Video games have been around for decades, and over the years, the market has seen many game makers come and go. In this piece, we used TipRanks’ Comparison Tool to evaluate three video game stocks — Roblox (RBLX), Take-Two Interactive (TTWO), and Activision Blizzard (ATVI). Recently, metaverse play Roblox has been putting up a fight against game makers ATVI and TTWO. However, a closer look reveals reasons to be bullish on Activision Blizzard, neutral on Take-Two Interactive, and bearish on Roblox.

For some companies in the space, video games are everything to them, while others have their fingers in enough pies that they don’t live and die on what happens to their next video game release.

The State of the Video Game Industry

Some companies, like Microsoft (MSFT), have staying power because video games aren’t their entire business, while others, like Capcom (CCOEY), survive only due to the strength of their video game brands. Of course, Microsoft also benefits from the strength of its Xbox line of gaming consoles.

Overall, the global gaming market is expected to be worth $268.8 billion in 2025, an increase from $178 billion in 2021. In-game purchases are expected to be $74 million of that 2025 total. Believe it or not, the video game sector is bigger than the music and movie industries combined.

The pandemic may have played a role in the growth of video games over the last two years, as most people were stuck at home in the early months of the pandemic, leaving them with nothing to do. The growing popularity of e-sports may also be playing a role in video game adoption.

Of course, the strongest video game makers will be those that can adapt to changing technologies and the whims of gamers. The next big thing in video games is the metaverse, which could be why investors think Roblox is a good play. However, it’s always best to read between the lines when picking long-term holdings.

Roblox

The first thing it’s important to realize about Roblox is that it isn’t profitable, and Wall Street is dumping unprofitable companies, at least for now. All that euphoria that led investors to greedily snap up shares of money-losing companies is over now, which puts names like Roblox out in the cold, despite the metaverse connection.

In addition to losing money, Roblox has also been missing earnings estimates. For the June quarter, it reported losses of $0.30 per share on $639.9 million in revenue compared to the $0.25 per share losses on $626.2 million in revenue that had been expected. In the previous quarter, the game maker reported losses of $0.27 per share on $631.2 million in revenue, compared to the consensus of $0.22 per share in losses on $646.2 million in revenue.

Because it’s losing money, Roblox can’t be valued using a P/E ratio and is down 44% since its initial public offering in March 2021. Year-to-date, the game maker is off more than 60%. Turning to Roblox’s balance sheet, it had $3.075 billion in cash and equivalents at the end of June.

Roblox’s total debt, sitting at $1.44 billion, is low relative to its cash, as it’s been paying off its debt. Still, Roblox’s total liabilities continue to mount, climbing to $4.4 billion in June. Although the game platform marker generated positive free cash flow in previous quarters, it shifted into the red for the June quarter.

The question investors should ask now is whether Roblox was a fad that’s starting to pass. Even insiders have sold $5 million worth of the company’s shares over the last three months, and hedge funds have shed 3.8 million shares.

With negative momentum, return on equity, and technicals, it’s hard to find anything to like about Roblox. Just about the only thing that could boost the game maker’s shares is a short squeeze, as 8% of the float is sold short, while the off-exchange short volume ratio stands at 46%.

We’ve already seen some of the effects of a short squeeze in the stock, with Bloomberg even labeling it a battleground stock for bears and growth investors. However, Roblox shares were quick to reverse and continue their downtrend.

What is the Price Target for RBLX Stock?

Roblox has a Moderate Buy consensus rating based on eight Buys, seven Holds, and two Sells assigned over the last three months. At $43, the average Roblox price target implies upside potential of 10.2%.

Take-Two Interactive

While Roblox makes a single platform that launches many games, including many from amateur game makers, Take-Two Interactive is known for its Rockstar Games Brand, which publishes the Grand Theft Auto series, among other titles. The company also owns 2K Games, which publishes names like BioShock.

Take-Two Interactive has been profitable for a long time, although it did miss earnings estimates for its most-recently-completed quarter, posting $0.71 per share on $1 billion in revenue. Those numbers compare to the consensus of $0.87 per share on $1.1 billion in sales.

The company’s P/E stands at 83.7x, which is rich compared to Activision Blizzard and other profitable game makers like Electronic Arts (EA). As a result, a neutral rating may be appropriate, given its profitability but high P/E. The stock is down over 30% year-to-date but only 7% in the last month.

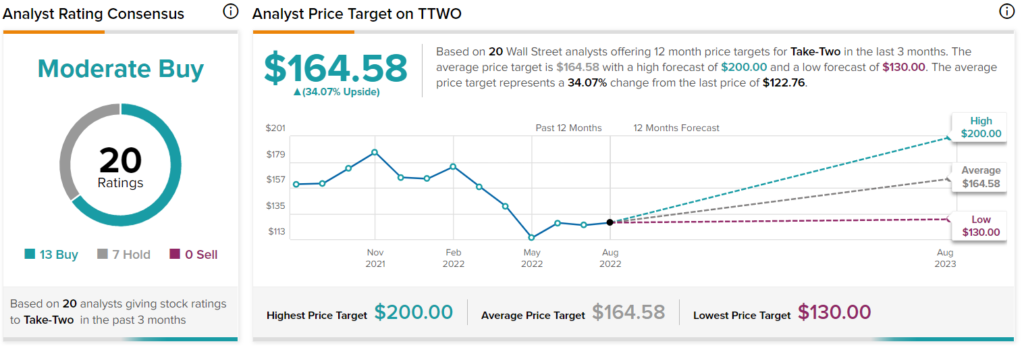

What is the Price Target for TTWO Stock?

Take-Two Interactive has a Moderate Buy consensus rating based on 13 Buy ratings, seven Hold ratings, and zero Sell ratings assigned over the last three months. At $164.58, the average Take-Two Interactive price target implies upside potential of 34.1%.

Activision Blizzard

The most important point about Activision Blizzard is that a long position on the company is a bet that the Microsoft acquisition will go through. Microsoft plans to pay $95 per share for Activision Blizzard unless regulators block the deal, so the current price of less than $80 is quite attractive if the transaction is completed.

Regulators in Saudi Arabia were the first to approve the deal, but Microsoft is a long way from completing it. Interestingly, the Xbox maker is downplaying Activision Blizzard’s game portfolio. In a recent filing, it told New Zealand regulators that the company doesn’t produce any “must-have games.”

Microsoft added that there’s “nothing unique about the video games developed and published by Activision Blizzard.” Of course, Grand Theft Auto and Call of Duty players would beg to differ, but time will tell whether regulators from other countries buy the argument.

Of course, the decisions from U.S., UK, and European regulators could greatly impact decisions from other regulatory bodies around the globe. The key question they must answer is whether the acquisition will significantly reduce competition in the video game space, so they could end up allowing it, blocking it, or forcing the two companies to shed some of their intellectual property in order for the deal to go through.

With Activision shares trading so far below the $95 per share price set by Microsoft, it looks like the market expects regulators to block the transaction. However, Warren Buffett’s team seems to expect the deal, as his Berkshire Hathaway (BRK.A) (BRK.B) boosted its position in the stock recently.

What is the Price Target for ATVI Stock?

Activision Blizzard has a Moderate Buy consensus rating based on four Buys, four Holds, and zero Sell ratings assigned over the last three months. At $93.43, the average Activision Blizzard price prediction implies upside potential of 18.8%.

Conclusion: Bearish on RBLX, Neutral on TTWO, Bullish on ATVI

Investors might see Roblox as the hippest of these three gaming stocks, at least partially because of the metaverse connection. After all, wouldn’t it make sense to grab up shares of a company that plays in one of technology’s hottest spaces? However, valuations and fundamentals make it clear that a bullish view is appropriate for the stalwart Activision Blizzard, pending its acquisition by Microsoft. On the other hand, a neutral take is apt for Take-Two Interactive, while the money-losing Roblox deserves a bearish view.