Some experts have said that the consumer is strong in 2023. With earnings season upon us, investors should consider checking out a handful of revenge travel stocks, personally selected based on their price-appreciation prospects.

What is revenge travel? Apparently, it’s a term that was coined in 2021 to describe people’s pent-up desire to travel after being stuck at home due to COVID-19 lockdown restrictions. Revenge travel seems to persist even in 2023, as one survey of over 1,000 U.S. adults found that nearly 85% of respondents “said they intend to travel at least once this summer,” according to KRON 4 News.

So, what does this mean for financial traders? It means that you can conduct your due diligence on these top revenge travel stocks, and with any luck, you’ll catch a high flyer or two before they lift off.

Southwest Airlines (NYSE:LUV)

If any sector will likely benefit from revenge travel, it’s the airline industry. One recent report stated that U.S. airline travel has actually surpassed pre-pandemic levels to the point where airlines have had to cancel some flights due to the strong demand.

That’s not the worst problem a business could have, wouldn’t you agree? Thus, I’ve included two carriers on this list, and the first one is Southwest Airlines. LUV stock has pulled back during the past couple of weeks, but that shouldn’t be a problem if you’re a contrarian investor.

Southwest Airlines pays a decent annual dividend of 1.45%, and LUV stock is highly favored by hedge funds. Furthermore, this might be your last chance to board the plane before liftoff, as Southwest Airlines is getting ready to report its second-quarter 2023 earnings results on the morning of July 27.

Analysts expect the company to report earnings of $1.09 per share – and speaking of analysts, let’s see how they’re rating Southwest Airlines stock now.

What is the Price Target for LUV Stock?

Turning to Wall Street, LUV is a Moderate Buy, based on five Buys and six Hold ratings. The average Southwest Airlines stock price target is $41.64, implying 17.2% upside potential.

Hilton (NYSE:HLT)

Along with airlines, hotel businesses should also benefit from revenge travel spending in the U.S. Hilton is apparently banking on the post-COVID travel resurgence, as the company is reportedly introducing apartment-style, extended-stay hotel suites targeting the workforce travel market.

Income-focused investors might not be blown away by Hilton’s 0.4% annual dividend yield, but just consider it a nice little bonus for long-term shareholders. Plus, HLT just earned price-target boosts from Wells Fargo (NYSE:WFC) analyst Dori Kesten ($151 to $161) and Barclays (NYSE:BCS) analyst Brandt Montour ($166 to $169).

Hilton is scheduled to report its second-quarter 2023 financial results on July 26 before the market opens. The company has a good track record of beating analysts’ quarterly EPS forecasts and is anticipated to report $1.58 per share this time. After five consecutive EPS beats, there could be a sixth one in the offing, so stay tuned.

What is the Price Target for HLT Stock?

On TipRanks, HLT stock comes in as a Moderate Buy based on four Buys and three Hold ratings. The average Hilton stock price target is $160.29, implying 6.1% upside potential.

Alaska Air (NYSE:ALK)

Now, here’s a contrarian investing opportunity that you might not have expected. Alaska Air stock plummeted by 9.7% on July 25 after the carrier announced its second-quarter 2023 results. The question is, could this panic selling be an overreaction?

Alaska Air’s quarterly revenue of $2.84 billion exceeded analysts’ average forecast by $70 million, while the airline’s non-GAAP EPS of $3 beat the consensus estimate of $2.71. Why did ALK stock drop, then? Most likely, it’s because Alaska Air’s U.S. airline fares declined, prompting the company to predict 8% to 10% sales growth for 2023. This guidance falls short of the average analyst expectation of 11% sales growth for the year.

However, that guidance is now baked into the ALK share price, and Alaska Air’s Q2 revenue and EPS results certainly weren’t terrible. Therefore, after a crash landing, audacious investors can take a close look at Alaska Air stock for a possible revenge travel recovery play.

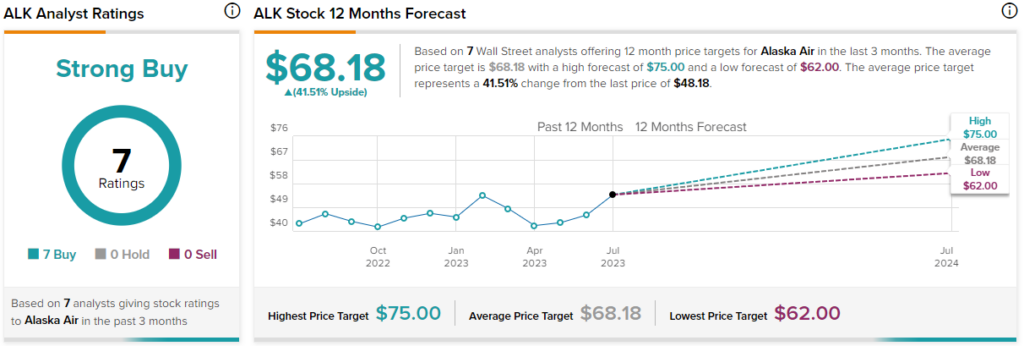

What is the Price Target for ALK Stock?

According to TipRanks’ analyst rating consensus, ALK is a Strong Buy, based on seven unanimous Buy ratings. The average Alaska Air stock price target is $68.18, implying 41.5% upside potential.

Conclusion: Should You Consider These Revenge Travel Stocks?

Revenge travel is a real phenomenon, and financial traders should factor its impact into their investing strategies. Three possible beneficiaries from revenge travel — Southwest Airlines, Hilton, and Alaska Air — might provide outstanding returns to their shareholders as travelers return to their pre-pandemic spending habits. So, depending on your risk tolerance and your willingness to ride along with the ups and downs of the U.S. economy, you’re invited to consider LUV, HLT, and ALK shares.