While there are naysayers out there, this year has clearly demonstrated the stock market’s underlying strength. This has also been reflected in IPO activity – the entry of new companies into the public trading realm – which is up after a lackluster 2023. During 2Q24 alone, IPOs hit a two-year high; 39 such transactions raised some $8.9 billion. The offerings were supported by both optimistic sentiment and a sound overall liquidity situation.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The new listings include plenty of stocks with both solid foundations and high prospects. Naturally, this makes the current field of IPOs a prime target for investors.

The analysts at Goldman Sachs would definitely agree. They’ve done some of the footwork, investigating newly public stocks, and have tagged several as ‘Buy’ prospects. Using the TipRanks database, we can see if the rest of the Street agrees with two recent Goldman picks. Let’s take a closer look.

Concentra Group Holdings (CON)

We’ll start in the healthcare industry, where Concentra Group Holdings is an important player in the occupational health services market. The company offers a wide range of services, including direct-to-employer care and workers’ compensation services, to more than 50,000 patients every day. Concentra employs 11,000 people, including affiliated physicians and clinicians, and operates from approximately 550 medical centers and 150 onsite medical facilities.

Until this past July, Concentra was a subsidiary of Select Medical – but the company spun off through its July 25-26 IPO. Concentra’s CON shares started trading at $23.50, with 22.5 million shares put on the market. The IPO brought in approximately $529 million in gross proceeds, and Select Medical, the former parent company, remains the single largest shareholder, owning upwards of 80% of Concentra’s common shares. Concentra boasts a current market cap of approximately $3 billion.

Shortly after the IPO, on August 1, Concentra released its 2Q24 earnings results. This was closely watched, as it was the company’s first such release as a public entity and covered the immediate pre-IPO period. Concentra reported a top line for Q2 of $477.9 million, up 2.3% year-over-year, and had a bottom line of 50 cents per share. The EPS was down by 2%, or a penny, from the previous year’s period.

This new stock has caught the eye of Goldman analyst Jamie Perse, who sees plenty of advantages here for investors to build on. Perse writes of Concentra, “The existing management team has been with the company since Select Medical bought Concentra from Humana in 2015. In addition to delivering significant revenue growth, the team has executed on significant margin expansion. Specifically, margins over that period have increased from roughly 9% to 20%, driven by post-Humana P&L optimization, ongoing cost control and operating leverage.”

Perse goes on to outline just how he expects those strengths to directly benefit investors in the stock, adding of CON, “Looking forward, we expect margins to improve from 19.7% in 2023 to 20.5% in 2025, driven by reimbursement increases in Florida partly offset by standalone public company costs, and modest gains thereafter of 50bps per year to 21.5% in 2027. These assumptions drive our expectation of EBITDA growth through 2027 of 7.8%.”

Taken together, these facts and predictions lead Perse to initiate his coverage of CON with a Buy rating and a $32 price target that suggests a one-year gain of 38%. (To watch Perse’s track record, click here)

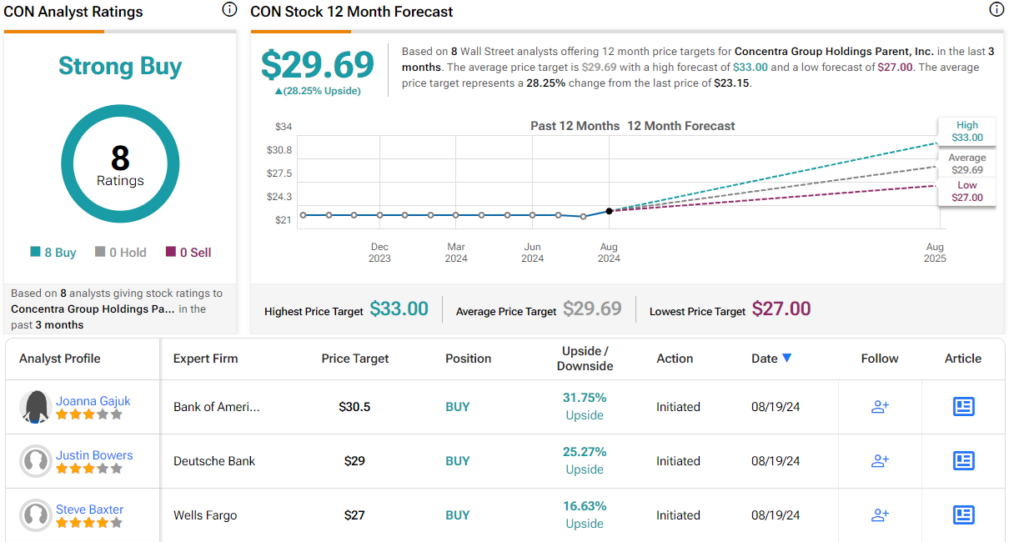

Overall, this new stock has generated some love on Wall Street. The shares hold a Strong Buy consensus rating, based on 8 unanimously positive analyst reviews, and the $29.69 average target price, and current trading price of $23.15, together imply an increase of 28% on the one-year horizon. (See Concentra stock forecast)

Lineage (LINE)

We don’t think much about food supply chains, but perhaps we should. Before the invention of modern refrigeration, most food was local. But the development of cold storage and transport technology, particularly cold storage warehousing, has allowed us access to foods from all over the world – fresh grapes in a Michigan winter, for example, or Norwegian salmon fillets in a California restaurant.

The next stock on our list, Lineage, is a real estate investment trust (REIT) specializing in temperature-controlled warehouse facilities across North America and Europe, and in the Asia-Pacific region. The company’s network of properties includes automated warehouses, freight forwarding and port facilities, and regional distribution centers, and totals more than 480 locations with more than 84.1 million square feet of usable space and 3 billion cubic feet of storage capacity. The company has partnerships with food and beverage producers, retail sellers, and mass distributors, and uses high-tech end-to-end supply chain solutions to deliver efficiency and sustainability while minimizing waste.

Like Concentra above, Lineage held its IPO this past July. The company, from its base in Novi, Michigan, announced the offering of 56,882,051 common stock shares at $78 each, with the underwriters having an option to purchase another 8,532,307 shares. Net proceeds from the offering are intended to be used in paying down debt and other corporate purposes. The company announced on July 30th that the underwriters fully exercised their option and that gross proceeds were approximately $5.1 billion.

In a note that should interest investors, both Moody’s and Fitch credit rating agencies gave Lineage initial ratings at investment-grade following the IPO. The Moody’s rating is set at Baa2, and the Fitch rating at BBB+. Both agencies describe the outlook for Lineage as ‘Stable.’

For Goldman analyst Caitlin Burrows, this company presents a sound position in a vital niche, one that is capable of supporting further growth. She writes of the stock, “We expect earnings growth will be driven by a re-acceleration in same store NOI growth due to increased demand and a return to more normal seasonality in 2025 and 2026 (after a slower 2024 with tough comps versus 2023) while cost saving initiatives are realized (mainly related to labor and power). Our model does not assume incremental acquisitions or new development starts (which the company has done historically, in particular acquisitions) due to unclear timing and size; however, we do believe a roll-up opportunity exists, which could provide upside to our numbers over time.”

In line with her prediction of further upside over time, Burrows rates LINE as a Buy, with a $105 price target that indicates potential for almost 25% upside over the coming year. (To watch Burrows’ track record, click here)

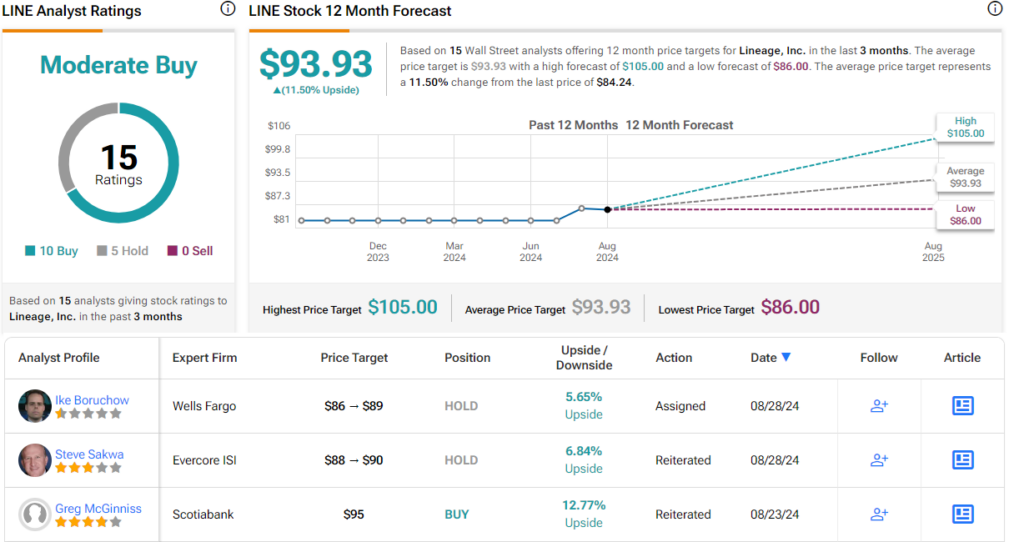

For the most part, Wall Street agrees with Burrows’ call on this company, although not all are on board. Based on 10 Buys vs. 5 Holds, the stock has a Moderate Buy consensus rating. The average price target stands at $93.93, suggesting one-year gains of ~11.5%. (See Lineage stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.