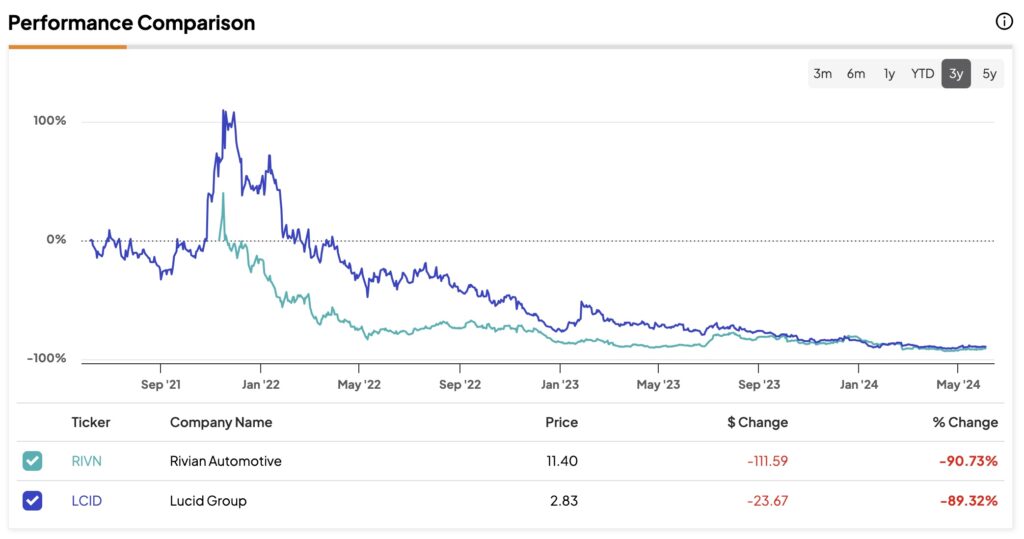

Electric vehicle manufacturers Rivian (NASDAQ:RIVN) and Lucid Group (NASDAQ:LCID) were once at the forefront of significant hype in the automotive industry back in 2021. However, the situation has drastically changed since then. Both stocks have plummeted by about 90% over the past three years. In this article, I’ll delve deeper into these companies and explain why I hold a bullish outlook for Rivian and a bearish outlook for Lucid.

Rivian (NASDAQ:RIVN)

The Irvine, California-based Rivian is an electric vehicle manufacturer that focuses on creating rugged, hip, and eco-friendly vehicles. Currently, Rivian offers two primary consumer vehicles: the R1T (a pickup truck) and the R1S (an electric SUV). By 2023, the company had produced over 57,000 electric vehicles and successfully delivered more than 50,000 of them.

Rivian has raised significant funding from big names like Amazon (NASDAQ:AMZN) and Ford (NYSE:F), and it’s been growing rapidly, with plans to produce 100,000 electric delivery vans for Amazon. Rivian has also been working on a new vehicle “skateboard” platform that could support future vehicles or be adopted by other companies.

As recently reported in its first-quarter earnings at the beginning of May, one of the main highlights was announcing a strategic shift by unveiling its new R2 model. This medium-sized, low-cost vehicle will start at $45,000, making it competitive with Tesla’s (NASDAQ:TSLA) Model Y and priced much lower than the R1. This seems to be an essential step towards a better cost-per-vehicle conversion, as well as a good strategy for increasing its market reach in the face of fierce competition in this space.

Furthermore, with the new model, Rivian hopes that lowering its conversion cost per vehicle in the second half of 2024 should lead the company to finally report a net profit in the fourth quarter of 2024, which could prove to be a near-term catalyst for the stock.

However, it is important to note that Rivian continues to face significant financial challenges, particularly its high cash burn rate. To illustrate the extent of this issue, in the most recent quarter, Rivian reported nearly $6 billion in cash and equivalents, a significant decrease from the $11.7 billion reported in the same period the previous year.

Yet, the $1.2 billion in revenues generated in the first quarter of the year, combined with a loss from operations of $1.48 billion, is not good. This is especially true when considering that the loss from operations did not evolve compared to the same period last year when Rivian lost $1.43 billion.

Therefore, Rivian is still at a stage where it is growing revenues but has not yet managed to improve its operating losses, which raises a yellow flag. So much so that over the last 12 months, Rivian has lost around 20% of its market value.

But even with the seemingly endless bearish momentum since its IPO, it’s still hard to say that Rivian is a cheap stock, although now it’s much easier to make that case than in recent years. Rivian trades at a price-to-sales (P/S) ratio of 2.2x, more than double the auto industry average of 0.80x and higher than that of Chinese EV manufacturers like BYD (OTC:BYDDY), NIO (NYSE:NIO), and XPeng (NYSE:XPEV), which trade below 2x. However, it is about a third of the P/S ratio that Tesla traded at in the past 12 months.

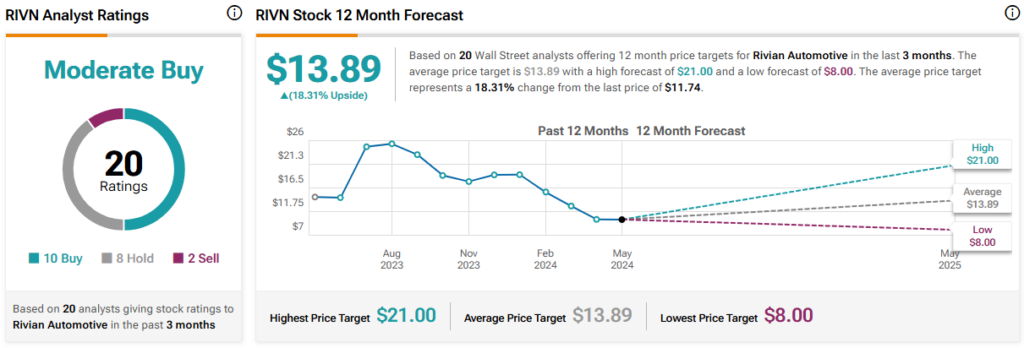

Is RIVN Stock a Buy, According to Analysts?

Among the 20 Wall Street analysts who have covered Rivian in the last three months, the general consensus is predominantly bullish, resulting in a Moderate Buy rating. The average RIVN stock price target is $13.89, indicating upside potential of 18.3%.

One standout among these bulls is Morgan Stanley (NYSE:MS) analyst Adam Jones, who believes Rivian is uniquely positioned beyond Tesla in the market to scale an integrated software stack critical to reaping rewards in AI. It can do so while it has a “market value 1/60th that of Tesla.”

Lucid Group (NASDAQ:LCID)

Unlike Rivian, Newark, California-based Lucid Motors is an electric vehicle maker that focuses on luxury electric sedans and SUVs. Lucid Motors has one main consumer vehicle, the Lucid Air, which the company sold 6,001 units of in 2023.

As Lucid concentrates on producing high-priced models with superior technology, the company places a strong emphasis on quality. The first Lucid Air model (the top-of-the-line Lucid model) boasted an impressive range of 520 miles on a single charge, making it the longest-range EV rated by the Environmental Protection Agency (EPA).

Lucid is also working on a new electric SUV model called the Lucid Gravity, which should be launched in December of this year and will be priced at less than $80,000. In addition to the Gravity SUV program, Lucid has also announced that it plans to introduce mid-sized vehicles that should begin production at the end of 2026, representing a significant step for it to expand its addressable market.

But while Lucid sales are still modest (to say the least), all these developments and expectations come at a huge price. To fund its operations, the luxury EV manufacturer relies mainly on the Public Investment Fund (PIF) of Saudi Arabia, which has been a loyal and long-term backer. In 2024, Lucid raised $1 billion, dedicated especially to producing its new SUV, the Gravity.

Even though Lucid has solid financial stability today, thanks to the PIF funding, the company faces significant sustainability challenges in the niche luxury EV market. In its most recent quarter, Lucid disclosed a cost per vehicle of about $200,000 based on nearly 2,000 deliveries and a cost of revenues totaling $404.8 million.

Additionally, the company reported a net loss of $680.9 million in Q1 2024, translating to a net loss of approximately $345,000 per vehicle. These results indicate underwhelming production and sales growth despite modest increases.

By the end of Q1, Lucid had $3.99 billion in total cash and short-term investments and a free cash flow of negative $714.9 million. If the company continues to burn cash at these levels by the middle of next year, it will come close to running out of cash.

This lack of sustainability has significantly impacted Lucid Motors’ market capitalization, which was valued at $90.9 billion in November 2021 but has since plummeted to around $6.4 billion. The primary concern is that even at a much-discounted historical valuation, there is still no justification for the company’s valuation multiples. Lucid trades at a price-to-sales (P/S) ratio of 10.4x, nearly double Tesla’s multiple and five times that of Rivian.

Is LCID Stock a Buy, According to Analysts?

The consensus on Wall Street regarding Lucid shows prevailing skepticism, as six out of eight analysts covering the stock in the last three months have given it a Hold rating. The average LCID stock price target among these analysts is $3.16 per share, indicating upside potential of 13.3%.

Needham analyst Chris Pierce is one of the skeptics. Although he recognizes Lucid’s best-in-class technology and leading efficiency, he notes that the company’s low delivery numbers limit fixed cost absorption and increasingly require capital injections.

The Verdict

Although EV stocks, in general, have been experiencing bearish momentum recently, I have a bullish view of Rivian and a bearish one of Lucid.

Both Rivian and Lucid face significant challenges in making their business operations truly sustainable, as recent results show they are still burning substantial amounts of cash.

However, I consider Rivian to be a better pick due to its closer proximity to achieving sustainability compared to Lucid, primarily because Rivian has a broader market presence and trades at a much more reasonable valuation.