Shares of Canada’s largest bank, Royal Bank of Canada (NYSE: RY) (TSE:RY) gained 3.5% yesterday after the company acquired MDBilling.ca to further strengthen its healthcare offering. The financial details of the deal were kept under wraps.

MDBilling.ca is a cloud-based platform that automates and simplifies medical billing and is used by 9,000 Canadian physicians. It also has partnerships with top healthcare providers across Ontario.

MDBilling.ca will join Dr.Bill at Royal Bank of Canada and fortify its healthcare business. Royal Bank of Canada acquired Dr.Bill in 2020.

Sid Paquette, Head at RBCx, the tech and banking innovation platform at RBC commented, “We are proud to be a leader in medical billing in Canada, helping to simplify and expedite the process for physicians to get paid for the incredibly important work that they do.”

Is RY a Good Buy?

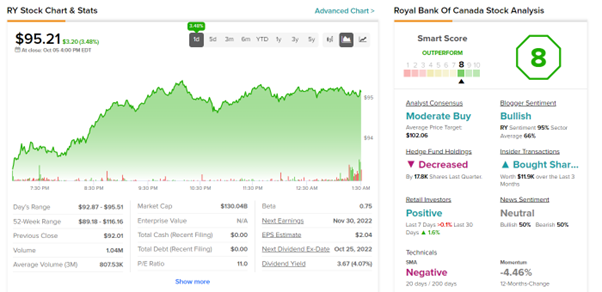

As per TipRanks, analysts are both cautious as well as optimistic about the RY stock. It has a Moderate Buy consensus rating based on nine Buys, three Holds, and one Sell recommendation. Royal Bank of Canada stock’s average price forecast of $102.60 implies 7.2% upside potential.

Last week, Barclays analyst John Aiken reinstated coverage on Royal Bank of Canada with a Buy rating and price target of C$137 ($100.37), implying a 5% upside potential.

Aiken is bullish on the recently-completed Brewin Dolphin acquisition. With the addition of the discretionary wealth manager, the analyst believes Royal Bank will emerge as one of the leading asset managers in the U.K. and Ireland.

Notably, RY stock boasts a score of 8 out of 10 on TipRanks’ Smart Score rating system, indicating it has strong potential to outperform market expectations.

Further, TipRanks’ Stock Investors tool shows that investors currently have a positive stance on Royal Bank Of Canada, with 1.6% of investors on TipRanks increasing their exposure to RY stock over the past 30 days.

Concluding Thoughts

The Canadian Bank is scheduled to report its fourth quarter Fiscal 2023 results on November 30, before the market opens.

RBC continues to add value to its shareholders by moving beyond traditional banking via accretive acquisitions across geographies and industries.

The continuous investments in technology, as well as banking space, augur well for the stock in the long run.