Coming off an earnings beat in Q2, Tesla (NASDAQ:TSLA) is gearing up to report earnings again on October 17. This time around the news might not be great, however.

In Q2, Tesla grew its sales by 47%, but its earnings increased by a much less impressive 16% year-over-year. This time around, the news could be downright depressing. Analysts have Tesla pegged for much more modest sales growth — 7% year over year — and believe that the company’s earnings will actually decline by a steep 30%. So should investors be worried?

In a curious note doubling down on his “buy” rating, Deutsche Bank analyst Emmanuel Rosner noted that there is “downside [risk] to 3Q23” earnings for Tesla, and even more risk to the company’s numbers in 2024. So why does this analyst recommend buying Tesla regardless, and why does he insist the stock is worth $285 a share when it currently costs $250?

That’s an excellent question.

Tesla could miss analyst targets for both production and deliveries in Q3, warns Rosner. Previously, the analyst had projected that Tesla would deliver approximately 455,000 EVs in the quarter, but he now projects only 440,000 deliveries — up 28% year over year but down 6% sequentially from Q2. Revenues, too, will come in lighter than expected — $23.3 billion instead of $24.1 billion — and gross profit margins could continue their slide from last year’s record 25.6% to as low as 17% this quarter, hurt by price cuts on Tesla electric cars in China and in the U.S.

Crunching all of the above numbers, Rosner calculates that Tesla’s profit this quarter could be as low as $0.71 per share, a steep reduction from the $0.87 per share that the analyst had previously calculated, and well below the $0.80 per share that Rosner says is the consensus forecast. (Note that according to Yahoo! Finance data, the consensus is actually only $0.75 per share — but if Rosner is right, Tesla will miss that number as well).

On the plus side, Rosner does believe that Tesla will reiterate its 1.8 million-vehicle target for the year, even if it misses on deliveries this quarter. On the other hand, though, that may not matter in the longer run.

It may not matter because, according to the analyst, Tesla is going to produce far fewer cars in 2024 than his fellow analysts anticipate, resulting in “considerable downside risk to earnings expectations” next year. Rosner sees production growing only 17% year over year in 2024, to about 2.1 million EVs, and with continued price reductions (about 1%) on those vehicles that Tesla does deliver.

Considering all this, therefore, the question naturally arises: If this quarter will be bad, and all of next year will be worse, then why is Rosner recommending that investors buy this stock?

The answer seems to be that he thinks gross margins will start to improve next year — to about 19% — despite slowing sales growth. And while that won’t enable Tesla to earn the $4.76 per share that everyone else is forecasting for 2024, it will permit the company to earn a more attainable $3.90 per share.

That still leaves the question: Assuming Rosner is right, at $250 a share, Tesla costs nearly 63 times forward earnings, but its sales growth will slow to only 17%. Is that cheap enough to buy? Rosner apparently thinks it is. (To watch Rosner’s track record, click here)

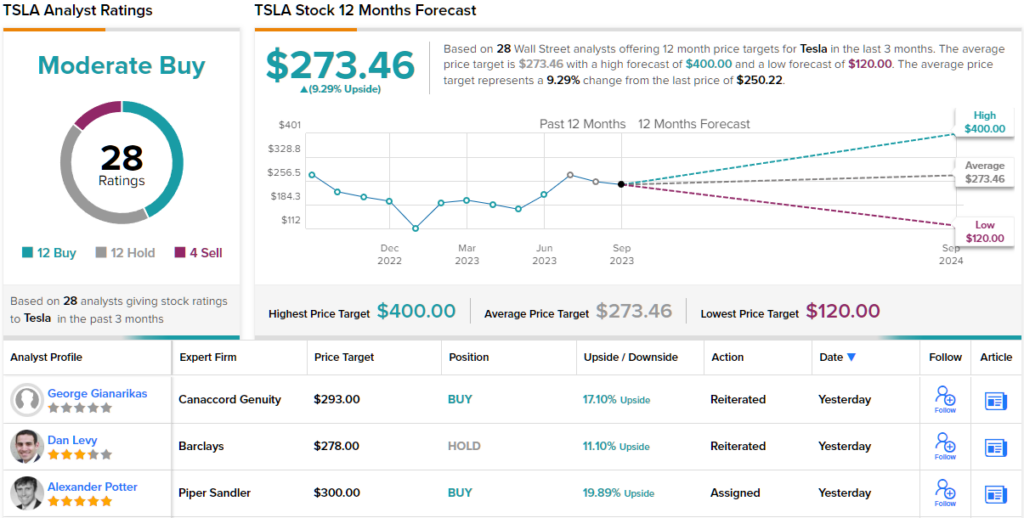

A look at the consensus breakdown reveals there is a fairly even amount of Tesla bulls and skeptics on Wall Street. The stock’s Moderate Buy consensus rating is based on 12 Buys, 12 Holds, and 4 Sells. Going by the $273.46 average price target, shares are expected to appreciate by ~9% over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.