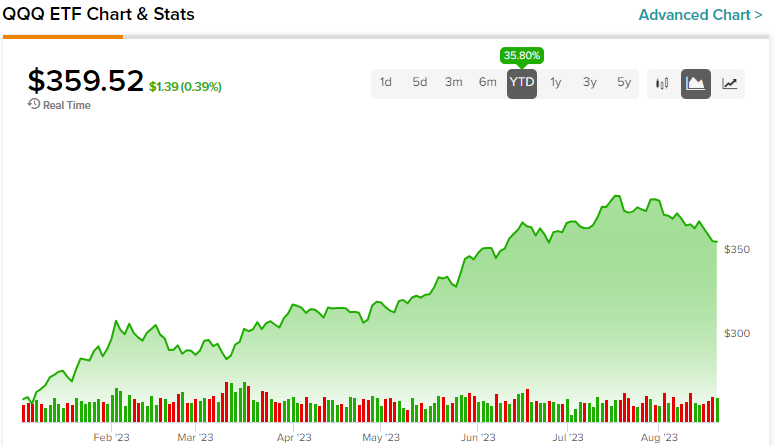

The Invesco QQQ Trust (NASDAQ:QQQ) is a must-watch ETF for investors. It’s designed to closely track the Nasdaq 100 Index (NDX), one of the most widely-followed indices, providing investors with exposure to about 100 non-financial companies. Besides that, the QQQ ETF’s Outperform Smart Score on TipRanks, coupled with a favorable average price target from top Wall Street analysts, indicates the potential for further price appreciation from its current price, making it worth considering.

Interestingly, the QQQ ETF stock has delivered impressive historical performance, outperforming many broad-market indices. The stock has beaten the S&P 500 Index (SPX) in nine out of the last 10 years, with the trend continuing in 2023 so far.

An Outperform Smart Score

According to TipRanks’ Smart Score System, QQQ has a Smart Score of 8 out of 10, which indicates that the ETF could outperform the broader market over the long term. It is worth highlighting that more than 50% of its holdings boast an Outperform Smart Score (i.e., a score of 8 or higher).

QQQ also has a Very Positive signal from retail investors. Our data shows that about 8.6% of TipRanks’ retail investors increased their holdings of the QQQ in the last 30 days. Moreover, hedge funds are also buying QQQ stock. Based on 13F filings, about 29 hedge funds collectively increased their QQQ holdings by 148,000 shares in the last quarter.

Ken Fisher of Fisher Asset Management, Joel Greenblatt of Gotham Asset Management, and Wayne Cooperman of Cobalt Capital Management were among the hedge fund managers who increased their exposure to the ETF.

Is Invesco QQQ a Good Buy, According to Analysts?

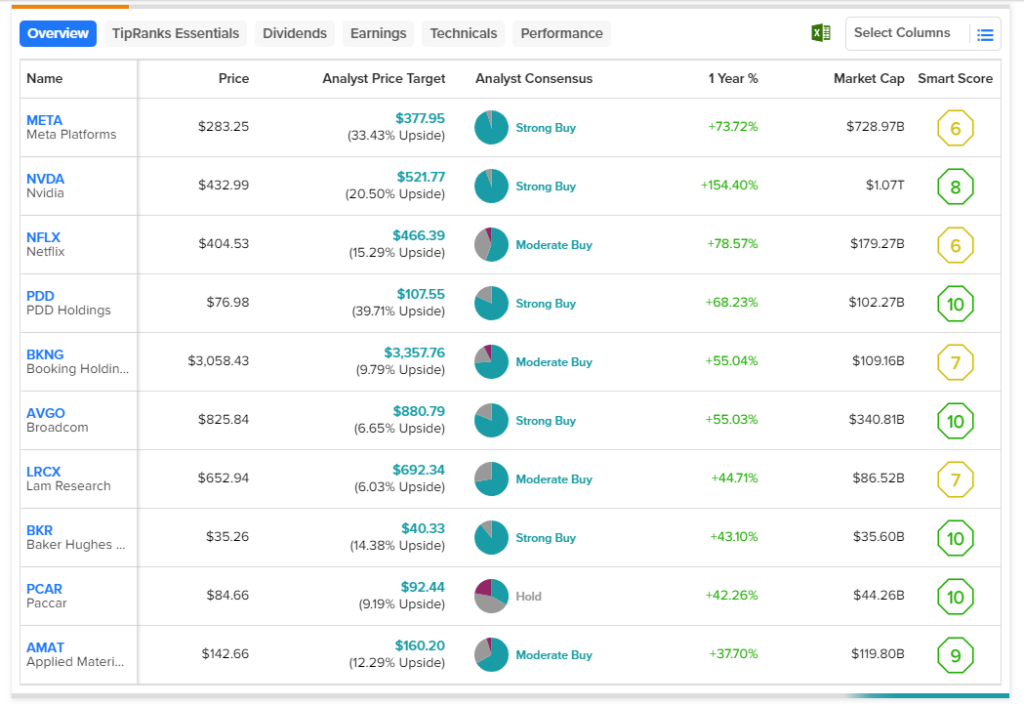

Based on Wall Street analysts’ ratings of the Invesco QQQ ETF’s 102 holdings, the ETF has a Moderate Buy consensus rating on TipRanks. Also, the 12-month average QQQ price target of $427.48 (from top-rated analysts) implies 18.8% upside potential from current levels.

Top 10 Performing Stocks in QQQ ETF

The rally in technology stocks drove the index fund higher this year. While several of the ETF’s holdings witnessed strong returns over the past 12 months, there are a few stars. Here are the 10 best-performing stocks in the ETF:

- Nvidia Corporation (NVDA)

- Netflix Inc. (NFLX)

- Meta Platforms, Inc. (META)

- PDD Holdings Inc. (PDD)

- Booking Holdings (BKNG)

- Broadcom Inc. (AVGO)

- Lam Research Corp (LRCX)

- Baker Hughes Company (BKR)

- Paccar (PCAR)

- Applied Materials, Inc. (AMAT)