Based in Menlo Park, California, Robinhood (HOOD) operates a platform for trading assets such as stocks, options, and cryptocurrencies. I am bullish on the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Whether you know it or not, you’re bearing witness to a revolution in the financial markets. Long gone are the days when people had to call up a broker and pay hefty fees to buy and sell stocks and exchange traded funds (ETFs).

Today, many ETFs have low expense ratios and online, self-directed brokers dominate the retail-trading landscape. Spearheading this movement is Robinhood, which pioneered the low-to-no-fee, app-driven trading revolution.

Ironically enough, though, Robinhood stock hasn’t risen with that revolution. The share price is below the initial public offering (IPO) price, and this suggests a prime buying opportunity for risk-tolerant investors.

Looking Under the Hood

Despite the share-price decline, the data indicates that there’s nothing terrible going on with Robinhood. If anything, the company is in growth mode.

Consider this: Robinhood’s fourth-quarter 2021 revenue totaled $363 million, representing a 14% increase. Not only that, but the company’s full-year 2021 revenue of $1.82 billion marked a very impressive 89% improvement over the prior year’s result.

Another metric to watch is Robinhood’s monthly active users, or what people in the business call MAU. It’s a great sign for the company that Robinhood’s MAU surged 48% to 17.3 million in December of 2021, compared to 11.7 million for the same month of 2020.

In light of that encouraging data, Robinhood Markets co-founder and CEO Vlad Tenev had every right to brag about his company’s recent performance.

“We had a momentous year, nearly doubling the number of customers on the platform and making critical investments in our team and infrastructure to support growth,” the CEO declared.

A Challenging Market

Now that we’ve looked under Robinhood’s hood and discovered the positive data, it’s time to consider why the company’s stock shares have declined in value.

In large part, it comes down to unfortunate timing. Wherever the stock and cryptocurrency markets are headed, that’s where Robinhood stock is likely to go as well.

That’s because retail traders get hyped up to use the Robinhood trading app when asset prices are going up. Naturally, they’re less motivated to place trades when the prevailing sentiment is fear.

Precipitated by the Omicron Covid-19 variant strain, a general winding down of the meme-stock trade, and fears of the U.S. Federal Reserve hiking government bond yields, the stock market contracted in late 2021 and early 2022.

During that same time frame, Bitcoin slid from $68,000 to $44,000. Moreover, wherever Bitcoin goes, many other crypto coins are bound to follow.

Therefore, if you’re bullish on stocks and Bitcoin, you might anticipate a powerful bounce-back in Robinhood stock this year.

Wall Street’s Take

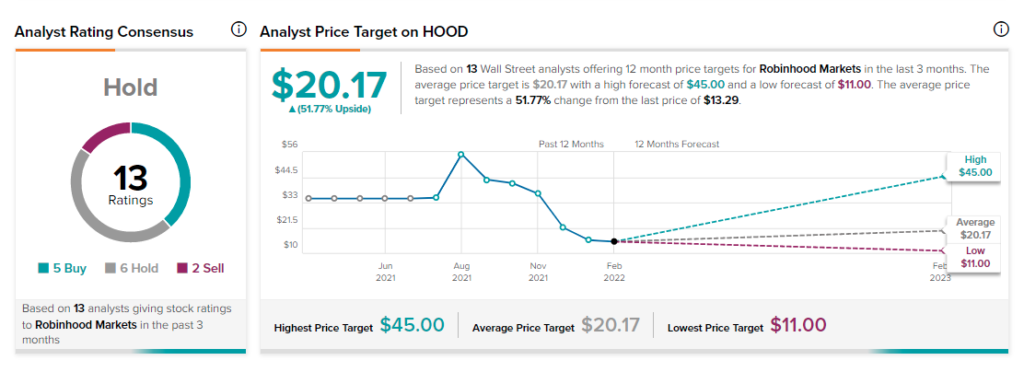

According to TipRanks’ analyst rating consensus, HOOD is a Hold, based on five Buy, six Hold, and two Sell ratings. The average Robinhood price target is $20.17, implying 51.8% upside potential.

The Takeaway

The Robinhood share price is particularly sensitive to changes in the prices of stocks and cryptocurrency.

This might seem like a fault, but really it’s a chance to capitalize on an imminent recovery in asset prices (if it happens). Any rebound in the stock market and/or Bitcoin could, indeed, catalyze a massive rally in Robinhood stock.

Besides, the data shows that Robinhood isn’t in terrible fiscal condition and Wall Street analysts aren’t particularly bearish on the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure