The retail industry has historically been a safe space for steady shareholder value creation. It’s a mature space, and a handful of big companies have remained the dominant players in their respective categories, resulting in constant profitability and growing dividends. Some retail stocks are worth considering, like TGT and LOW, while others should probably be avoided right now, such as COST.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

These days, investors fear that the ongoing macroeconomic turmoil is likely to result in reduced consumer spending, which would obviously hurt the performance of retail giants.

Surprisingly, however, consumer spending in the U.S. has remained rock-solid. It came in at $14,149.03 billion for the third quarter of 2022, compared to last year’s then-record of $14,099.46 billion. Accordingly, U.S.-based retail giants have sustained elevated revenues. Nonetheless, this doesn’t mean every retail stock is a buy.

2 Retail Stocks to Consider

Target Corporation (NYSE: TGT)

Shares of Target have recovered from their 52-week lows yet are still down about 40% from their 52-week highs. I have always liked Target for its focus on capital returns, including the company featuring a 54-year-long track record of consecutive annual dividend increases.

Admittedly, Target’s most recent Q3 results were somewhat mixed. Specifically, while the company posted revenues of $26.5 billion in revenues, a year-over-year increase of 3.4%, earnings per share came in at $1.54, down a massive 49.3% from $3.04 in the prior-year period.

Additionally, management warned investors that due to weakening sales and profit trends that emerged late in Q3 and persisted into November, the company feels it is “prudent to plan for a wide range of sales outcomes” next quarter, including a Q4 operating margin rate centered around 3%. No wonder this outlook scared investors into selling off the stock.

However, looking at the bigger picture, sales have remained quite robust given the overall circumstances, while expenses should normalize with logistic bottlenecks fading and price increases over time. In fact, analysts project that Target’s earnings per share will rebound by over 45% next year, counterbalancing this year’s equally steep projected decline.

This suggests that Target is currently trading close to 15x next year’s projected earnings, which is a relatively attractive multiple for such a reliable company. It’s when quality stocks go on sale during extraordinary circumstances that they are worth considering, and Target’s investment case calls for exactly that.

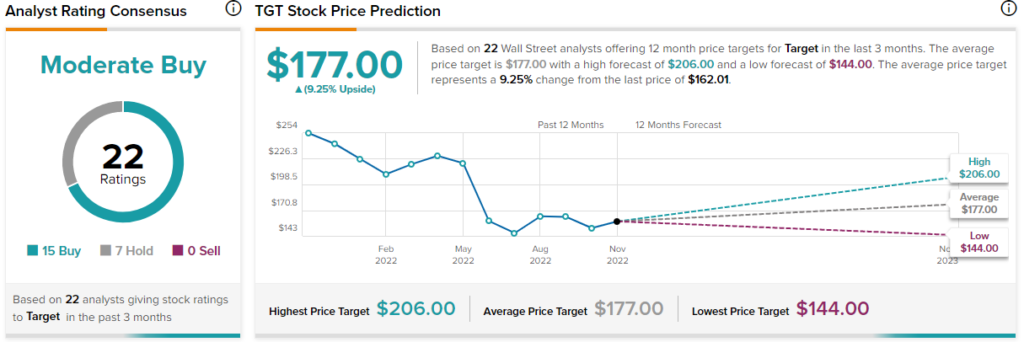

What is the Price Target for TGT Stock?

Turning to Wall Street, TGT stock has a Moderate Buy consensus rating based on 15 Buys and seven Holds assigned in the past three months. The average TGT stock price target of $177 implies 9.25% upside potential.

Lowe’s Companies (NYSE: LOW)

Similar to Target, Lowe’s Companies boasts decades of impressive capital returns, including raising its dividend for 60 consecutive years. It’s another one of these names that investors should pay attention to when it goes on sale. Since the stock is still trading around 20% lower from its 52-week high, this may be the time to do so.

The market’s reaction to Lowe’s Q3 results was quite more positive than that of Target, as the company managed to retain its bottom line to satisfactory levels amid more disciplined cost management. Specifically, total sales reached $23.5 billion, up 2.4% year-over-year, while adjusted earnings per share (which excludes $3.02/share related asset impairment and expected transaction costs associated with the sale of its Canadian retail business) landed at $3.27, a 19.8% increase compared to last year.

I expected Lowe’s to produce robust adjusted net income, as its cost management had already shown upbeat signs previously, but I could not have imagined an outlook raise. In particular, management’s outlook includes Lowe’s set to deliver adjusted earnings-per-share between $13.65 to $13.80 this year, up from $13.10 to $13.60 previously.

If we assume the company achieves the midpoint of this range, then the stock is currently trading at a forward P/E of 15.2x. Lowe’s rarely trades at a discount, and while the current P/E does not imply you are stealing the company, it should provide a great entry point for long-term investors willing to hold Lowe’s in their portfolios in the coming years.

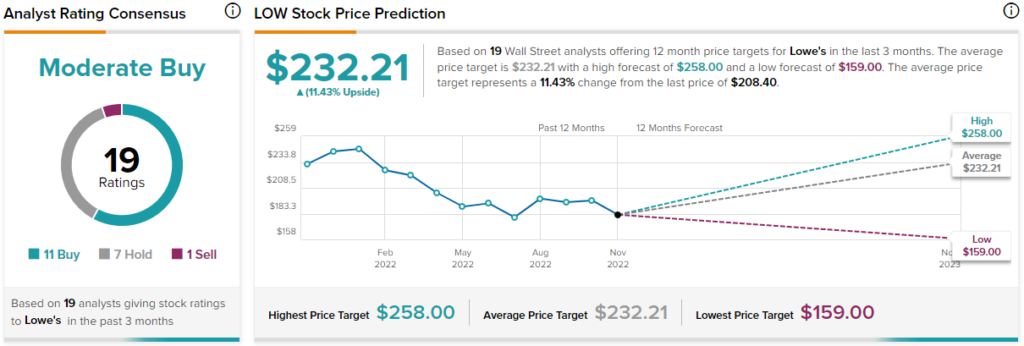

What is the Price Target for LOW Stock?

Turning to Wall Street, LOW stock has a Moderate Buy consensus rating based on 11 Buys, seven Holds, and one Sell assigned in the past three months. The average LOW stock price target of $232.21 implies 11.4% upside potential.

1 Retail Giant to Avoid

Costco (NASDAQ: COST)

Costco is an institutional sweetheart. Wall Street just loves this stock, and for a good reason. The company is cherished for its qualities, including exceptional customer experience, its reputation in being one of America’s favorite workplaces, and, most importantly (for investors), its ability to consistently drive double-digit comparable sales growth.

In late September, the company posted its full-year 2022 results, with numbers once again impressing the markets. Net sales for the year rose 16% to $222.73 billion, including comparable sales growth of 10.6%, while earnings per share advanced 16.6% to $13.17.

But wait, there’s more, as Costco’s growth has remained vigorous subsequent to its year-end results. In fact, for September and October, the company posted comparable sales growth of 8.5% and 7.4%, respectively. Slightly lower than usual but still impressive, given the current macro landscape.

My concern, however, has to do with the stock’s valuation, which provides investors with no margin of safety at its current levels. Even with analysts expecting another 10.4% growth in earnings per share to $14.64 next year, that still implies a forward P/E of around 35.6x.

The truth is that shares of Costco have always been rather expensive due to the company’s unique characteristics. However, if comparable sales growth remains in the single digits and revenue growth declines below the double digits throughout Fiscal 2023, investors will find themselves exposed to an overvalued stock which could result in unavoidable losses following a significant multiple compression.

What is the Price Target for COST Stock?

Turning to Wall Street, COST stock has a Strong Buy consensus rating based on 15 Buys and four Holds assigned in the past three months. The average COST stock price target of $552.47 implies 6% upside potential.