Riot Blockchain (RIOT) is in the process of setting up what it claims is the bitcoin mining industry’s first industrial-scale immersion-cooling operation.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The new mining hardware is being installed at the Whinstone facility, where 200 MW of the infrastructure is earmarked for immersion-cooling mining. The main advantages off this method include extending machine life and lowering maintenance needs. Immersion cooling also reduces the total cost of ownership (TCO)as the heat can be absorbed by the fluid, recycled for energy and boost productivity.

However, there have been some teething problems with the installation, although following conversations with management at the recent BTC 2022 conference, Roth Capital analyst Darren Aftahi thinks the company has been ironing out the kinks.

“We believe that some of the growing pains with immersion cooling earlier in the year, in terms of machine installs, have been mainly resolved, which should help with bridging the time gap between taking deliveries of rigs, and installation in immersion cooling tanks/buildings,” the 5-star analyst explained. “We walk away from our conversations with a slightly more bullish view on its ability to install its stated exahash targets by year end, assuming machine deliveries stay on schedule.”

Going by the recent March update, and with deliveries anticipated in April, the company’s stated 5.4 EH/s target is “slightly ahead” of Aftahi’s end of Q2 forecast of 5.35 EH/s. Taking into account additional deliveries in May, the analyst reckons this figure “is most likely beatable.”

That said, Aftahi’s end of year model errs on the side of caution, projecting ~8.5 EH/s compared to the 12.8 guide.

Nevertheless, on the back of the conversations, and considering some of the benefits of immersion cooling and its effect on performance, Aftahi admits his estimate now appears to be a “bit too conservative.”

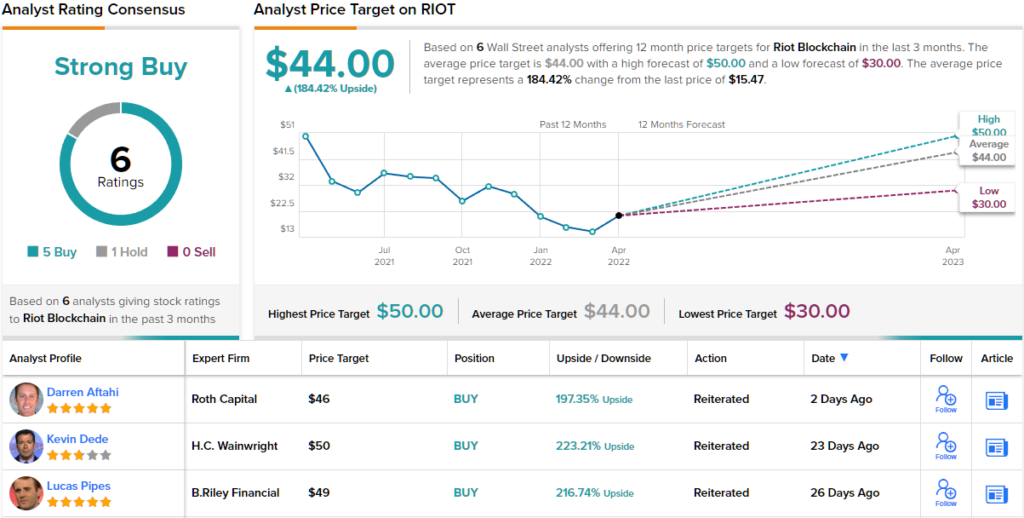

On the other hand, Aftahi’s $46 price target for the stock is anything but conservative and makes room for upside of 197% over the next 12 months. The analyst’s rating stays a Buy. (To watch Aftahi’s track record, click here)

Turning now to the rest of the Street, where barring one skeptic, all 5 other analyst reviews are positive, providing the stock with a Strong Buy consensus rating. The average target complements the bullish ratings; at $44, the figure suggests one-year upside of 184%. (See Riot stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.