Themes like cryptocurrency and AI have driven the market higher in recent years. Quantum computing could be the next hot theme that takes the market by storm, and investors should consider getting ahead of the trend and looking into it now. The Defiance Quantum ETF (NYSEARCA:QTUM) is an exciting ETF dedicated to this high-tech theme.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

I’m bullish on QTUM based on the long-term potential of quantum computing, its carefully selected portfolio, and its excellent track record of performance over the past five years. We are still in the early stages of quantum computing, so this could be a high-risk, high-reward investment.

An investment like this is likely best as a smaller allocation for risk-tolerant investors, but as we will discuss below, QTUM does a good job of mitigating some of these risks with a diversified portfolio that benefits from the rise of quantum computing without being solely reliant on it.

What is Quantum Computing?

Without getting too into the weeds, quantum computing uses quantum mechanics to perform calculations “exponentially faster” and more efficiently than typical computers. According to QTUM’s sponsor, Defiance ETFs, they “process information in a radically different manner and therefore have the potential to explore big data in ways that have not been possible until now.”

While not all use cases are known at this point in time, quantum computing will likely have a major impact on applications like machine learning and encryption and could impact fields like industry, defense, academia, and beyond. Renowned management consulting firm McKinsey & Company says quantum computing may “provide an exponential increase in computational performance for certain problems and transform communication networks by making them more secure.”

While the space is in its infancy, it’s growing fast. CB Insights reports that venture capital investment in the space grew by 500% between 2015 and 2020. Meanwhile, McKinsey named quantum computing one of its top 15 trends in its 2023 McKinsey Technology Trends Outlook and reported that the industry received $2 billion in equity investment in 2022, while job postings for the space grew by 12%.

McKinsey also rated quantum computing’s adoption as a 0 on a scale of 0 to 5, with 0 indicating no adoption. This is an important reminder that practical, scalable quantum computers are still in the early stages of development, so their commercial success isn’t necessarily set in stone. However, this score of 0 also indicates that there is a long runway of growth ahead if quantum computing becomes commercially viable.

What is the QTUM ETF’s Strategy?

According to fund sponsor Defiance, QTUM seeks to provide “exposure to companies on the forefront of machine learning, quantum computing, cloud computing, and other transformative computing technologies.”

It does this by investing in its underlying index, the BlueStar Quantum Computing and Machine Learning Index (BQTUM), an index comprised of “leading global companies engaged in the research & development or commercialization of systems and materials used in quantum computing.”

These companies include those engaged in “advanced traditional computing hardware, high powered computing data connectivity solutions and cooling systems, and companies that specialize in the perception, collection, and management of heterogeneous big data used in machine learning.”

The fund launched in 2018 and is still relatively small, with $208.4 million in assets under management (AUM).

QTUM’s Portfolio is a Smart Way to Gain Exposure to the Space

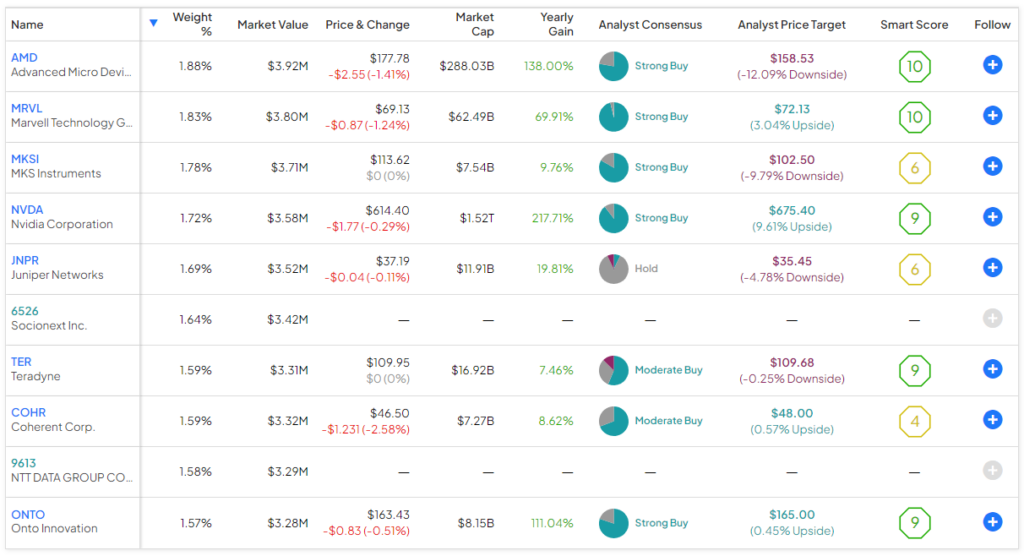

QTUM is nicely diversified. It owns 71 stocks, and its top 10 holdings account for just 16.7% of assets, so this isn’t an ETF that is overly exposed to a small handful of holdings. This is because the fund’s underlying index is equal-weighted and rebalanced semi-annually.

Below is an overview of QTUM’s top 10 holdings using TipRanks’ holdings tool.

One appealing aspect of QTUM is that because quantum computing is still in its early phases, the fund doesn’t limit itself solely to the few publicly-traded companies that are focused on quantum computing as their core business, such as IonQ (NYSE:IONQ) and Rigetti Computing (NASDAQ:RGTI).

This seems like a prudent approach, as there are only a few of these companies, and they are likely years away from turning a profit. While QTUM invests in these companies, it spreads its risk by also investing in companies that will facilitate the growth of quantum computing and those that will benefit from it.

For example, the fund holds a large number of semiconductor stocks like Advanced Micro Devices (NASDAQ:AMD), Marvell (NASDAQ:MRVL), and Nvidia (NASDAQ:NVDA).

It also owns Taiwan Semiconductor (NYSE:TSM), which fabricates the semiconductors for many of these companies, and stocks like Lam Research (NASDAQ:LRCX) and Applied Materials (NASDAQ:AMAT), which provide the equipment needed to manufacture semiconductors. These stocks can be thought of as the “picks and shovels” way to gain exposure to quantum computing.

QTUM owns mega-cap tech stocks like Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and IBM (NYSE:IBM) that are working on developing quantum computing technology but are not reliant upon it for revenue or earnings today.

You may be surprised to find stocks like Honeywell (NASDAQ:HON) in QTUM’s holdings since investors often think of it as more of an “old school” industrial company than a tech stock, but Honeywell has established a strong foothold in quantum computing. In fact, its quantum computing subsidiary, Qauntinuum, recently raised new funding that values it at $5 billion.

This measured approach is a sensible way to invest in this nascent space, and it has led to excellent returns over the years, as you’ll see below.

Outstanding Past Performance

QTUM’s portfolio has translated into a very strong performance over the years. The fund lost 28.8% of its value in 2022 when the tech sector and more speculative growth stocks took a major haircut. However, it bounced back with a spectacular total return of 39.9% in 2023 when tech stocks staged a major rebound.

This excellent 2023 performance was nothing new for QTUM — the fund posted a 35.2% return in 2021, a 42.1% return in 2020, and an incredible 48.0% return in 2019.

As of December 31, the fund generated an annualized 10.5% three-year return and an annualized 25.2% five-year return.

These stellar annualized returns not only easily outperformed the broader market but also slightly outperformed the high-flying Invesco QQQ Trust (NASDAQ:QQQ), which invests in the 100 largest non-financial stocks on the tech-centric Nasdaq (NDX) exchange. As of December 31, QQQ generated an annualized three-year return of 10.0% and an annualized five-year return of 22.4%.

QTUM’s Expense Ratio

QTUM’s expense ratio of 0.40% isn’t cheap, but it isn’t overly expensive either, especially when considering the fund’s strong performance. This 0.40% expense ratio means that investors will pay $40 in fees annually on an investment of $10,000. Assuming that the expense ratio remains 0.40% and the fund returns 5% annually, investors will pay $505 in fees over a 10-year time span.

Is QTUM Stock a Buy, According to Analysts?

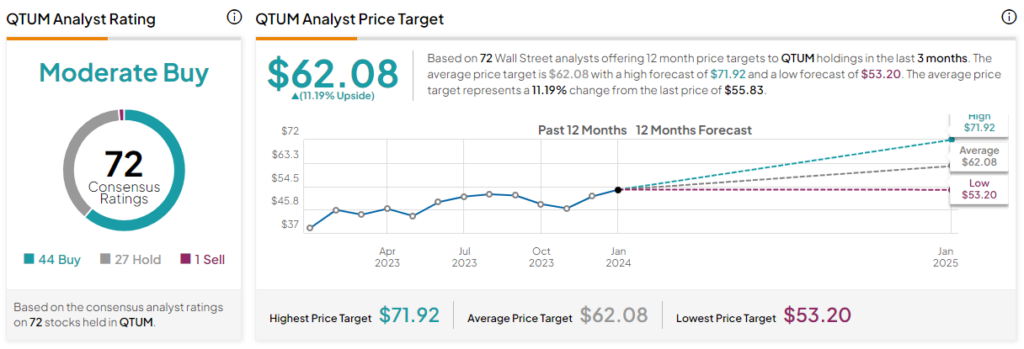

Turning to Wall Street, QTUM earns a Moderate Buy consensus rating based on 44 Buys, 27 Holds, and one Sell rating assigned in the past three months. The average QTUM stock price target of $62.08 implies 11.2% upside potential.

Looking Ahead

In conclusion, I’m bullish on QTUM based on its stellar track record of performance and the long-term potential of quantum computing. I also like that the fund smartly casts a wide net and invests in stocks that will benefit from the rise of quantum computing, those that will help fuel its growth, and some pure-play quantum computing stocks.

Quantum computing is still in its early stages and a long way off from being commercially successful, but QTUM takes the right approach of investing in stocks that will give investors exposure to the upside of quantum computing without betting the entire farm on it.