Nvidia (NVDA) is a dominant player in consumer and data center-grade graphics processing units or GPUs. Its Gaming segment contributes almost 50% of Nvidia’s $6.5 billion quarterly revenue.

This company’s stock is trading at 10.2% discount to its 52-week high of $230.43. (See Analysts’ Top Stocks on TipRanks)

Growing Market Share

The most recent Jon Peddie Research report said Nvidia grew its market share to 83% in discrete GPUs in Q2 2021.

Advanced Micro Devices (AMD) saw its GPU share decline to 17%. This market share gain is important for Nvidia. The add-in, or discrete GPU card business is worth $11.6 billion per quarter.

The gaming segment of Nvidia generated $3.1 billion in Q2. The PC gaming and computer graphics hardware industry is worth $36 billion. Nvidia’s overwhelming 83% market share protects its high 32.3% net income margin.

The top gaming GPUs are all Nvidia-branded. Gamers are so endeared with GeForce GPUs that the $1,599 Asus-branded Nvidia GeForce RTX 3070 V2 is still in big demand.

Windows 11 is another strong tailwind for discrete GPU sales. New TPM 2.0-compliant Windows 11 laptops and desktop PCs need discrete graphics cards for gaming and content creation purposes.

No Threat from Intel’s GPUs

The gaming GPU leadership of Nvidia might face serious challenge from Intel (INTC). On the other hand, Intel’s ARC Alchemist gaming GPUs will probably only start shipping by Q2 2022.

The future of Intel’s comeback greatly depends on TSMC’s (TSM) extra 6-nanometer production capacity. Like Nvidia, Intel has outsourced its ARC Alchemist GPU production to TSMC.

It will take many years before PC gamers and content creators start trusting Intel ARC GPUs over Nvidia’s GeForce RTX.

Data Center/AI Leadership

This company has over 90% of the market share for supercomputer accelerators. Nvidia’s Data Center segment generated $2.4 billion during Q2.

Intel and AMD’s failure to come up with an equalizer to Nvidia’s $199,000 DGX A100 accelerator is why NVDA is valued higher by investors.

NVDA has a forward P/E of 44.2 because the data center accelerator industry is worth $13.7 billion. It is projected to be worth $65.3 billion by 2026.

Data center accelerator products can improve Nvidia’s TTM net income of $7.1 billion.

Wall Street’s Take

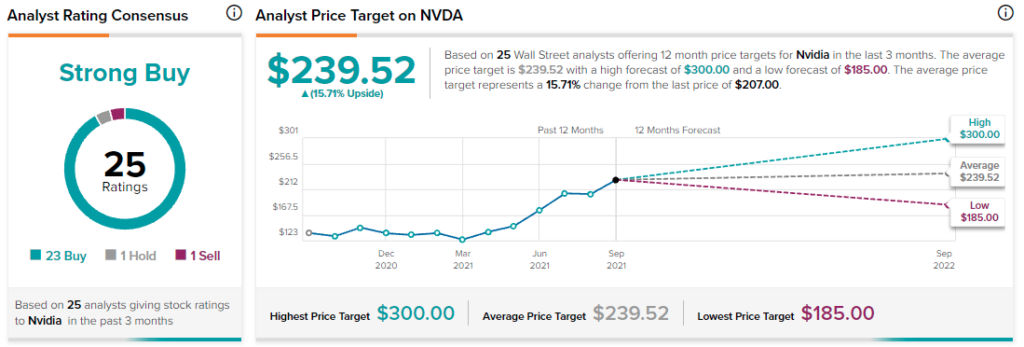

The consensus among Wall Street analysts is that NVDA is a Strong Buy, based on 23 Buys, 1 Hold, and 1 Sell. The average Nvidia price target is $239.52, implying 15.7% upside potential.

Conclusion

Nvidia’s massive lead in discrete PC and data center GPUs makes it highly profitable and fast-growing.

Disclosure: At the time of publication, Motek Moyen did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.