After an all-night voting session, the US Senate passed the Democrats’ Inflation Reduction Act. The bill brings up many questions – not least of which is, will a government spending bill actually reduce inflation? – but leave that aside for now. The bill includes huge funding, on the order of $370 billion, for climate-related clean energy initiatives. It’s widely expected to pass in the House, and President Biden has already indicated that he will sign it; so investors would be wise to start looking into clean energy stocks.

Among other things, the climate provisions of this bill include new and/or increased subsidies for solar power projects, including residential-based solar installations. This is an important segment of the solar industry – for while there are legitimate debates to be had about the ability of industrial-scale solar farms to power the overall grid, residential systems have already proven themselves to be effective at reducing the users’ electric bills.

Against this backdrop, we’ve used the TipRanks database to locate two solar stocks that stand to gain should the Inflation Reduction Act’s climate provisions become law. Both are Strong Buy options with plenty of upside potential, according to the analyst community. Let’s take a closer look.

Sunrun, Inc. (RUN)

With 15 years’ experience in the business, Sunrun is a leader in the US residential solar industry. The company offers full packages of solar power installations for private homes, customized to the user’s particular location and situation. The installations can include combinations of rooftop solar power generation panels and ‘smart’ power storage batteries, and installations can power a house or return power to the grid.

Sunrun has seen a surge in demand in recent months, resulting in recent record sales numbers. A look at the 2Q22 financial release, the most recent quarter reported, will tell the story.

The company saw a 45% year-over-year increase in top line revenue, to $584.5 million – a company record. The increase at the top line was driven by increases in some of the drill-down numbers. Solar energy capacity installed grew by 33% y/y in the second quarter, and the company recorded a 21% y/y increase in customer additions, for a total of 724,177 active customers. Sunrun’s annual recurring revenue reached $917 million, and the average contract life remaining for the company’s customers stands at 17.6 years.

In recent weeks, Sunrun has announced initiatives to expand its business, including an agreement with SPAN to provide solar panels and storage batteries in the Puerto Rican market, and the launch of an electric vehicle (EV) charger as an option in its home installations.

Mark Strouse, 5-star analyst with JPMorgan, has reviewed Sunrun and come to a bullish stance on the stock. He writes, “We believe the US Inflation Reduction Act could increase RUN’s TAM by providing ITCs for new technologies (increasing RUN’s value per home), providing ITC adders for low-income households and domestically-sourced content (RUN estimates that ~1/3 of its customer base is deemed to be in low-income areas), as well as access to relatively cheap cost of capital from tax equity for the next ten years…”

“Owing to pricing increases implemented earlier this year, enabled by surging utility retail rates, RUN is on track for value per subscriber to increase significantly in 3Q,” Strouse added.

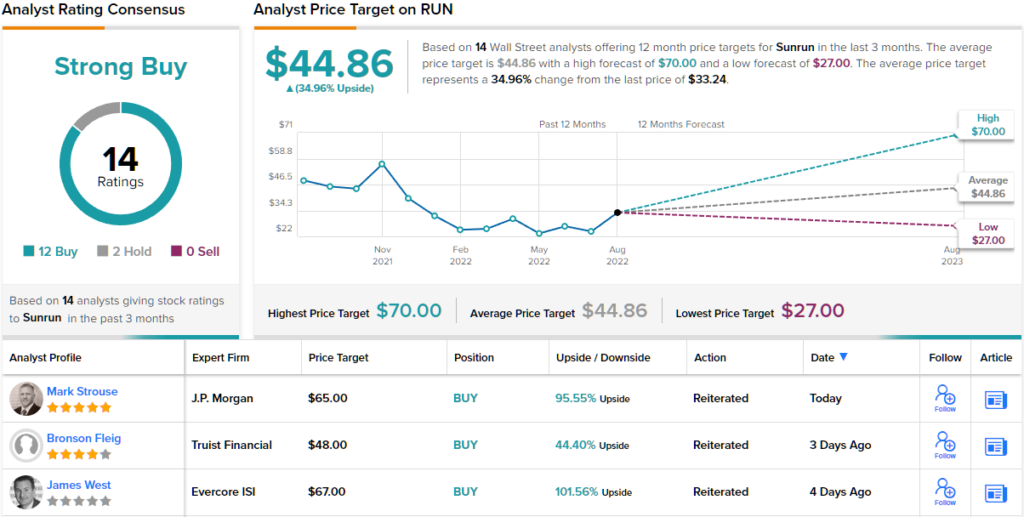

Strouse doesn’t stop with his upbeat commentary. He rates Sunrun shares an Overweight (i.e. Buy), with a $52 price target that implies a one-year upside potential of 56%. (To watch Strouse’s track record, click here)

So far, so good, and it looks like Wall Street is in agreement with this upbeat take on Sunrun. The stock has 14 recent analyst reviews, including 12 to Buy and 2 to Hold, for a Strong Buy consensus rating. The shares are priced at $33.24 and their $44.86 average price target suggests ~35% one-year upside. (See Sunrun stock forecast on TipRanks)

Sunnova Energy International (NOVA)

Next up is Sunnova, one of Sunrun’s competitors in the residential solar market. Sunnova is active in each stop of home solar installation, from installing rooftop panels to providing storage batteries, and will even repair, modify, or replace the roof if that is necessary to complete the solar installation. The company also provides financing to assist customers in paying for the solar system, and insurance and maintenance plans to protect the investment.

Sunnova has seen a surge in demand, and increased demand led to record revenues. The 2Q22 top line expanded by $80.5 million, to reach $147 million total – a year-over-year jump of 121%. The company attributed the high revenue to a combination of an increase in the number of solar systems installed and serviced plus an increase in the sale of inventory to dealers. Sunnova began that latter in April of this year.

During the second quarter, Sunnova recorded an increase of 17,300 new customers, bringing its total customer base to 225,000 as of the end of June.

Sunnova has been aggressively moving to expand the business and increase sales and customer numbers. The company is moving into the Puerto Rico market, targeting retail stores rather than residences. In July, Sunnova announced that its panel and battery systems will be available through Home Depot stores across the island. Also in July, Sunnova announced a partnership with a San Francisco-based non-profit to make clean solar energy available to the Navajo Nation.

Guggenheim’s 5-star analyst Joseph Osha covers Sunnova, and likes what he sees. Pointing out strains on the US electric grid, Osha writes, “Demand for residential solar remains front and center this summer as we continue to face extreme heat waves, possible public safety power shutoffs in the West, and increasing homeowner desire for energy resilience and independence. We have tweaked our model to reflect the more back-end-weighted customer additions but otherwise our operating assumptions remain relatively unchanged.”

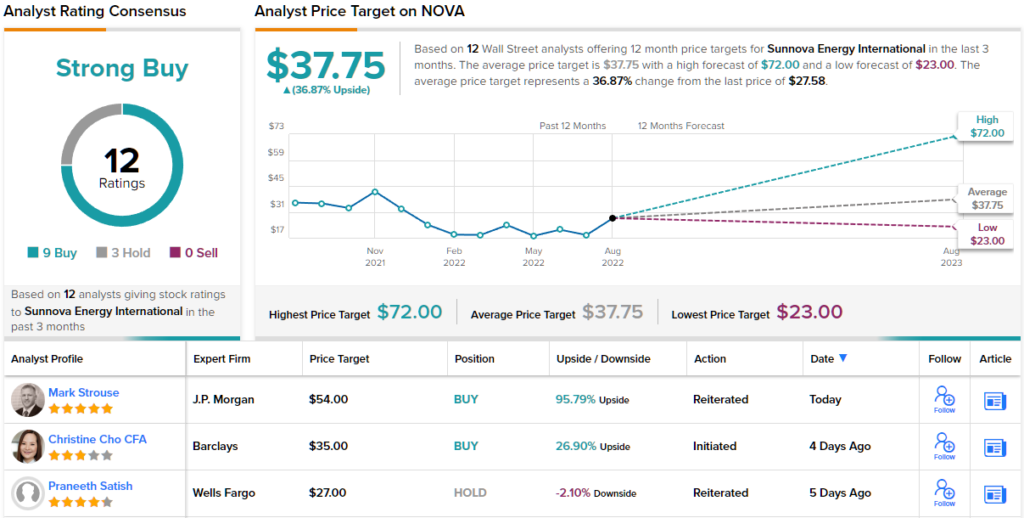

To this end, Osha puts a Buy rating on shares of Sunnova, and sets a $72 price target to indicate his confidence in a robust 12-month upside of 161%. (To watch Osha’s track record, click here)

In recent weeks, 12 analysts have reviews this stock, and they have given it 9 Buy ratings against 3 Holds – for a Strong Buy consensus view. NOVA is currently trading for $27.58 and its $37.75 average target implies ~37% one-year upside potential. (See Sunnova stock forecast on TipRanks)

To find good ideas for solar stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.