Investing in mutual funds has several benefits, such as diversification, higher liquidity, and low minimum investment requirements. Ahead of entering 2024, investors looking to park their money in the booming technology sector could look at – PRSCX and FSELX – two tech-focused mutual funds with over 10% upside potential in the next year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a deeper look at the two funds.

T. Rowe Price Science and Technology Fund Inc. (PRSCX)

The T. Rowe Price Science and Technology Fund targets long-term capital gains. It invests at least 80% of its net assets in the stocks of companies expected to benefit from the development and use of science and technology. Apart from U.S. stocks, PRSCX invests in foreign stocks as well. The fund has an annual expense ratio of 0.84%.

As of today’s date, PRSCX has 57 holdings with total assets of $6.97 billion. Its top three holdings include Microsoft (MSFT), Alphabet (GOOGL), and Nvidia (NVDA).

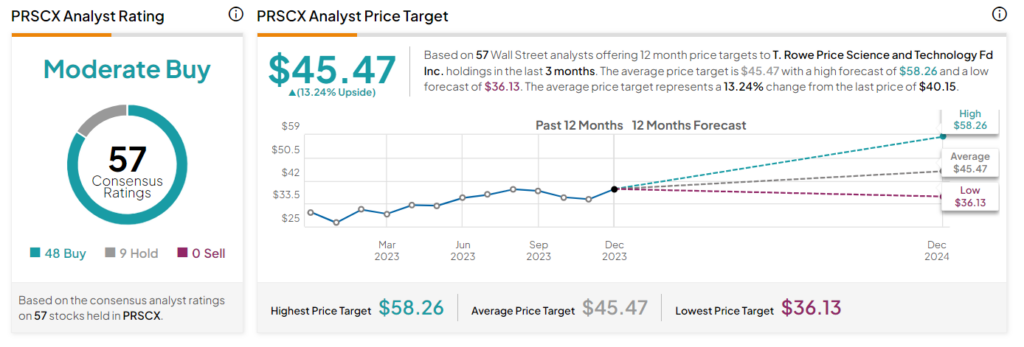

On TipRanks, PRSCX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 57 stocks held, 48 have Buys and nine stocks have a Hold rating. The average T. Rowe Price Science and Technology Fund price target of $45.47 implies a 13.2% upside potential from the current levels. Year-to-date, PRSCX has gained 53.7%.

Fidelity Select Semiconductors Portfolio (FSELX)

The Fidelity Select Semiconductors Portfolio seeks long-term capital appreciation by investing nearly 80% of its assets primarily in high-performing companies within the semiconductor industry. It invests in the stocks of both foreign and domestic companies. FSELX has a low annual expense ratio of 0.69%.

As of today’s date, FSELX has 31 holdings with total assets of $11.8 billion. Its top three holdings are Nvidia, NXP Semiconductors (NXPI), and ON Semiconductor (ON).

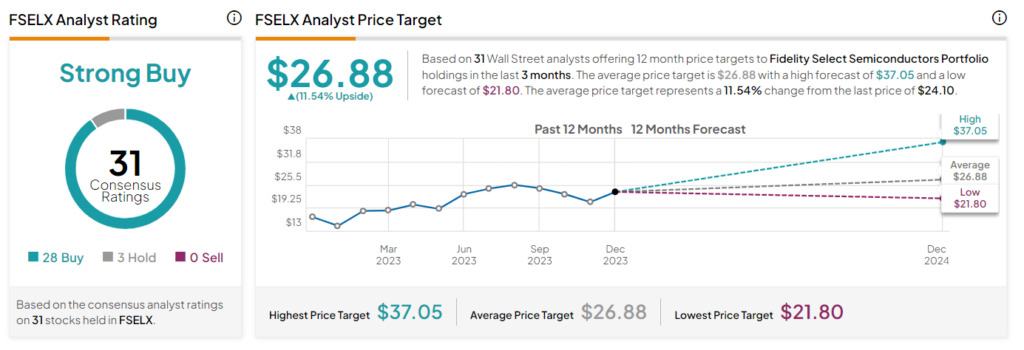

On TipRanks, FSELX has a Strong Buy consensus rating. This is based on 28 stocks with a Buy rating and three stocks with a Hold rating. The average FSELX mutual fund price target of $26.88 implies an 11.5% upside potential from the current levels. FSELX has gained 65% so far this year.

Ending Thoughts

Mutual funds are considered a safe choice for investors. Based on the bright prospects of the technology sector in 2024, owing to the possibility of interest rate cuts, investors can consider both PRSCX and FSELX, which offer further upside potential.