Rivian (RIVN) investors have badly needed some good news, and they finally got some on Wednesday. The struggling electric truck start-up announced Q2 vehicle production and delivery numbers, and they were better than expected.

The company said 4,467 vehicles were delivered in the quarter while 4,401 vehicles were manufactured. Consensus expected deliveries to come in at 3,500.

Adding further sheen, Rivian also said it remains on track to hit its 25,000 production target in 2022.

The strong display did not come as much of a surprise to RBC analyst Joseph Spak, who believes the results should “boost investor confidence in 2022 targets.”

“Recall we previewed that we had a lot of confidence in delivery expectations and thought there could be upside,” the analyst went on to say. “Our RBC Elements™ work showed production at Rivian’s Normal IL plant was likely improving, and it did.”

Rivian encountered many issues earlier this year, which ranged from chip shortages to covid-related headwinds while the vehicle lines were also rearranged. All served to affect production but also soured investor sentiment.

But evidently investors were happy the business was able to maintain its annual output objective in spite of these difficulties. That was reflected in the share price’s 18% uptick over the past two trading sessions.

So far this year, Rivian has manufactured 6,954 vehicles, which suggests that for the rest of the year it will need to manufacture ~18,000 or ~687/week to meet its target.

“This is likely to be accomplished by continued improvement on the current shift and the addition of a second shift,” says Spak, “which we believe will occur in August.”

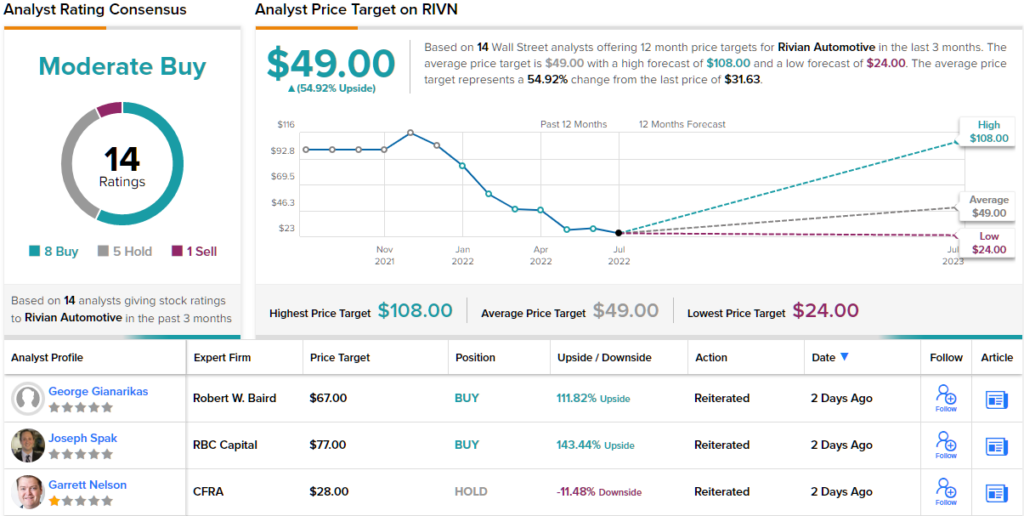

To this end, Spak reiterated an Outperform (i.e. Buy) rating on RIVN along with a $77 price target. If the target is achieved, RIVN shares could provide ~143% returns over the next 12 months. (To watch Spak’s track record, click here)

Reflecting Spak’s positive take, Baird’s Ben Kallo thinks the results could be indicative of a sea change at Rivian.

“RIVN has faced growing pains as it has started production,” the analyst noted, “but the news shows a step in the right direction.”

In fact, the analyst believes that as the EV story unfolds on a global scale, Rivian has a “solid opportunity to mount a challenge to Tesla’s current dominance.”

In line with this view of RIVN’s underlying strength, Kallo rates the stock an Outperform (i.e. Buy), with a $67 price target that implies a 12-month upside of ~112%. (To watch Kallo’s track record, click here)

Looking at the consensus breakdown, 8 Buys, 5 Holds and 1 Sell have been assigned in the last three months. Therefore, RIVN gets a Moderate Buy consensus rating. Based on the $49 average price target, shares could rise ~55% in the next twelve months. (See Rivian stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.