Today was a big day for financial firms generally and for Charles Schwab (NYSE:SCHW) in particular, with the bulls feeling some relief in the wake of Schwab’s better-than-anticipated quarterly results. I am bullish on SCHW stock and fully expect it to recover 2023’s losses while delivering decent dividend payments along the way.

Charles Schwab, commonly just known as Schwab, is a well-known bank and investment broker that also offers advisory services. With earnings season kicking off now, all eyes are on the mega-banks, but Schwab deserves some attention, as well.

Deutsche Bank (NYSE:DB) analyst Brian Bedell recently lowered his price target on Schwab stock from $70 to $69, but I have a funny feeling that he’ll regret that decision a year from now. Schwab has challenges to overcome, I’ll admit, but the company’s management has been honest about this, and Schwab’s Street-beating results should get the bulls excited for 2023’s final quarter.

“Cash Sorting” is Still a Problem for Charles Schwab

Let’s take a moment to talk about cash sorting. This refers to banking customers withdrawing their funds from investment accounts and placing them into CDs (certificates of deposit), money-market accounts, and other low-risk but high-yielding asset classes.

Some banking customers engaged in cash sorting earlier this year when companies like Silicon Valley Bank collapsed. Bankers pulled their capital due to a sense of panic and because CDs and money-market accounts have offered unusually high interest rates in 2023.

This has caused investment outflows at brokerages like Charles Schwab. Furthermore, worries about the cash-sorting phenomenon are a primary reason why SCHW stock is down this year.

The cash-sorting problem helps to explain some of the less-than-ideal results that showed up in Schwab’s third-quarter 2023 earnings report. Schwab’s bank deposits declined by 28% year-over-year and 7% quarter-over-quarter $284.4 billion, so we can clearly see that cash sorting is taking a toll on the company.

Another challenge for Schwab is high interest rates. Schwab’s management was forthright about this issue, stating that the company’s Q3-2023 net interest revenue fell by 24% year-over-year to $2.2 billion, “reflecting the impact of client allocation decisions within a higher interest rate environment.”

In other words, high interest rates inhibited borrowing and lending activity – but again, Schwab was honest about that. Charles Schwab CEO Walt Bettinger even admitted that the “overall backdrop is decidedly negative,” so no one can accuse Schwab’s management of trying to whitewash a challenging situation.

Charles Schwab: Looking on the Bright Side

The outlook isn’t all problematic for Charles Schwab, though. Bettinger celebrated the fact that, during Q3 2023, Schwab “gathered $46 billion in core net new assets, including $27 billion in September following the completion of [its] latest Ameritrade client conversion cohort.”

Thus, there isn’t a massive bank run in which the customers are pulling all of their funds out of Schwab. Moreover, even while Schwab’s sales and income declined year-over-year, the company managed to exceed Wall Street’s expectations. Specifically, Schwab’s $4.6 billion in revenues beat the consensus estimate of $4.64 billion, while the company’s adjusted earnings of $0.77 per share came in above the consensus call for $0.74 per share.

With that, Schwab has three consecutive quarters of EPS beats. Plus, Schwab offers decent relative value with a GAAP-measured trailing 12-month P/E ratio of 14.88x; this represents a discount compared to Schwab’s five-year average P/E ratio of 21.45x. Finally, I should mention that Schwab is known to be a dividend grower and currently offers a forward annual dividend yield of 1.89%.

Is SCHW Stock a Buy, According to Analysts?

On TipRanks, SCHW comes in as a Moderate Buy based on 12 Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average Charles Schwab price target is $71.93, implying 33.9% upside potential.

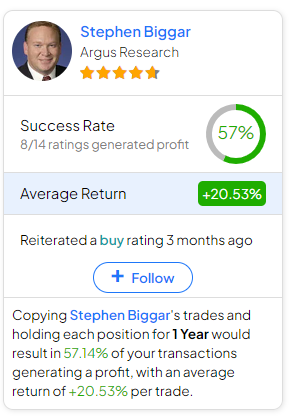

If you’re wondering which analyst you should follow if you want to buy and sell SCHW stock, the most profitable analyst covering the stock (on a one-year timeframe) is Stephen Biggar of Argus Research, with an average return of 20.53% per rating and a 57% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SCHW Stock?

Believe it or not, Charles Schwab stock traded for $80 at the beginning of this year. Then, the regional banking crisis happened, and the Federal Reserve decided to increase interest rates.

So, don’t expect Schwab’s results to be perfect. What’s important is that Schwab’s quarterly data was better than expected, and the company’s management understands the primary problems. Consequently, this is a good time to consider SCHW stock, keep that $80 level in mind as a price objective, and reinvest its dividends for optimal results.