According to CapitolTrades.com, a platform offering real-time data related to politicians’ trades, Dan Sullivan, an American politician and a U.S. Senator from Alaska, recently sold shares of Charles Schwab (NYSE:SCHW). At the same time, he bought Church & Dwight (NYSE:CHD) and Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG).

Per the data, each of these transactions had a size range of $15-$50K.

Using TipRanks’ data, let’s find out what’s on the horizon for SCHW, CHD, and GOOGL stocks.

Is Schwab a Good Buy?

Charles Schwab stock lost about 26% of its value month-to-date. The recent developments in the banking sector weighed on its stock price. Given the pullback in SCHW stock, its CEO, Walter W. Bettinger, bought about 50,000 shares.

While top insiders buying stocks is a positive, investors’ negative outlook on the banking sector could pose challenges in the short term.

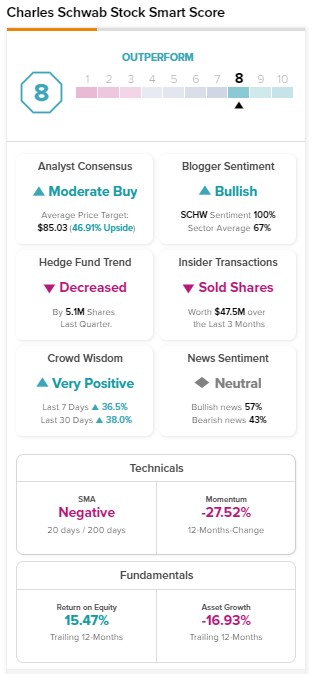

SCHW stock has 14 Buy, three Hold, and one Sell recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $85.03 implies 46.91% upside potential.

While analysts are cautiously optimistic about SCHW stock, hedge funds sold 5.1M shares in the previous quarter. Nevertheless, SCHW stock has an Outperform Smart Score of eight.

What’s the Prediction for CHD Stock?

Shares of consumer goods company Church & Dwight face near-term headwinds from continued softness in its discretionary categories. While higher pricing will likely support organic sales and gross margins, increased commodity and material costs could remain a drag on profitability.

Due to the short-term uncertainty, the CHD stock sports a Hold consensus rating on TipRanks, reflecting six Buy, six Hold, and three Sell recommendations. Further, analysts’ average price target of $86.92 implies an insignificant upside potential of 1.12%.

CHD stock also fails to attract attention on TipRanks’ Smart Score system. With insiders and hedge funds lowering their exposure to CHD stock, it has a Neutral Smart Score of four.

Is GOOGL a Good Buy Right Now?

The weakness in the ad market due to the macro headwinds posed short-term challenges for GOOGL stock. However, the tech giant’s leadership position in the digital ad space indicates that it is better placed to capitalize on the recovery in ad spending. Further, its investments in AI (Artificial Intelligence), solid cloud business, and increased focus on reducing costs bode well for future revenue and earnings growth.

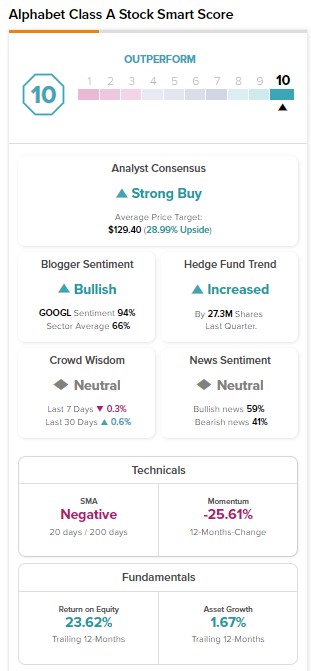

Wall Street is bullish on GOOGL’s stock. It has a Strong Buy consensus rating on TipRanks based on 31 unanimous Buy recommendations. Further, analysts’ average price target of $129.40, suggests 28.99% upside potential.

Our data shows that hedge funds bought 27.3M shares of GOOGL in the previous quarter. Overall, GOOGL stock has a “Perfect 10” Smart Score.

Bottom Line

Retail investors could benefit from following politicians’ trades. At the same time, one can use TipRanks’ Experts Center tool to form investment decisions with ease. As for the three stocks mentioned in this article, GOOGL, with its Strong Buy consensus rating and a “Perfect 10” Smart Score, appears lucrative and is more likely to outperform broader markets.