Prologis (NYSE:PLD) kicked off its Fiscal 2023 with solid Q1 results, positioning the company for another year of record profitability. In fact, management displayed great confidence by revising its previous guidance upward, a notable feat considering the challenging environment for most real estate investment trusts grappling with the impact of rising interest rates on their financials.

This positive development not only highlights Prologis’ exceptional qualities, including its ability to achieve superior economies of scale as the largest industrial REIT in the U.S., but it also signifies the robustness of its dividend growth potential. The company’s most recent double-digit dividend hike is a shining example of this strength, further cementing its position as a sound dividend growth option. Therefore, I am bullish on the stock.

Q1 2023: Solid Numbers Despite Macro Instability

Given the ongoing macroeconomic instability, many investors have been preparing themselves for an economic downturn. Among other effects, therefore, there is an anticipated decrease in demand for industrial properties, including those owned by Prologis.

Nevertheless, it’s worth noting that Prologis’ rental income is presently backed by multi-year leases bound to its massive portfolio. In fact, the company’s weighted average lease term was around four years at the end of Q1, with many of these agreements arranged at exceptional rates during the pandemic, when industrial properties were in record demand due to the supply-chain jams at the time.

I find this lease term particularly exceptional, as it strikes a perfect balance between providing ample protection for the company against the prevailing challenges in the short-to-medium term while also allowing flexibility to pursue more advantageous lease arrangements in the foreseeable future.

Overall, Prologis’ current lease profile and property acquisitions over the past four quarters resulted in revenues growing by 51.7% to $1.63 billion and funds from operations (also known as FFO, the cash flow from a real estate company) per share rising by 11.9% to $1.22.

Of particular significance is the exceptional growth in FFO per share, highlighting that the rise in rental revenues was not solely driven by acquisitions through share issuance. On the contrary, Prologis’ share issuances were accretive to the per-share growth of FFO, demonstrating the creation of underlying shareholder value.

In the meantime, Prologis’ occupancy rate also remained at an outstanding 98%, raising no doubts regarding the underlying demand for its underlying properties. With its properties full and future cash flows locked through its multi-year leases, management felt comfortable enough to raise its guidance.

Management expects FFO/share between $5.42 and $5.50 (slightly up from $5.40 and $5.50 previously) for the year, the midpoint of which implies a year-over-year rate of 5.8%. This may not sound like an impressive growth rate, but it’s actually a very sound one, given that a significant number of REITs are going to experience a decline in profitability this year due to rising rates.

Prologis’ 2.8%-Yielding Dividend Appears Attractive

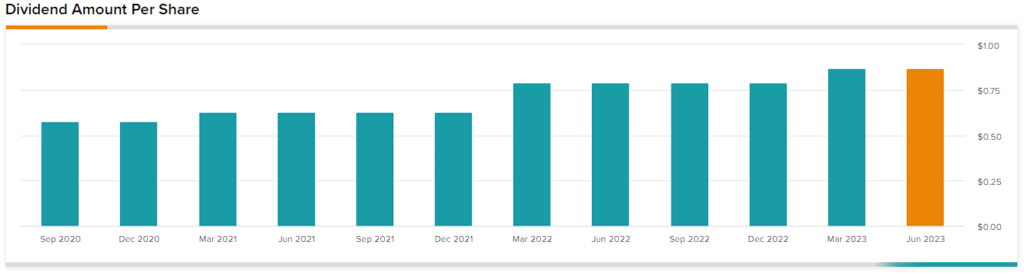

With Prologis’ stock price having declined by about 29% from its 2021 highs of ~$174/share and the company continuing to raise its dividend during this period, the dividend yield has gradually risen. It stands at 2.8%, which I find to be a rather compelling yield given Prologis’ strong dividend growth potential.

The midpoint of management’s guidance implies that Prologis’ payout ratio stands at just 64%, meaning the company has sufficient room to sustain vigorous dividend increases with ease. A prime example of this potential was demonstrated through the most recent dividend hike in February, which amounted to an impressive 10.1%.

Is Prologis’ Valuation Reasonable?

Shares of Prologis have historically traded at a premium valuation. Currently, shares trade at 26x the midpoint of management’s FFO/share guidance, implying a significant premium compared to the real estate sector’s average price/FFO of 11.9. This is likely because of the company’s decades-long track record of creating shareholder value as well as the multiple qualities that come attached to being the largest REIT in the country and the world.

One such example is that the company can achieve industry-leading financing terms with creditors. This can be a particularly strong advantage in a rising-rates landscape like the one we are currently experiencing.

With the REIT’s weighted average interest rate still standing at 2.6% and its weighted average remaining maturity standing at 9.7 years, Prologis is relatively insulated from potentially expensive refinancings over the medium-term relative to the average player in the sector. Hence, I believe that its seemingly rich valuation is somewhat justified.

Is PLD Stock a Buy, According to Analysts?

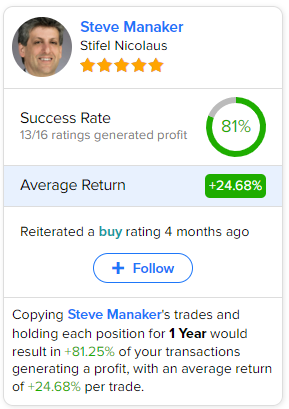

Turning to Wall Street, Prologis has a Strong Buy consensus rating based on 16 Buys and two Holds assigned in the past three months. At $142.50, the average Prologis stock forecast suggests 14.05% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell PLD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Steve Manaker from Stifel Nicolaus, with an average return of 24.68% per rating and an 81% success rate. See below.

The Takeaway

Prologis continues to deliver robust results, defying concerns surrounding a potential economic downturn. Additionally, the company’s multi-year leases ensure stable and predictable cash flow, further supported by management’s optimistic guidance. This indicates that Prologis’ potential for dividend growth remains highly promising. Moreover, Prologis’ exceptional knack for securing competitive financing terms enhances its investment proposition and helps justify its seemingly elevated valuation.