While the rest of the world is struggling with its myriad issues, one industry is reaping benefits: the insurance industry, and the topmost beneficiaries are firms that are offering coverage against cybercrime.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The pandemic years led to increased digitalization, online shopping, mobile banking, and online payments, as well as increased electronic documents that further triggered several cybercrimes.

Ransomware is the fastest-growing and most dangerous type of cybercrime and has cost businesses billions globally in FY2021.

Cyber attacks are now considered the dominant risk for many businesses and have become a growing concern for governments around the world.

It is estimated that government legislation around cyber protection and compliance will become the need of the hour and is inevitable. Following a series of well-known cyber attacks last year, cyber insurers’ products are in huge demand.

Supporting Data

Following the May 2021 hack of Colonial Pipeline Co. and the costly ransomware attacks thereon, the world markets have become much more aware of the graveness of the security threats and have unleashed new cyber regulations, especially in the U.S. U.S. regulators are now vouching for the need for increased private-sector security.

According to the National Association of Insurance Commissioners, direct-written premiums (DWP) recorded by the biggest U.S. insurance providers grew by a whopping 92% year-over-year in 2021.

Notably, cyber insurance companies have not only increased their pricing but have also become more stringent on the terms of the cyber security insurance they provide.

The insurers have much stricter criteria for firms applying for coverage, with minimum requirements to follow like basic cyber hygiene; safety measures like multi-factor authentication; continuously monitoring employee devices for incursions; and training the staff to ward off intrusions, among others.

The Impact of the Russia-Ukraine War

Contrary to the gains from rising demand for cyber insurance, the insurance industry is struggling with huge claims from the prolonged war in Ukraine that has led to wide-ranging sanctions.

In fact, many insurers are evaluating a cut in coverage for Russia and Ukraine to protect themselves from the risk of heightened claims.

Some insurers have clarified act-of-war terms, specifying what is and what is not covered by insurance. The terms may exclude cyber threats from property and casualty policies as more conflicts are leading to increased cybercrime.

Chubb (NYSE: CB)

Based in Zurich, Switzerland, Chub is the world’s largest publicly traded property and casualty (P&C) insurance company, and it is also one of the biggest providers of cyber insurance with an approximate 15% market share.

Shares of the insurer, with a market capitalization of $86.1 billion, have gained over 22% over the past year, massively outpacing benchmark performances.

Chubb’s range of cyber products integrates privacy, network, media, and errors and omissions (E&O) products to provide customized coverage.

Notably, Chubb reported upbeat Q1 results on April 26, with 8.7% and 10% increases in commercial written rates in North America and internationally. Furthermore, both rate levels were above cost.

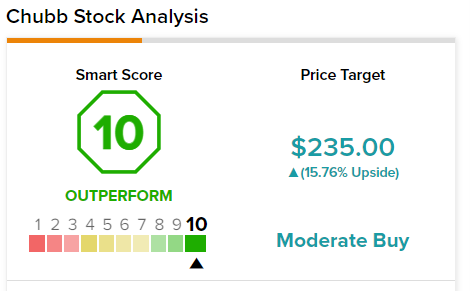

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys, two Holds and 1 Sell. The average Chubb price target of $235 implies 15.76% upside potential to current levels.

Chubb scores a “Perfect 10” on the TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

American International Group Inc (NYSE: AIG)

American International Group, Inc. (NYSE: AIG), better known as AIG, is an American multinational finance and insurance corporation, with operations in more than 80 countries and jurisdictions.

Shares, with a current market capitalization of over $45 billion, have gained 15% over the past year.

AIG provides cyber insurance with coverage for physical and non-physical losses resulting from a cyber event on a primary basis via its CyberEdge or CyberEdge Plus products.

During the stronger-than-expected first quarter of 2021, Commercial net premiums written grew 8% year-over-year, with 10% growth in the International region and 6% in North America.

According to TipRanks’ analyst rating consensus, AIG is a Moderate Buy, based on four Buys and four Hold ratings. The average AIG price target is $70.38, implying 21.55% upside potential.

Concluding Thoughts

The changing landscape of cybercrime threats, ranging from the release of data to ransomware to the shut down of infrastructure, has increased the need for cyber insurance across sectors and industries.

Although earlier the threats were kept under wraps, now companies are required to disclose such incidences, helping insurers to predict and calculate the cost of attacks better, protecting them from future liability.

On top of that, stricter government regulations concerning cyber security norms have further boosted the demand for cyber coverage for businesses across the globe.

To tackle the financial threat, a complete cybersecurity strategy is required that not only includes technological solutions aimed at preventing, detecting, and mitigating attacks but should also include cyber insurance to help manage the associated financial risks.

Consequently, cyber insurers command a higher bargaining power and have significantly increased the premiums charged on their offerings. The mammoth demand for cyber insurance bodes well for the insurance companies with exposure in the space.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure