Roblox’ (RBLX) Investor Day will take place on Thursday (September 15) and ahead of the event, BTIG analyst Clark Lampen has been looking at recent trends for the online gaming platform.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

August tracking showed a ~5-6% month-over-month decline to roughly 55-56 million DAUs. With monetization rates akin to those of July, Lampen thinks there could be ~$230 million of Bookings in the month. “That would be slightly above the ~2% m/m drop discussed on the 2Q earnings call,” notes the analyst, “though our estimate could be light if engagement is healthier.”

As of September 12, sign-up trends are also showing a slight m/m drop (-2%), and therefore Lampen expects to see existing user engagement trend lower too. The analyst’s model currently factors in a ~14% m/m Bookings drop compared to Roblox’s ~15%. Considering the $230 million August figure Lampen’s tracking implies, the analyst thinks his Q3 Bookings target might be ~2% too high (~$671 million compared to the $685 million modelled). Consensus is still some way above both figures at $693 million.

Lampen also notes some takeaways from last week’s Roblox Developer Conference (RDC). In contrast to last year’s event, when outlining “product concepts and vision” for the developer community appeared to be the focal points, this year’s RDC offered “clearer proof points of progress and near-term product initiatives.”

“Specifically,” says Lampen, “improvements to infrastructure (lower latency and load times) and creation tools (more robust Luau tools) have resulted in a richer experience for both users and developers, contributing to growth of the global user base, total time spent on platform, and as a result growth in aggregate developer earnings (1000th RBLX developer now earning >$30K annually).”

At the investor day, Lampen expects many of those same topics will be revisited with more of a “financial bend” added in.

While overall DAU trends have been improving and the growth of the 17+ user cohort (which has now overtaken the 9 -12 group to become the largest cohort) have “removed some of the mystery around what could drive a re -acceleration in growth,” Lampen still thinks that for investor sentiment to truly change, “proof points will be needed.” That said, the analyst thinks there are now “clearer markers of progress and catalysts to look forward to.”

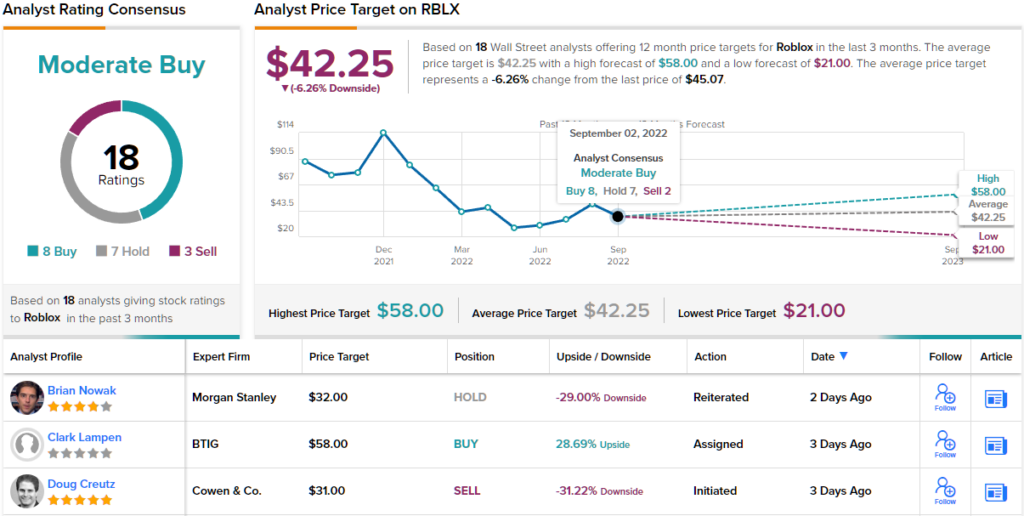

To this end, Lampen reiterated a Buy rating, backed by a $58 price target. The implication for investors? Upside of ~29% from current levels. (To watch Lampen’s track record, click here)

Looking at the consensus breakdown, based on 8 Buys, 7 Holds and 3 Sells, the stock claims a Moderate Buy consensus rating. However, the share price projections tell a different story; the $42.25 average target suggests the stock is currently overvalued by ~6%. (See Roblox stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.