide sales of $442.1 million, up 21.4% compared to last year. Of course, not all locations are owned by the company. Some are licensed, from which the company receives frictionless (and higher-margin) royalties. Thus, on a company level, net sales grew by 20% to $286.2 million.

Moving forward, the company plans to open about 80 shacks system-wide this year, approximately 40 company-operated and approximately 40 licensed shacks. This suggests that the company will maintain the same pace of new openings as last year (41 company-operated and 44 licensed openings). Therefore, Shake Shack’s revenue growth is likely to be sustained in the double digits. Wall Street’s consensus revenue estimates for FY 2024, indeed, predict revenue growth of 14.7% to $1.25 billion.

Nevertheless, Shake Shack’s biggest problem — its lackluster unit economics and lack of strong prospects for profitability — remains unsolved.

Lackluster Unit Economics Keep Hampering Profitability

On the surface, Shake Shack’s strong revenue growth has certainly inspired confidence among investors. That said, the rather lackluster unit economics the company has to deal with keep hampering its margins and, thus, overall profitability prospects. This problem has two heads.

Firstly, roughly half of Shake Shack’s locations are company-operated, with only 223 of them being licensed at the end of the year. This means the company can’t enjoy the high-margin cash flows that franchisors who have opted to have most of the locations franchised, like McDonald’s (NYSE:MCD) or Domino’s Pizza (NYSE:DPZ), can.

Secondly, the challenge lies in the scalability of unit economics, as the current trajectory of same-store sales growth falls short. The reported 2.8% increase in same-store sales during Q4 is very soft, particularly considering Shake Shack’s status as an emerging brand poised for significant expansion. For perspective, McDonald’s, probably the most mature company in the space with some of its locations standing for decades, posted same-store sales growth of 9% in FY 2023.

Sure, management celebrated the year-over-year expansion of the restaurant margin by 240 basis points to nearly 20% in Q4, which led to Shack’s operating profit growing by 37%. However, this is only part of the story.

Despite the 37% growth seeming like a noteworthy development, it translates to just $54.6 million in restaurant-level operating profit. Now, account for SG&A expenses of about $35.8 million (which got added back to the $54.6 million figure), and you see why there is barely any money left for the company.

Evidently, adjusted EBITDA (a suspicious metric on its own, given that it excludes very real expenses such as stock-based compensation) came in at just $31.4 million, implying a margin of just 11%. On a GAAP basis, in fact, Shake Shack’s operating income came in at just $5.9 million in FY 2023, implying a bleak operating margin of just 0.5%.

Management has set another margin expansion target for FY 2024, targeting a restaurant-level operating margin of 20% to 21%. Still, this may be, at best, only possible to raise the company’s overall operating margin by a couple of percentage points. Yes, net income growth may seem strong from a percentage perspective, but it still doesn’t imply meaningful net income levels.

Take Wall Street’s consensus EPS estimates, which illustrate this point. Analysts expect EPS growth of 86%, 39%, and 19% in FY 2024, FY 2025, and FY 2026, respectively. Yet, even the FY2026 projection implies a mere EPS of $1.13 (i.e., net income of just $55.8 million). That’s such a thin profit that it virtually implies the stock is trading today at 97 times its FY 2026 earnings – a truly absurd valuation – especially for Shake Shack’s underwhelming same-store sales growth momentum.

Is SHAK Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Shake Shack features a Moderate Buy consensus rating. This is based on six Buy, 11 Hold, and one Sell ratings assigned in the past three months. At $99.00, the average SHAK stock forecast suggests 5.1% downside potential.

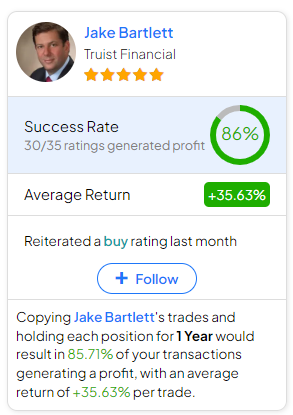

If you’re wondering which analyst you should follow if you want to buy and sell SHAK stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jake Bartlett from Truist Financial, with an average return of 35.63% per rating and an 86% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, while Shake Shack’s aggressive expansion and revenue growth through store openings has captured investors’ attention, its razor-thin margins remain a concerning issue. Double-digit growth could be sustained, moving forward. However, Shake Shack’s lackluster unit economics hurt any prospects for significant profitability. Thus, with mild same-store sales growth and a doubtful path to meaningful profits, caution is warranted following the stock’s extended rally.