Robinhood (HOOD) are set to report earnings today after market close.

Let’s dive into what could happen by analyzing the company’s key performance metrics as well as the Q4 guidance from the company.

One of the company’s performance metrics is MAU’s, defined by the company as: “We define MAU as the number of Monthly Active Users during a specified calendar month. A “Monthly Active User” is a unique user who makes a debit card transaction, or who transitions between two different screens on a mobile device or loads a page in a web browser while logged into their account, at any point during the relevant month….Additionally, MAUs are positively correlated with, but are not indicative of the performance of revenue and other key performance indicators.”.

HOOD Monthly Visitors Report

If we use Robinhood’s Monthly Visitors tool, we can see that for Q4 unique visitors are just slightly up from the previous quarter:

And total estimated visits are down from the previous quarter, as well as from the same quarter last year, which is never a good thing in a company which is in a stage of growth. Declining estimated visits can also suggest less transaction volume on the platform.

HOOD Revenue Breakdown

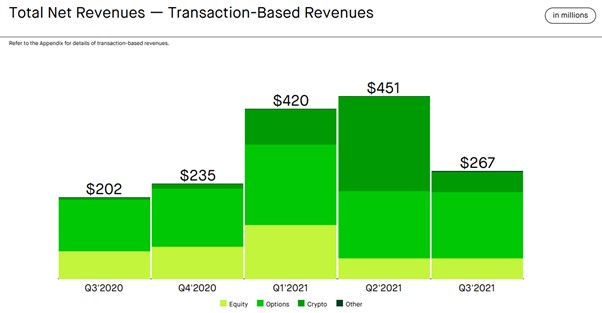

In its Q3 investors presentation the company shared its revenue breakdown:

Let’s see what we can anticipate for Q4, 2021:

Potential Revenue from Equity Trading

Based on data from CBOE on trading activity on the NASDAQ and NYSE exchanges we can see that the notional value of traded volume has picked up slightly from the previous quarter, this data corresponds with the transaction-based revenues from Robinhood that showed high revenues in Q1 and then less revenues from equities in Q2 and Q3

Potential Revenue from Options Trading

CBOE option volume on equities also shows a significant pickup in Q4

Potential Revenue from Crypto Trading

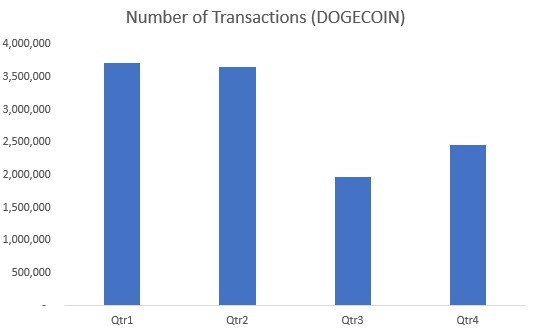

In Robinhood’s Q3 earnings call, Vlad Tenev (Robinhood’s CEO) said: “Looking back at Q2, we saw a huge interest in crypto, especially doge, leading to large numbers of new customers joining the platform and record revenues. In Q3, crypto activity came off record highs, leading to fewer new funded accounts and lower revenue as expected. Historically, our growth has come in waves. The surges have come during periods of increased volatility or market events. We’ve also seen that new customers join when we add new products and features, giving us some degree of control over our growth.”

Using data from IntotheBlock, we can see that the number of transactions for Dogecoin has picked up from the lows in the previous quarter

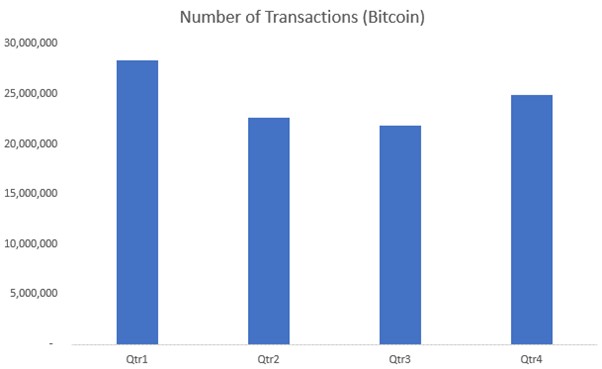

Again, using data from Intotheblock we can see that Bitcoin (BTC-USD) transactions for the quarter has also picked up:

So, to sum it all up:

Monthly Unique Visits and Total Estimated Visits are down or not showing any growth. That’s a big negative.

Estimated trading volume in equities has picked up this quarter, suggesting a positive sign for Robinhood.

Estimated trading volume in options has also picked up this quarter, also a positive sign for Robinhood.

Estimated trading volume in cryptocurrencies (we examined Bitcoin and Dogecoin) has also grown in this quarter, which is also a positive sign.

In Robinhood Q3, 2021 press release the company provided its estimated for Q4:

“Our business is affected by many factors, including seasonality, general market conditions (including volatility) and retail trading behavior as well as significant, unanticipated market events. For the three months ending December 31, 2021, we anticipate that many of the factors that impacted our third quarter results, such as seasonal headwinds and lower retail trading activity, may persist. In the absence of any changes to the market environment or exogenous events, we believe this may result in quarterly revenues no greater than $325 million and full year revenue of less than $1.8 billion. Additionally, we expect new funded accounts for the fourth quarter will be roughly in line with the 660,000 opened in the third quarter of 2021.”

Trading activity across the board went up but monthly visitors traffic showed a decline (excluding mobile app), let’s see Q4 results so we can be smarter for the next quarter.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure