In this piece, I evaluated two social and digital advertising stocks, Reddit (NYSE:RDDT) and Taboola.com (NASDAQ:TBLA), using TipRanks’ Comparison Tool to see which is better. A closer look suggests bearish views for both.

While both companies address the digital advertising market, they do so in different ways. Reddit has been hosting online communities since 2005, although its fame as a social platform was kicked up another notch with the first meme-stock frenzy in early 2021. On the other hand, Taboola.com focuses more directly on advertising, operating a platform powered by artificial intelligence that enables websites and mobile apps to reach targeted audiences with ads.

Shares of Reddit are up 21% since the firm’s initial public offering (IPO) in March 2024. Meanwhile, Taboola.com stock is off 7% year-to-date, although it has gained 36% over the last year.

This dramatic difference in the two companies’ recent share-price performances is at least partially due to the IPO-related glow that sometimes follows tech companies in the weeks or months after they go public.

Neither company is profitable, so we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and their industry. For comparison, the media industry is trading at a P/S of 1.4x versus the three-year average of 1.2x.

Reddit (NYSE:RDDT)

At a P/S of 10x, Reddit is trading at an exorbitantly high valuation following an impressive earnings beat for its first report as a public company. To put this into perspective, the hugely profitable Facebook parent Meta Platforms (NASDAQ:META) is trading at a P/S of around 9.2x. Thus, a bearish view seems appropriate for Reddit — at least until the post-IPO glow wears off.

There’s no denying that Reddit’s first earnings release was a whopper, but the company is still losing millions of dollars per quarter. The company posted adjusted losses of $8.19 per share on $243 million in revenue versus expectations of $8.75 per share in losses on $214 million in revenue.

The social media firm had 82.7 million daily active users during the first quarter—significantly more than the StreetAccount estimate of 76.6 million. Meanwhile, Reddit’s net losses for the quarter totaled $575.1 million. However, according to the company, the IPO accounted for most of the extra expenses that contributed to that loss, including $595.5 million in stock-based compensation and related taxes.

In fact, the March quarter was Reddit’s first quarter with positive adjusted EBITDA, which rose to $10 million from -$50.2 million a year ago. Still, the company is nearly 20 years old, and it’s not profitable yet and has no apparent expectations of being profitable soon — despite the 88.6% gross profit margin.

For the current quarter, Reddit projected $240 million to $255 million in revenue, also smashing the consensus estimate of $224 million. At the midpoint, the company’s revenue could rise 32% from $183 million in the year-earlier quarter.

If Reddit continues to put up such impressive growth, it will eventually earn the valuation it currently has. Nonetheless, investors may want to consider whether a company that has never been profitable in almost 20 years and is earning less than $300 million in revenue per quarter deserves a market capitalization of over $9 billion.

On a positive note, the company announced a content-licensing deal with Google in February and a partnership with OpenAI that gives the platform access to its data. Both are deals that could help push it toward profitability.

But that brings us to another potential concern for Reddit stock. The company allowed some of its top users to buy shares in its IPO alongside institutional investors. While that might sound like a positive, Reddit stock could face significant volatility if the company’s users turn against it (for example, if they don’t want their data looked at) — especially if most of those buying the shares at its current price are doing so because they like the platform and not because they think it’s a good investment.

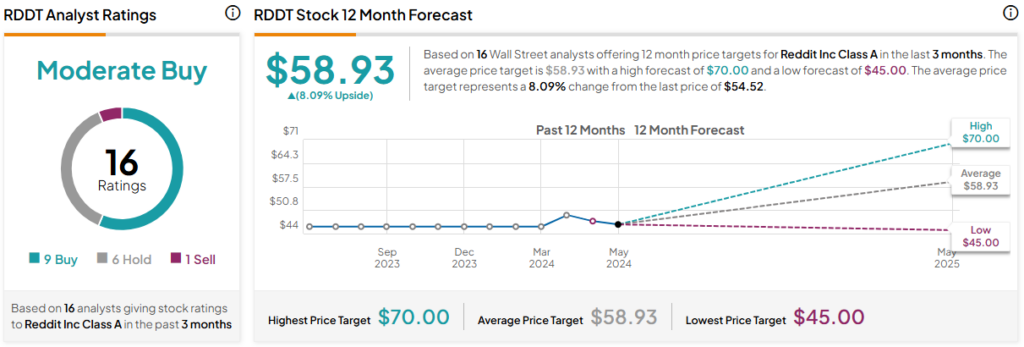

What Is the Price Target for RDDT Stock?

Reddit has a Moderate Buy consensus rating based on nine Buys, six Holds, and one Sell rating assigned over the last three months. At $58.93, the average Reddit stock price target implies upside potential of 8.1%.

Taboola.com (NASDAQ:TBLA)

At a P/S of 0.9x, Taboola.com is trading at a deeply depressed valuation, and it’s easy to see why. The company had one barely profitable year in 2020 but has been in the red since going public. Despite Taboola’s depressed valuation and the potential for profits in the near future, a bearish view seems appropriate due to its consistent losses and uncertain profitability outlook. Any shift toward profitability this year would be crucial in reassessing this stance.

Like with Reddit, it’s difficult to see a scenario where Taboola will ever become profitable, although the consensus is that 2024 could be the company’s first profitable year. Taboola is nearly as old as Reddit, having been founded in 2007, but it went public in June 2021.

At this point, though, Taboola remains a show-me story, given that it continued to lose money in the first quarter and is expected to lose more money in the second. In the most recent quarter, the company posted adjusted losses of eight cents per share, in line with estimates, on $414 million in revenue versus the consensus of $403.3 million.

Taboola did grow its revenue on a year-over-year basis versus the $327.7 million it reported in the year-ago quarter. However, the company’s annual revenue growth has slowed to a crawl, up only 1.6% in 2022 and 2.8% in 2023.

In the second quarter, analysts expect Taboola to post adjusted losses of five cents per share. The company guided for revenue of $425 million and over $25 million in adjusted EBITDA. Taboola also called for accelerating growth in 2024, but it remains to be seen whether it can achieve that.

After all, the company’s full-year net losses widened significantly from $12 million in 2022 to $82 million in 2023, so it just looks like this company can never be profitable on a full-year basis. If the company does report a profitable quarter or two this year, its stock price will likely soar, but as things stand now, that looks like a big “if.”

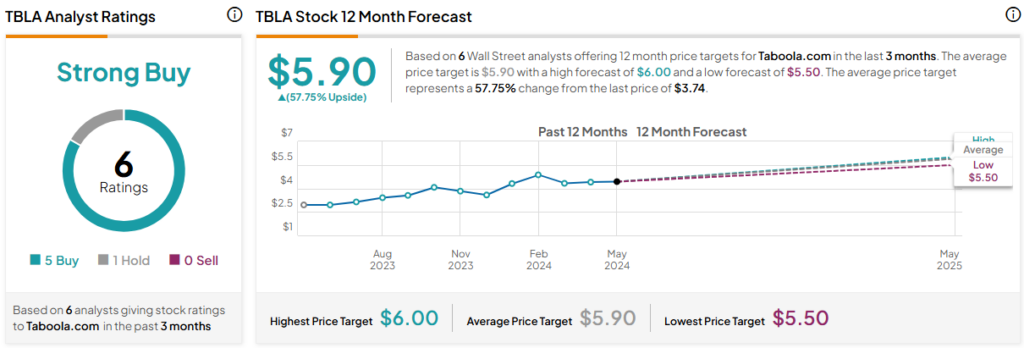

What Is the Price Target for TBLA Stock?

Taboola.com has a Strong Buy consensus rating based on five Buys, one Hold, and zero Sell ratings assigned over the last three months. At $5.90, the average Taboola.com stock price target implies upside potential of 57.75%.

Conclusion: Bearish on RDDT and TBLA

Unfortunately, Reddit and Taboola face the same issue: profitability. Without some significant changes to their business models, it’s impossible to see profitable scenarios for either company.

However, Reddit is still in the early stages of its publicly traded life, so it’s the winner of this pairing. Plus, the content-licensing deal with Google and the OpenAI partnership can help with its profitability issues.

On the other hand, even buying Reddit stock on a dip could be like catching a falling knife because if the company’s users turn on it for licensing their data, the backlash could be severe. Thus, while Reddit does beat Taboola in the likelihood of turning a profit in the near term, there’s just too much uncertainty with the company’s users potentially owning shares because they like the platform and not because it’s a good investment.