In this piece, we’ll leverage TipRanks’ Comparison Tool to evaluate two standout holdings within the ARKK ETF: Roblox (NYSE:RBLX) and Block (NYSE:SQ). Both companies have seen their shares get obliterated. That said, I view both firms as strong enough to claw higher over the long haul, even while other innovation stocks flirt with death due to this high-rate world we suddenly found ourselves in.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Cathie Wood’s ARK ETFs have pretty much mirrored the Nasdaq 100’s performance through the 2000 dot-com bust. The crash trajectories of the flagship ARK Innovation Fund (ARKK) and the Nasdaq 100 are so incredibly similar. Indeed, history doesn’t repeat twice, but it often does rhyme, according to Mark Twain.

As we march into a recession year, questions linger as to what the recovery trajectory will look like. If ARK follows in the footsteps of a 2000-era Nasdaq exchange, swift recoveries will probably be out of the cards, at least over the next two or three years.

That said, there are likely to be a handful of companies that will rise from the rubble and enrich shareholders over the long haul. Amazon (NASDAQ:AMZN) was one of the imploded firms that took endless uppercuts to the chin during the dot-com bust despite continuing to record steady growth results.

Sometimes, market participants don’t care to invest in exciting growth stories anymore, and they won’t pay up for any sort of thesis up front. In a higher-rate environment, the risks of doing such are just too high.

It’s hard to imagine that Cathie Wood’s ARK funds will be in for more damage as we enter 2023. Regardless, it is possible that buyers of innovation stocks at these depths may be left with little to show for their investment until years or even decades down the road. However, that may not be the case with the following stocks.

Roblox (RBLX)

Roblox is one of the ARK holdings that stands out as a potential long-term winner that can shrug off the market plunge of 2022. Arguably, the metaverse that investors grew excited about in 2021 already exists, and Roblox is the firm that’s done a terrific job of bringing it to younger audiences.

Indeed, young gamers spending so much time and money (on Robux) know that the metaverse is real, and Roblox’s platform may be a hint of what to expect over the coming decade.

Roblox isn’t immune to recession headwinds. It could be pushed back a step or two, just like most other innovation-driven firms in this market. The difference is that Roblox can continue growing its user base as it looks to improve upon its ability to monetize.

In September, Roblox saw daily active users (DAUs) surge an impressive 23% year-over-year.

As a part of Roblox’s 2022 Investor Day meeting, the company shed light on efforts to help improve engagement and monetization. For now, analysts aren’t too sure what to make of such initiatives. There was no real “One More Thing” moment, after all. Regardless, I do think investors have a lot of reasons to give management the benefit of the doubt as it looks to move forward in a recession year.

At its worst, shares of RBLX shed more than 80% of their value. After a partial recovery, Roblox stock is down around 66% from its peak. Unlike other ARK holdings that crumbled over 80% from their highs, I think Roblox has the best chance of eclipsing such highs over the next 15 years.

If Roblox can make good on its monetization efforts, the stock could easily fall back into the good books of investors, even as rates continue climbing above the 4% mark.

At 12.6 times sales, Roblox stock isn’t nearly as expensive as it could be, given the magnitude of profitable growth that could be realized over the next 10 years.

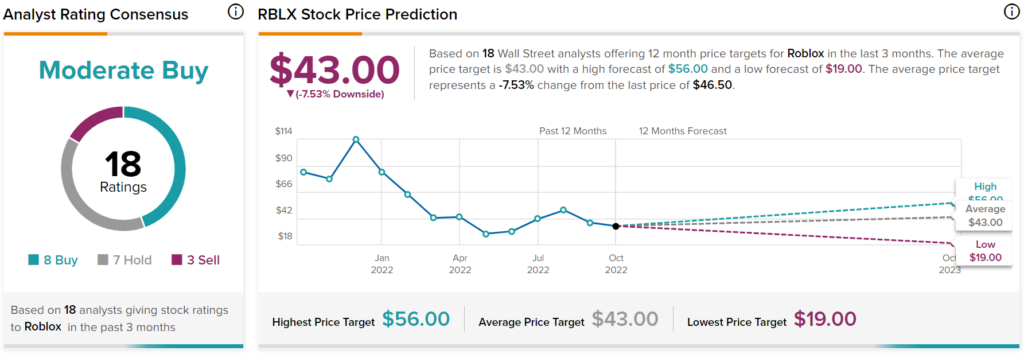

What is the Price Target for RBLX Stock?

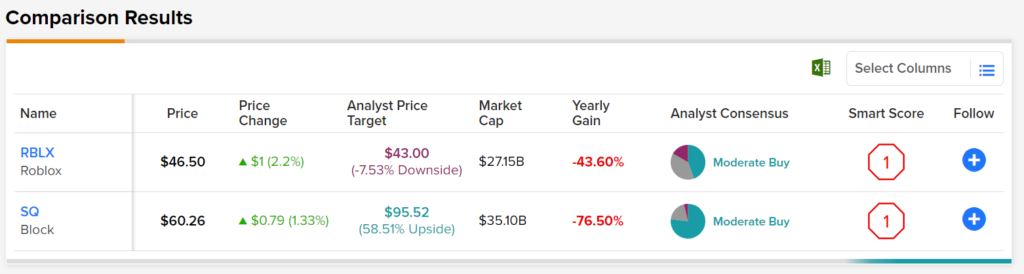

Wall Street has a “Moderate Buy” consensus rating on RBLX. The average RBLX stock price target of $43 implies downside potential of 7.53%. Indeed, Roblox is a confusing story, but its long-term vision is realistic for those looking to bet on today’s version of the metaverse.

Block (SQ)

Block, formerly Square, is another Cathie Wood stock that got put on the chopping block in 2022. Shares crumbled nearly 82% from peak to trough as enthusiasm surrounding Bitcoin, fintech, and payments crumbled.

It’s been a hard landing for Block stock amid its growth slowdown. However, I think shares are too cheap at just 2.2 times sales and 2.1 times book value. Cash App, Square, and Afterpay may face intense competitive pressures, but they are solid products that seem scalable under the leadership of Jack Dorsey.

Undoubtedly, it’s hard to tell if Block will ever regain its growth groove. The perfect storm of macro headwinds and rising rivals have put the once-glorified fintech stud to its knees.

Even as a recession takes a toll, don’t expect Dorsey to slow progress on his next big ambition. The man is an innovator at heart, and if there’s a firm that can overcome a setback, it’s Block with the undivided attention of its brilliant CEO, founder, and “Block Head.”

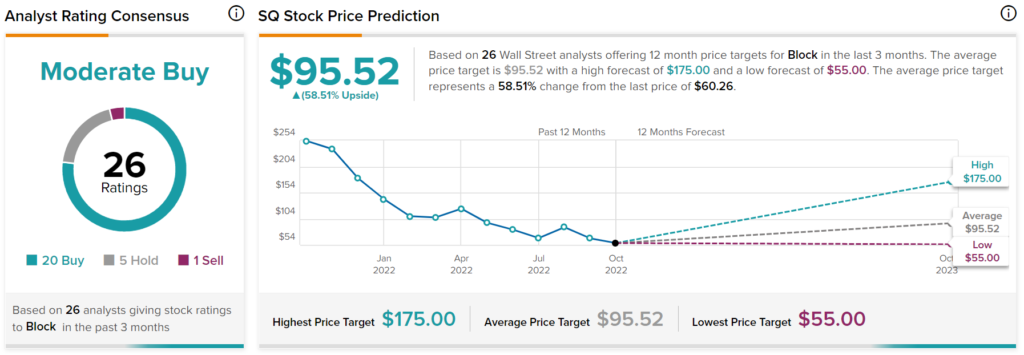

Is SQ a Good Stock to Buy?

Wall Street is pretty upbeat on Block, with a “Moderate Buy” consensus rating. The average SQ stock price target of $95.52 suggests 58.51% upside on the horizon. Yes, Block has growth issues, but analysts are bound to feel that the firm is in good hands under Dorsey.

Roblox and Block Shares Will Likely Rise from the Rubble

Cathie Wood stocks are in no hurry to recover. While it could take years for her top holdings to re-enter bull markets, I view Roblox and Block as secular growers with the best shot of rising from the rubble.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue