Amid radical changes in the labor market following the COVID-19 crisis, shares of staffing agency Robert Half (RHI) spiked up through the early spring season of this year. However, tough economic circumstances have led to many investors hitting the exits. Nevertheless, it’s the troubled times that can also possibly create a rebound effect, thus making its present weakness a discounted opportunity. I am bullish on RHI stock.

At the onset of the pandemic, U.S. real GDP slipped nearly 9% between the first quarter of 2020 and the second. Naturally, many households assumed the worst, bracing themselves for an apocalyptic outcome. However, unprecedented fiscal and monetary support translated into a clear message: federal and state agencies were committed to bailing out the American labor force.

In response, the millions of worker bees that collectively bolstered the economy had felt an unparalleled sense of power and control. It was the employees – not the employers – that were in the driver’s seat. Many people simply quit unfavorable working environments for greener pastures, sparking intense competition for laborers, a phenomenon known as the Great Resignation.

With applications flying everywhere and prospective (and desperate) employers willing to pay top dollar for talent, RHI stock jumped considerably higher from its spring doldrums of 2020. Unfortunately, economic realities have taken their toll, leading to Robert Half shares struggling this year. Still, this fallout could be a time-capsule opportunity for the bold.

Robert Half Stock Analysis

RHI has a 2 out of 10 Smart Score rating on TipRanks. This indicates a strong potential for the stock to underperform the broader market.

RHI Stock and the New Labor Paradigm

Presently, analysts have a rather dim view of RHI stock, and their pessimism isn’t entirely unreasonable. Aside from the security’s sharp losses this year, data from the U.S. Chamber of Commerce revealed a lack of significant “reshuffling” in the business and professional services arena. That’s one of the core areas for which Robert Half provides solutions.

Further, a main contributor to the deliberate lack of mobility in the aforementioned space is the broader work-from-home initiative. In a way, people now had their perfect job: salary, benefits, and the ability to call it in from their living rooms, avoiding the daily commute and annoying coworkers.

However, for those who participated in the Great Resignation, an awful realization started to sink in: workers’ enjoyment of power and control was illusory. Especially with the economy worsening through inflation and overall instability, very few people were discovered to be truly indispensable. Even for the extraordinarily talented, financial viability would ultimately play the role of arbiter between the employed and unemployed.

In other words, workers will get very desperate, likely very soon. Sure, high-profile companies have demanded their employees return to the office, meeting fierce resistance and thus implying significant worker moxie. Still, with real GDP declining between Q4 2021 and Q1 2022, office employees can’t afford to play hardball in a diminishing ecosystem.

Almost variably, it would seem, worker capitulation must occur. When it does, RHI stock may benefit (if only cynically).

Robert Half’s Strong Fundamentals

When analysts criticize RHI stock, they’re not doing so because the underlying financials are poor. Instead, they’re quite solid. However, it’s the predictability of the financials that market experts question. Put another way, RHI’s losses this year may be a future signal of financial underperformance.

Still, the numbers may hold up, in part because of the aforementioned desperation in the U.S. labor force and also because of the company’s strong brand presence in the employment services industry.

To be fair, a repeat of Q1 2022’s strong performance might not be in the cards when Robert Half delivered $1.82 billion in revenue, up 30% from the year-ago level. Also, net income in the most recently reported quarter was $168 million, up over 51% year-over-year.

Nevertheless, Robert Half commands a strong balance sheet, in particular a cash-to-debt ratio of 2.1 times that exceeds the industry’s median of 1.06 times. Therefore, the company has the resilience to navigate through distressing waters, buying itself enough time while attracting eager and motivated clients through its doors.

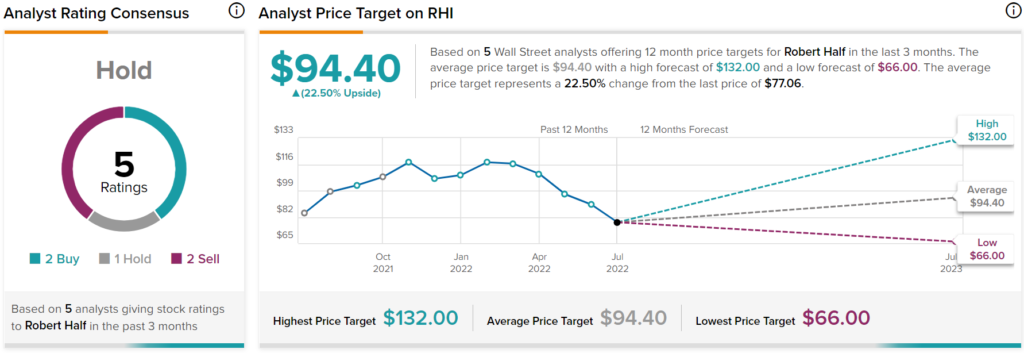

Wall Street’s Take on Robert Half

Turning to Wall Street, RHI has a Hold consensus rating based on two Buys, one Hold, and two Sells assigned in the past three months. The average Robert Half price target is $94.40, implying 22.5% upside potential.

Robert Half is Cynical but Effective

Frankly, RHI stock is not a pretty investment, neither appealing to the moral compass nor inducing a good night’s rest. It’s a contrarian trade, requiring patience and grit. Still, over the long run, Robert Half could be an effective investment, playing into the harsh realities of the current labor paradigm.