The Inflation Reduction Act renewed interest in electric vehicle (EV) makers and their suppliers. In this piece, we used TipRanks’ Comparison Tool to evaluate two makers of batteries for electric vehicles. Both QuantumScape (NYSE:QS) and Romeo Power (NYSE:RMO) are losing money because their technologies aren’t quite ready. However, a careful review of both companies’ technology, financials, and positions within the EV battery space reveals reasons to be bullish on QS and bearish on RMO.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Of course, it’s important to remember that any investment in either company will take some time to play out, although it appears that QuantumScape could be further along than Romeo Power.

State of the EV Battery Market

The EV battery market is estimated to grow from $27.3 billion in 2021 to $67.2 billion by 2025, a compound annual growth rate of 25.3%, on the back of growing EV adoption. U.S. lawmakers are trying to boost adoption in the coming years with the enactment of the Inflation Reduction Act, which, among other things, offers consumers tax credits on EV purchases.

However, there are some caveats when it comes to securing the tax credit on EV purchases. In addition to income limits, the law restricts those credits to vehicles assembled in North America and those with batteries made in the U.S. or its free-trade partners.

Additionally, EV battery makers cannot source any of their materials from a “foreign entity of concern,” which includes China. They also must source at least half of their materials from the U.S. or its allies by 2024 and grow that percentage to 80% by 2026. By 2029, 100% of their battery production must be in North America.

At this point, China dominates the EV battery market with 76% of the world’s battery cell production and 85% of the world’s rare earth metal processing, while the U.S. holds only 10% of the EV battery market. That presents EV battery makers with ample opportunities if they build their facilities in the U.S.

QuantumScape

First, investors should note that QuantumScape has much better connections than Romeo Power. Backed by Bill Gates and Volkswagen, the company has been on solid financial footing since it began. In fact, Volkswagen (OTC:VWAGY) owns 20% of QuantumScape, and the two companies revealed plans for their joint venture to build the latter’s solid-state EV batteries last year.

Volkswagen is a leader in the EV market, coming in second place in the U.S. after Tesla, with a 7.5% share of the market, and first place in Europe. In fact, a report earlier this year suggested that Volkswagen will surpass Tesla as the biggest EV seller by 2024. Thus, its connection with Volkswagen sets QuantumScape up nicely for a dominant share of the EV battery market in the coming years.

Aside from its connections in the EV industry, what makes QuantumScape’s technology so attractive is that it is solid-state batteries, which appear to be much safer than the conventional lithium-ion batteries currently in use because they are far less flammable. Presumably, QuantumScape’s batteries could have prevented the spectacular fires we’ve seen in several Tesla vehicles.

Unfortunately, the market is still a few years away from mass-market production of solid-state batteries, which is why QuantumScape is still burning cash. The good news is that solid-state batteries could pack twice as much energy per pound, charge faster, and last much longer than conventional lithium-ion batteries.

However, the bad news is that manufacturing them is exceptionally difficult and expensive with current technology. QuantumScape has managed to slash its all-in battery costs by 17% compared to traditional lithium-ion batteries, so that is one problem solved.

The company has also solved another problem—lithium dendrites that grow inside the battery and reduce its life and performance—by utilizing a ceramic electrolyte that resists dendrite growth. In theory, QuantumScape’s batteries should work, and management has promised that they should be ready by 2025.

The company has established its pre-pilot production line in California, so it appears to be in a good position. QuantumScape announced in a regulatory filing earlier this year that a fourth automaker had signed on to test its batteries.

What is the Price Target for QS Stock?

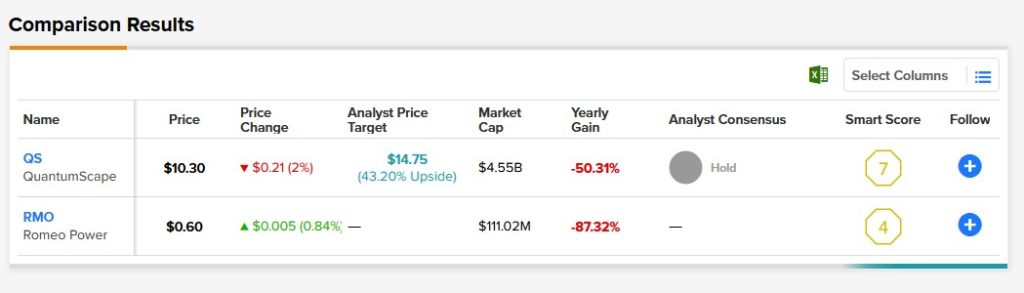

QuantumScape has a Hold consensus rating based on four Holds assigned over the last three months. At $14.75, the average QuantumScape price target implies upside potential of 44.5%.

Romeo Power

Like QuantumScape, Romeo Power is burning through cash on the development of its EV batteries. However, Romeo lacks the high-quality industry connections that Quantum enjoys. Its largest customer is Nikola (NASDAQ:NKLA), which itself is losing money after having delivered only a handful of trucks so far.

In fact, Nikola announced plans to acquire Romeo Power by granting Romeo shareholders 0.1186 of a Nikola share for every Romeo share they owned. That amounted to a 34% premium on Romeo’s closing price on July 29. The offer is Nikola’s way of taking control of its battery supply line. The company expects to save $350 million by 2026 by making its own batteries.

However, Romeo Power’s batteries are not solid-state batteries, so they lack some of the benefits of QuantumScape’s, like the lack of flammability. Additionally, Romeo’s batteries are designed more for commercial vehicles than passenger vehicles, which is why Nikola is so interested in the company. However, there is less information about the type of technology Romeo Power’s batteries contain.

What is the Price Target for RMO Stock?

Romeo Power has no consensus rating because there are no analyst ratings from the last three months. Investors should be warned about the increased risks associated with investing in penny stocks.

Conclusion: QuantumScape is More Attractive than Romeo Power

If all goes according to plan for QuantumScape, the path to profits and success looks clearer for it than for Romeo Power. As a result, a neutral stance may be appropriate for short-term investors, but a bullish view could work well for investors with a long-term mindset.

As both companies are pre-revenue, their P/Es are both negative, with Quantum at -14.98 and Romeo at -0.42; it’s impossible to deny the risks of investing in money-losing companies. Wall Street lost its appetite for unprofitable tech companies fairly recently, so it’s unlikely that investors will see upward movement in either Quantum or Romeo anytime soon.