Royal Caribbean (NYSE:RCL) stock has extended gains from the past year after beating estimates in the first quarter of 2024. The cruise giant is benefiting from post-pandemic trends in experienced-based holidays and currently looks undervalued. The stock is trading at 13.6x forward earnings, which are expected to grow by around 17.8% annually throughout the medium term — leading to a price-to-earnings-to-growth ratio under 1.0x. This is why I’m bullish on the stock.

Royal Caribbean Reported Solid Earnings

Royal Caribbean Cruises reported a strong first quarter, with non-GAAP earnings per share (EPS) of $1.77 and revenue up 29% year-over-year. This represents an earnings beat of $0.44 versus the expected earnings of $1.33. Revenues were just 1.03% better than the expected $3.69 billion.

Passenger demand was high, with a 107% load factor, and profitability increased significantly. The load factor being over 100% reflects a situation whereby additional guests are added to each room, taking the guests per room above the stated capacity. A third or fourth room guest is often kids sharing with their parents.

Management gave the following positive appraisal: “The first quarter was tremendous, sending us well on our path to a year that is significantly better than we expected just a few months back. Wave season combined with a record-breaking introduction of the revolutionary Icon of the Seas resulted in consistently robust bookings at much higher prices than 2023.”

The company had previously highlighted that the Icon of the Seas — the world’s largest cruise liner — which entered service in January, was generating plenty of interest and bookings. The 364-meter ship can carry 7,600 passengers at maximum occupancy.

Looking ahead, the company raised its full-year outlook, projecting continued growth in net yields and adjusted EPS, reaching $10.70 to $10.90 — an increase of $0.80. This raised guidance “includes [a] $0.10 headwind from fuel prices and currency exchange rates as well as $0.17 benefit from the refinancing we completed in the first quarter,” management said in the Q1 earnings call on April 25.

Net yields are expected to increase by 9% to 10% in constant currency and as reported. This strong guidance reflects confidence in the cruise industry’s recovery and Royal Caribbean’s ability to deliver strong financial results.

Royal Caribbean’s Improving Financials

Royal Caribbean has embarked on a three-year program to improve its financial performance, and it’s progressing well. When I previously reported on Royal Caribbean, management said that it was likely to hit two of its three goals in 2024 — that’s one year early. However, in its earnings call, the company said that all Trifecta goals would be completed in 2024. The company said this would allow it to refocus on new, more ambitious, medium-term goals.

Part of the company’s financial improvements relate to refinancing and the paying down of debt. During the first quarter, Royal Caribbean refinanced $1.25 billion of its most expensive bonds with a new unsecured note, allowing the company to save 500 basis points or $56 million of annual interest expense. Moving forward, Royal Caribbean hopes and expects to reduce its leverage ratio to just under 3x by the end of the year.

RCL Stock Looks Undervalued

Royal Caribbean stock is currently trading at 13.6x forward earnings. That’s by no means expensive, and it actually represents a discount versus its peers. It’s also worth highlighting that Royal Caribbean’s earnings are expected to grow by around 17.8% annually throughout the medium term — that’s the next three to five years.

In turn, this leads to a forward price-to-earnings-to-growth (PEG) ratio of 0.76x. The PEG ratio is calculated by dividing the forward price-to-earnings (P/E) ratio by the expected growth rate for the medium term. Looking forward, Royal Caribbean’s forward P/E ratio falls to 11.7x in 2025 and 10.2x in 2026.

Is Royal Caribbean Stock a Buy, According to Analysts?

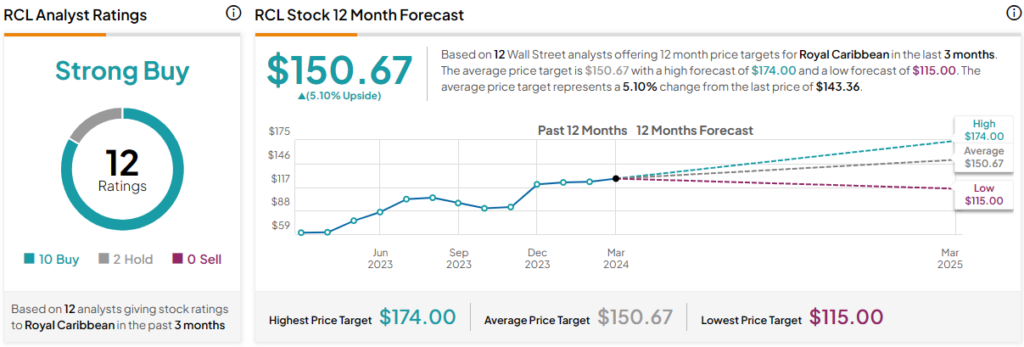

Royal Caribbean stock is rated as a Strong Buy based on 10 Buys and two Hold ratings assigned by analysts in the past three months. The average Royal Caribbean stock price target is $150.67, with a high forecast of $174.00 and a low forecast of $115.00. The average price target implies 5.1% upside potential. Given the recent outperformance, I’d suggest that analysts may revise their targets upwards in the coming months.

The Bottom Line on Royal Caribbean Stock

Royal Caribbean is outperforming analysts’ estimates and reported a stellar first quarter with a considerable $0.44 earnings beat. The company is experiencing a wide range of tailwinds originating from strong post-COVID booking patterns and interest in the world’s largest cruise vessel — the Icon of the Seas.

From a valuation perspective, Royal Caribbean also looks attractive. It has a Strong Buy rating, trades at just 13.6x forward earnings, and has a PEG ratio under 1.0x. Sadly for me, this isn’t a stock that my UK-based brokerage — and the UK’s largest brokerage — offers me access to.