EV (electric vehicle) maker Rivian (NASDAQ:RIVN) stock is trading way cheaper than Tesla (NASDAQ:TSLA), according to Mizuho Securities analyst Vijay Rakesh. The five-star analyst maintained a Buy on Rivian stock on November 7. Further, shares of RIVN offer a higher upside potential compared to Tesla (based on analysts’ average price target). Let’s dig deeper.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Rivian Trades at Discounted Valuation

Rakesh highlighted that Rivian is executing well. Furthermore, its stock is trading at a forward price-to-sales multiple of 3.8, representing a steep discount of about 59% compared to Tesla. RIVN stock is also trading about 54% cheaper than rival Lucid (NASDAQ:LCID).

The analyst expects Rivian to deliver sales growth of 170% and 73% in Fiscal 2023 and 2024. Meanwhile, the production ramp-up and the company’s focus on attaining profitability soon are why Rakesh is bullish about RIVN stock. Further, his price target of $30 implies 87.73% upside potential from the current level.

It’s worth noting that Rivian is driving cost efficiency, ramping up production, investing in differentiated technologies, enhancing the customer experience, and maintaining a solid balance sheet amid a challenging macro environment. All these initiatives are likely to impact its performance and share price positively. With this backdrop, let’s look at what the Street suggests for Rivian stock.

Is Rivian a Buy, Sell, or Hold?

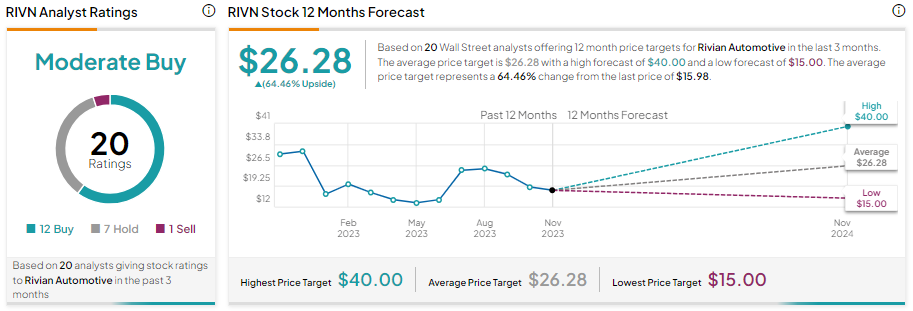

While Rakesh expresses optimism for RIVN, overall analysts’ sentiment remains a bit cautious due to a challenging macroeconomic environment. With 12 Buy, seven Hold, and one Sell recommendation, Rivian stock has a Moderate Buy consensus rating.

Further, the average RIVN stock price target of $26.28 implies a whopping 64.46% upside potential from current levels. In comparison, Tesla stock, which has gained quite a lot so far this year, offers a potential upside of 5.58%.

Bottom Line

While Tesla maintains its leadership in the EV space, the ongoing pressure on its margins keeps analysts sidelined. On the other hand, Rivian is ramping up production, focusing on lowering costs and targeting profitability, which is acting as a catalyst. This is reflected in analysts’ average price target for RIVN stock, which indicates significant upside potential from current levels.